Expansion of Legal Cannabis Markets Are Looking Up Down Under

By Oliver Bennett, Special Contributor to New Frontier Data

As the European markets grow progressively more open, legal cannabis supply chains worldwide — from Latin America, Africa, and India to more established places like the U.S. and Canada — are seeking potential inroads into contested marketplaces. Now there is another former outlier emerging as a key supplier of medical cannabis: Australia.

The country-continent, despite its geographic distance from Western markets, is becoming a player in the European cannabis industry with increased innovation and investment, and the establishment of cannabis supply chains that will take Australian brands and product to the rest of the world. The Australian Securities Exchange (ASX) has already listed MGC Pharmaceuticals, claiming to be the first medical cannabis producer to float on the London Stock Exchange.

Headquartered in Australia, MGC already straddles the geographical gap with a manufacturing base in Slovenia. For its part, Western Australian medical cannabis producer Little Green Pharma is now shipping its products to both Germany and the United Kingdom, and gained a government tender for France’s medical cannabis trial. The Australian Natural Therapeutics Group has its own deal to export medical cannabis to Germany. The interplay between continents is seen as a mutual opportunity for Australia and Europe. Little Green Pharma’s founder-CEO Fleta Solomon was quoted as touting Australia as “the dominant player in Europe”, and if previous demand for medical cannabis in Germany has been met by the Netherlands and Canada, Europe’s largest established market is expected to widen its pipelines from Australia, along with Uruguay, Spain, and Israel in respectively established relationships.

Australia already enjoys a key advantage over other suppliers since its Therapeutic Goods Administration (TGA)’s Good Manufacturing Practice (GMP) has been recognised as complying with the EU’s own GMP, whereas other world suppliers may have to gain permission and address bureaucratic obstacles. That alone affords the Australian industry encouragement, but beyond its exports Australia also has an expanding internal market, with a medical cannabis space worth an estimated $575 million. Australia has seen its patient rolls for medical cannabis expand from 500 three years ago to roughly 30,000, according to Australian-based FreshLeaf analytics, while the Australian Institute of Health and Welfare has estimated that upwards of 600,000 Australians consume cannabis for medical purposes. IBIS World notes that since the Australian government only legalised production and cultivation in 2016, the maturation of its industry will see revenues in its medical cannabis manufacturing sector leap more than fivefold year over year, from AU$5.4 million in 2019-20 to AU$31.2 million for 2020-21.

