European CBD: Checking the Currents in Continually Changing Markets

By Calin Coman-Enescu, Director of Capital Markets, New Frontier Data

Europe is a diverse region in constant flux, and as a result so its regulations are ever-changing.

While the European Union (EU) includes 27 member states with approximately 447 million residents, the United Nations also recognizes 17 other nations on the continent. They make for a lot of moving parts, and despite overarching laws and regulations on a supranational level imposed by the European Commission, each EU country has its own laws for CBD and regulations for implementation. While in North America CBD products are readily available, the EU’s regulatory fragmentation is effectively constraining cannabis and CBD companies from making major inroads in the European market, while making it onerously difficult to move product between member states.

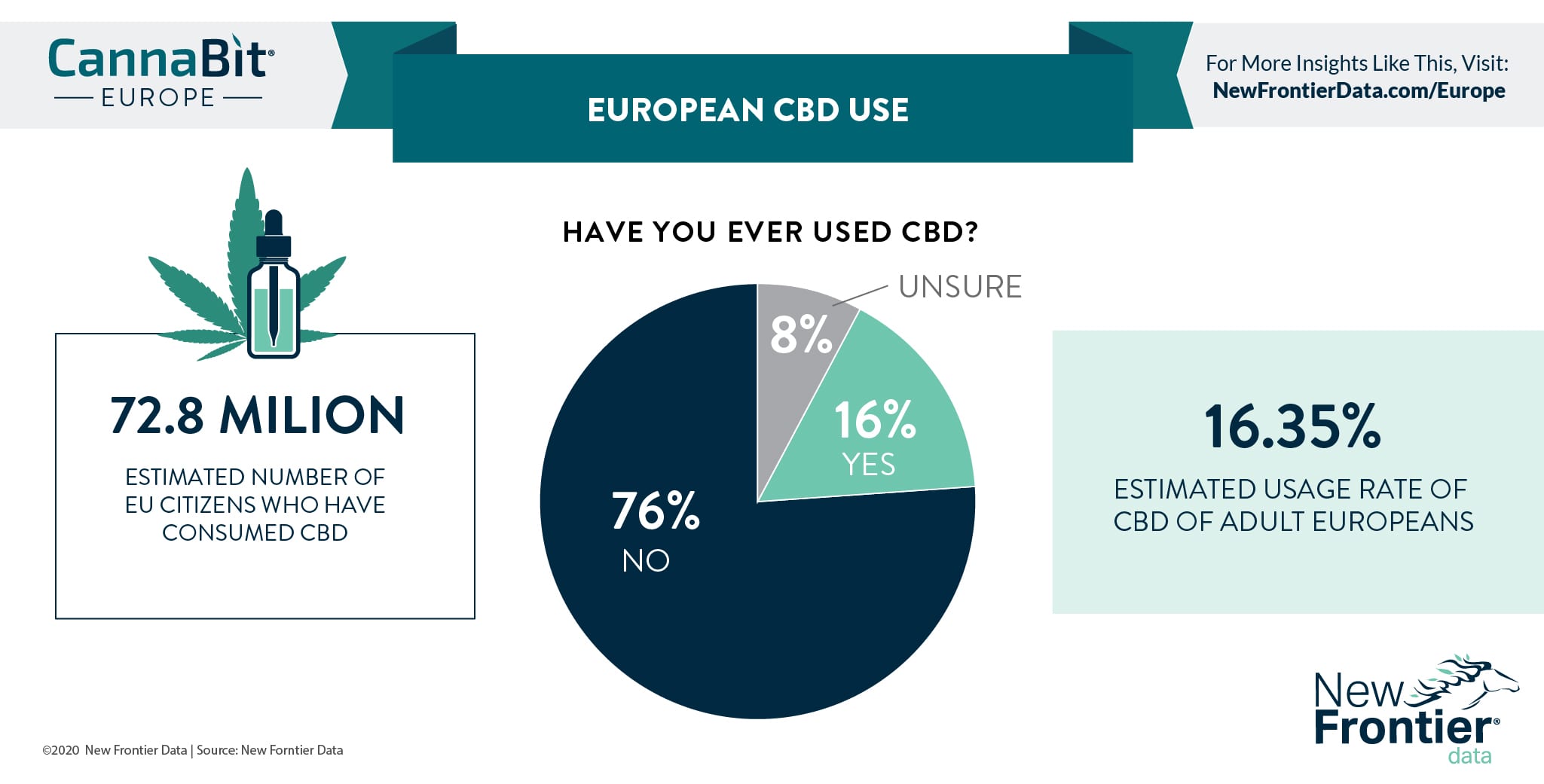

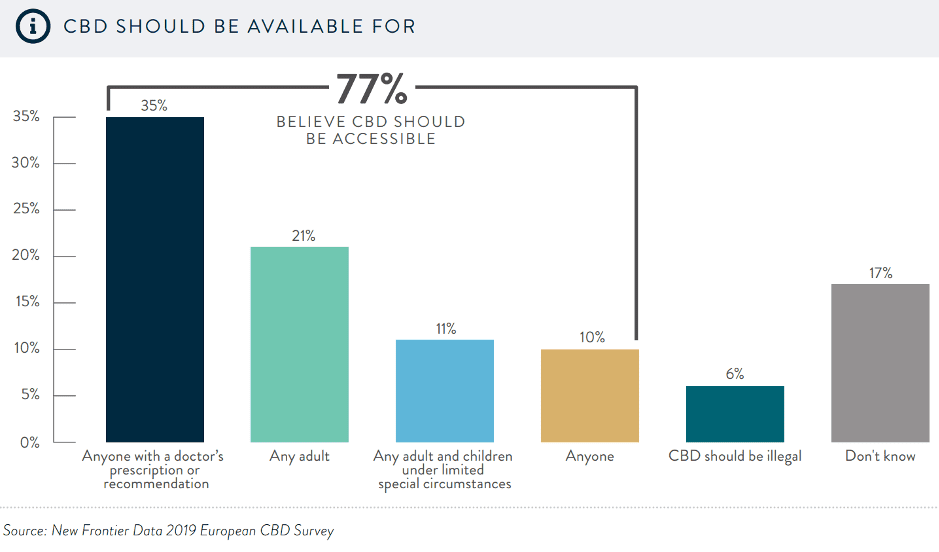

Despite the challenges, significant demand exists. As described in the recent foundational survey for New Frontier Data’s EU CBD Consumer Report: 2019 Overview, 46% of Europeans view CBD favourably, while 15% conversely have a negative impression of CBD and CBD products. Meanwhile, a reported 77% of respondents believe that CBD should be accessible in some form or another:

As a result of the difficulties faced by companies trying to meet such demand, there is a substantial grey market in Europe existing under the radar of most regulators. The recent novel food ruling only adds to the confusion. Not only does it pose a problem for professional firms entering the market, but it means consumers are often left purchasing products of dubious quality with potential health consequences.

As ever in Europe however, change is afoot for better or worse. Portugal last year implemented new laws for hemp products to be regulated under Infarmed. As a result, industrial hemp farmers must now submit to a licensing procedure as strict as the one for medical cannabis, while also remaining true to the country’s original regulations as issued by the Direcção-Geral de Alimentação e Veterinária (DGAV), the Portuguese National Authority for Animal Health. The upshot leaves a huge administrative burden on farmers and producers; while acknowledged by the government which promised new regulations in August 2019, no relief has yet been presented.

