Australia’s Medical Cannabis Market: Lots of Potential, Yet Few Patients

By Noah Tomares, Research Analyst, New Frontier Data

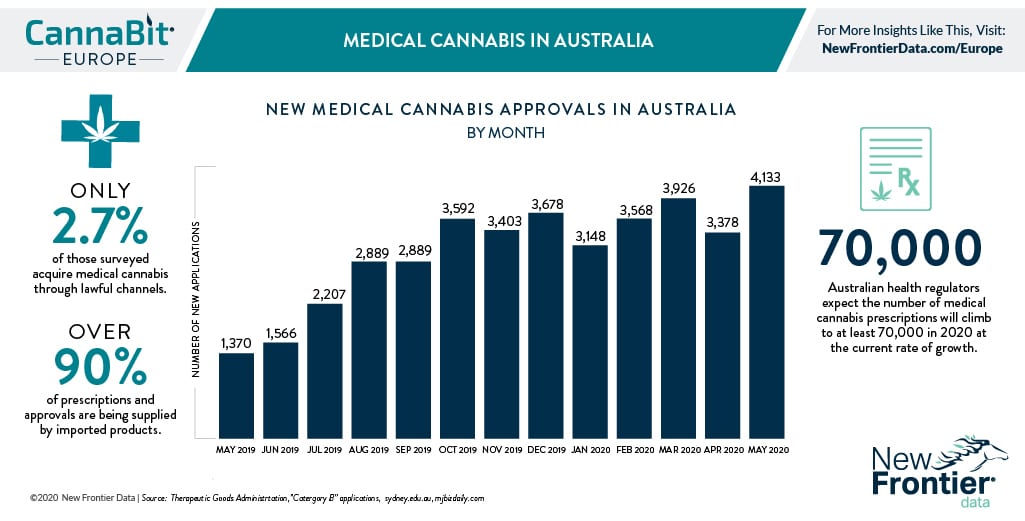

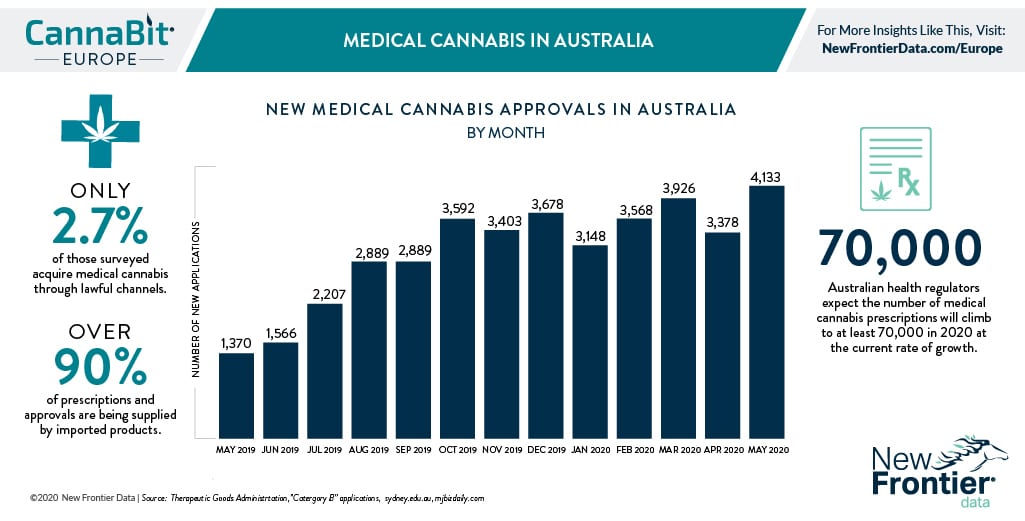

By the numbers, Australia’s medical cannabis market is booming: In 2017, only 457 patients on the continent had access to medical cannabis. That number increased 5.5x to 2,526 in 2018, and again 6.2x to 15,556 in 2019. From January to December 2019, active medical cannabis patients increased by an average monthly growth rate of 19%. In the first five months of 2020, more than 18,000 medical cannabis applications were approved by the Therapeutic Goods Administration (TGA). By December 2020, the market will support a projected 25,000–30,000 active patients, and based on the current rate of growth Australian health regulators expect the number of medical cannabis prescriptions to reach at least 70,000.