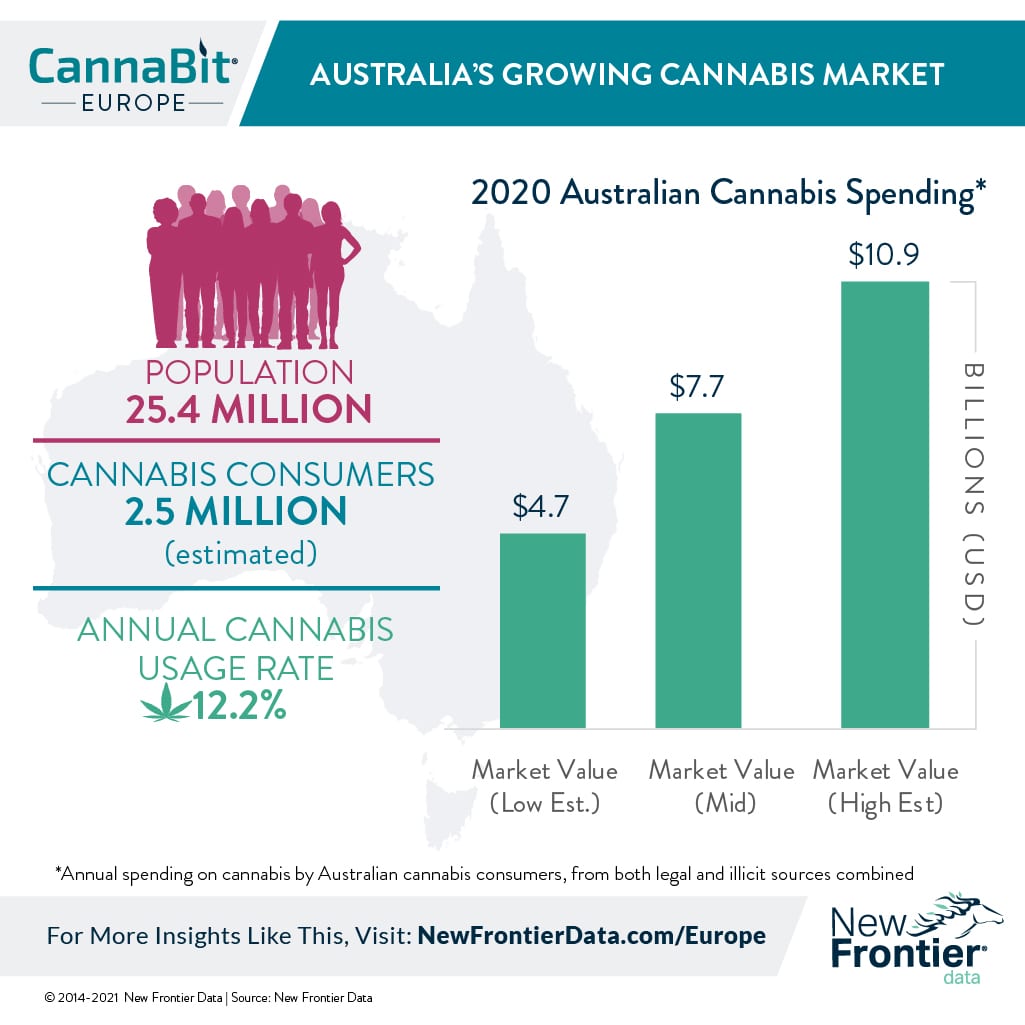

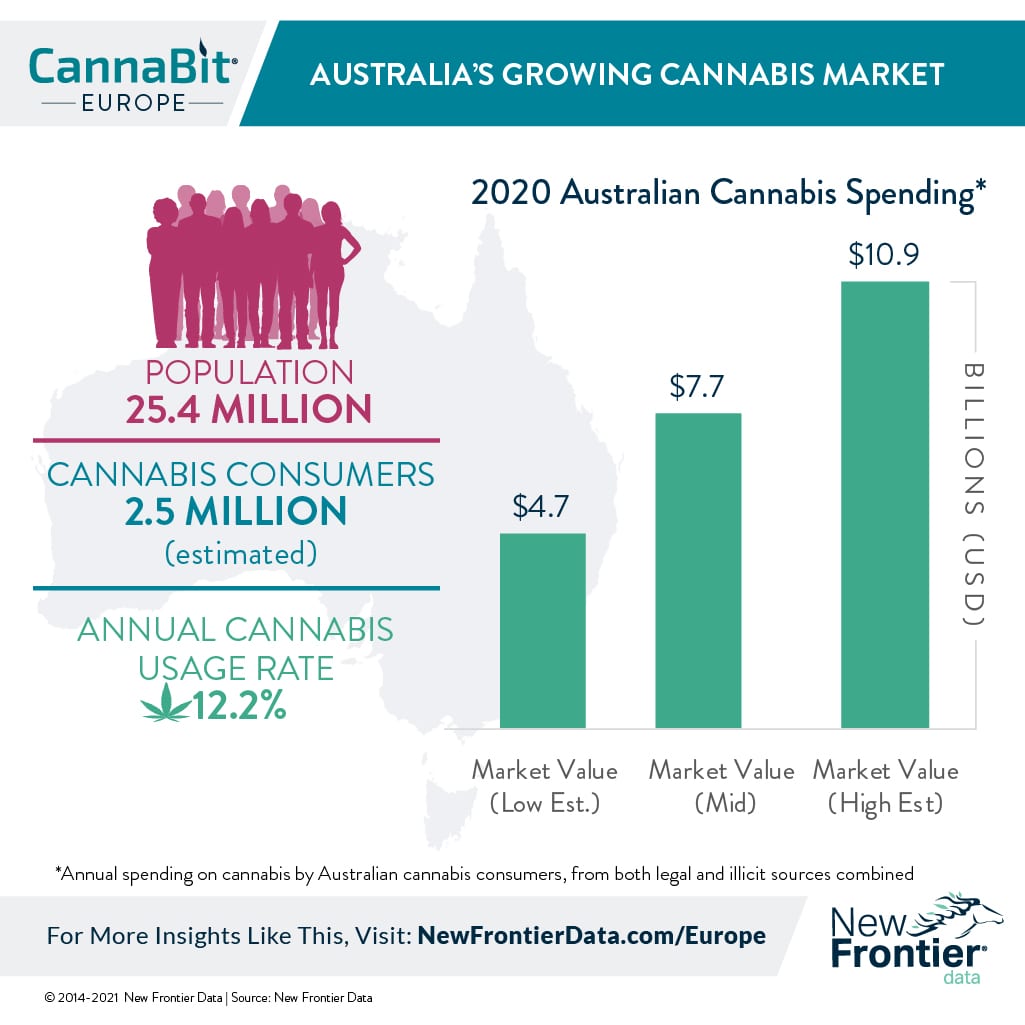

Last summer, New Frontier Data noted Australia’s receptivity to new international opportunities, citing the need to “remove unnecessary and unintended regulatory barriers imposed on Australia’s exports” to facilitate trade Australia’s export market for low-THC hemp and medical cannabis. New Frontier Data also observed how the TGA last month had approved more than 91,000 applications for unapproved medicinal cannabis products – illustrating with a growing market among some 2.5 million cannabis users spending nearly USD $7.7 billion last year alone.

In an increasingly accepted environment, Australia has recently proposed new legal amendments. The Narcotic Drugs Amendment (Medicinal Cannabis) Bill 2021 is aimed to streamline the medical cannabis industry, and stimulate inward investment for exports and imports alike. Israeli companies Panaxia and the Seach Medical Group recently announced intentions for commercial exports of medical cannabis flower to Australia, though the medical cannabis program is still showing relatively low participation rates.

Given the activity, calls for adult-use legalisation has also crept onto the agenda: In January 2020, the Australian Capital Territory (ACT) Legislative Authority passed a bill to legalise personal possession, use, and cultivation in the first of the country’s federal districts to do so. While legalisation or decriminalisation of recreational cannabis yet lacks overwhelming support – its neighbour and cultural cousin New Zealand saw a bid to legalise cannabis defeated by 53.1 percent to 46.1 percent – there are dedicated advocates to be found, including small political parties like HEMP (Help End Marijuana Prohibition) Party, the LCQ (Legalise Cannabis Queensland) Party and a group called Who Are We Really Hurting, which concocted a publicity stunt by sending Prime Minister Scott Morrison a counterfeit pound of cannabis for headlines.

Within Australia, growing areas are being established. Western Australia, traditional home to a big part of the country’s wine industry, will see its Gascoyne region soon house one of the largest medicinal cannabis facilities in the southern hemisphere (with Elite Cannabinoids having gained approval to cultivate 46 hectares north of Perth). On the east coast, Australian biotech company CannaPacific has a cultivation facility in Byron Bay with a breeding programme and intentions for cannabinoids product development to treat conditions involving PTSD, anxiety, and pain. It is already supplying white label goods to Australia, New Zealand, and South Africa with its developments expected in Europe.