Further north, Luxembourg is poised to become the first European nation to fully legalize cannabis, if business is not necessarily booming. Though CBD products are completely legal in Europe’s investment management centre, the authorities are militant about enforcement — last year, police checks were conducted on 34 among some 40-odd shops in the small city-nation. At the same time, new tax regulations enacted last December have seen the rates imposed jump from 3% (the standard on food items) to 33% plus 17% VAT. The 47% increase in the tax burden has hit small businesses particularly hard, and it remains to be seen how many merchants will survive the change.

Conversely, across the English Channel there is a beacon of hope aglow as Boris Johnson’s administration aims to set the U.K. free from the regulatory orbit of the EU, and his cabinet members are beginning to take note of the industry. Meantime, industry giants GW Pharma and British Sugar continue to charge ahead with the production of cannabis-based medicines. Blair Gibbs, policy advisor to Johnson, has gone so far as to call the U.K. licensing position “perverse” and “unsustainable”, whilst noting that the novel foods regime is “not workable for the U.K. CBD market”.

The sampling of examples gives indication of the regulatory variable in Europe, and impacts unfolding as a result. New Frontier Data will continue to track regulatory developments involving European CBD, and will plan to discuss wider cannabis and hemp regulatory and policy on a global scale with Hoban Law Group at the InterCannAlliance Europe Symposium this April.

Want to learn more about the cannabis market in Europe?

Apply to the InterCannAlliance Europe Symposium to connect with executives, government officials and other early shapers in the region.