Ask Our Experts 08/12/2018

Q: What is the best way to determine which states’ licenses have the highest value?

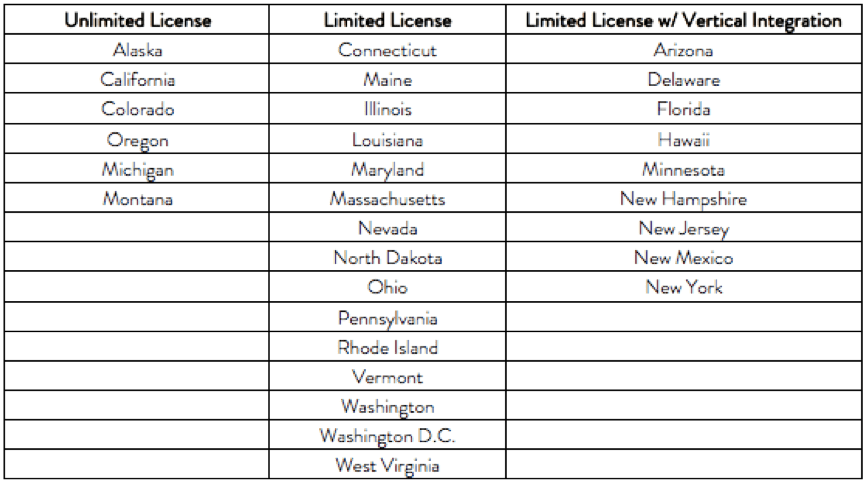

Perhaps the most decisive factors in determining which states have the highest-valued licenses are 1) licensing limits; and 2) vertical integration regulations. By and large, states without licensing limits and with individually licensed market segments (cultivation, retail, manufacturing, distribution, and testing) have lower-valued licenses than those which place caps on the number of licenses issued, and those states which additionally mandate vertical integration of the supply chain. States with defined regulations are listed below according to licensing types.

Digging a bit deeper, many of the early states to legalize adult-use cannabis (including Oregon, Colorado, and California) operate in unlimited licensing regimes, with no caps on the total amount of available licenses. Notably, some such states are allowed to control the number of licenses Issued to meet the demand (which would potentially limit licenses), but have chosen instead to let the market regulate the supply-and-demand balance. Those states also have separate licenses for each market segment, usually meaning that cultivators, retailers, manufacturers, distributors, and testing laboratories are only permitted to operate in their specific vertical spaces. In those states, a business need only pass the qualifying conditions for licensing (inspections, local licensing, application fees, etc.) in order to receive a state license. Such markets are defined by a large number of small facilities operating in a highly competitive market in which wholesale prices are plummeting. Regardless, the practice has the advantage of quickly converting consumers from illicit to legal markets.

Conversely, many states have placed caps on the number of licenses available in each market segment. Given the exclusivity of the licenses, their relative values are naturally higher. For example, Pennsylvania has capped the number of cultivation and dispensing licenses at 25 and 50, respectively, resulting in one cultivation license per every 39,000 people in the addressable market, and one retail license for every 19,500 people. That is contrasted by Oregon, which averages one cultivation license and one retail license per every 530 and 990 people, respectively, in the addressable market. States which put tight restrictions on the number of licensed cannabis businesses see a small number of very large operators in an environment with less dramatic price-based competition.

States with vertical integration and limited license laws often have the most valuable licenses: In Florida, MedMen Enterprise recently announced that it would be paying $53M to acquire dispensary and cultivation assets from Florida’s Treadwell Nursery. In the Sunshine State, licensed cannabis operators must be involved in the entire supply chain (from cultivation and manufacturing to retail). Notably, this involves large up-front costs, and similar states often require license applicants to prove a specified financial well-being.