Meantime, changes in regulations have provided Australian producers with new international opportunities. According to the Export Control Legislation Amendment Bill 2020’s explanatory memorandum, lawmakers intend to “remove unnecessary and unintended regulatory barriers imposed on Australia’s exports. This will facilitate trade and growth of Australia’s legitimate export market for low-THC hemp, medicinal cannabis industries, as well as other legitimate narcotic goods exports.”

Australia’s Agricultural Minister David Littleproud noted that the bill broadens current legislation to allow for certification of medical marijuana and hemp exports. “The proposed amendments will allow Australian exports to meet the biosecurity import requirements for any market that requires a phytosanitary certificate,” he said, while ”the industry will be able to export markets in Southeast Asia, China, Canada, and the lucrative U.S. market.”

Some have already taken advantage of the opening. West Perth-based Little Green Pharma has completed the first-ever export of Australian-produced medical cannabis oil to the United Kingdom. Greg Hunt, Australia’s Minister of Health, said it marked “an important step in fulfilling Australia’s vision of building a global medicinal cannabis industry capable of supplying quality medicinal cannabis products to both Australian and overseas patients.”

While Hunt’s goal for Australia as a global supplier of medicinal cannabis products appears to be making headway, there remain challenges at home: Chiefly, that Australia is not supplying Australian patients with medicinal cannabis products.

By the end of 2019, 92 licenses had been issued: 31 for cultivation, 20 for research cultivation, 41 for the manufacture of medicinal cannabis products, and another eight of unspecified nature not yet in effect. Australian license holders are collectively authorized to produce more than 35,000 kilograms (77,000 lbs.) of dry flower for medicinal cannabis annually. Germany, a country with more than 3x the population, reportedly imported 6,714 kilograms (14,802 pounds) of medical cannabis in 2019.

According to the Medicinal Cannabis Industry Australia (MCIA), the amount of cannabis licensed and permitted to be cultivated does not reflect the actual amount of medicinal cannabis currently available. The MCIA estimates that at least 95% of current prescriptions and approvals for medical cannabis are being supplied by imported products; the health department estimates that in 2019 approximately 10% of prescriptions involved locally cultivated and manufactured products. In fact, despite two years of legally available medicinal cannabis, a recent survey found that merely 2.7% of respondents had accessed legally prescribed medical cannabis.

Australian cannabis consumers may favor the illicit market due to high barriers to entry presented by the legal market. Cannabis remains unlicensed as a medicine, and has not yet been entered in the Australian Register of Therapeutic Goods (ARTG). That means that clinicians applying for permission to prescribe medical cannabis must be able to demonstrate that they have exhausted options for conventional treatment. For any whose doctor is not interested in investigating medical cannabis as a treatment option, they can find a willing second opinion. According to Health Europa, as of this month 89 doctors were registered with the Authorized Prescriber Scheme (APS), and more than 1,400 clinicians have prescribed cannabis through the APS or the Special Access Scheme.

Given the relatively low quantities of cannabis currently being imported into Europe, and the still-low legal market participation rates among patients in Australia, the country’s producers will need to be measured in how quickly they scale their operations to ensure that overproduction does not flood the market, resulting in acute downward price pressure and market destabilization as seen in Canada.

The interplay between domestic and international demand is especially important for a young and evolving market. Last week, New Frontier Data explored the complicated relationship between domestic producers and international exporters, and noted how much growth potential exists in the relatively nascent global market. Australia provides another example of a nation primed to take advantage of international growth, but simultaneously hampered by domestic demand. Producers would do well to consider the potential of domestic markets in addition to exploring international opportunities for additional revenue.

In last year’s Global Cannabis Report: 2019 Industry Outlook, the value of demand for cannabis throughout Oceania was estimated at $8.7 billion, while European demand was estimated at $68.5 billion. For domestic producers, if the grass seems greener abroad, there remains plenty of opportunities at home. It will take time and coordinated effort between the industry and healthcare practitioners to build a robust medical cannabis market: With a population of 25 million and strong public support for medical cannabis, Australia has the key ingredients for significant domestic opportunities, though to date its patient population is about one-quarter that of the U.S. state of Colorado, which has roughly one-fifth the residents.