Ask Our Experts 9/29/2019

Q: Given some persistent headlines about Oregon’s chronic oversupply in cannabis production, what are the prospects for the 2019 harvest season there?

By New Frontier Data

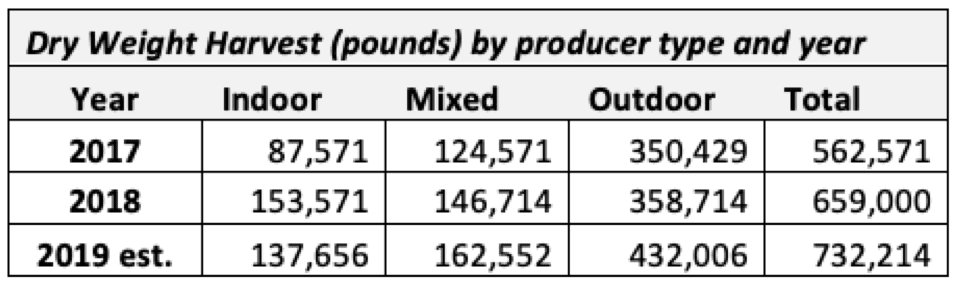

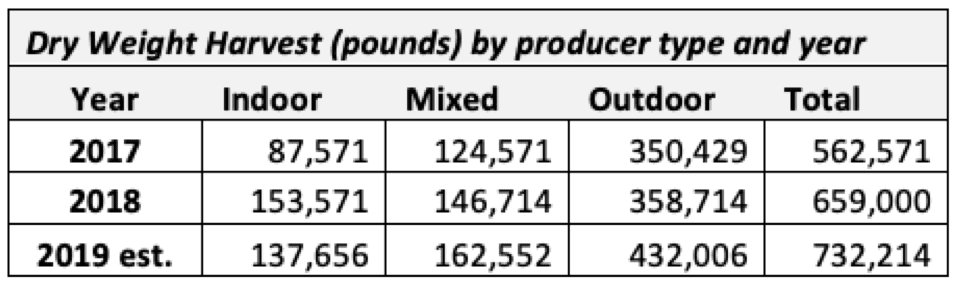

A: According to a forecast prepared by New Frontier Data’s Senior Economist Beau Whitney, another significant harvest is predicted for Oregon this season. Based on his calculations, the yield should be over 10% larger than last year’s.

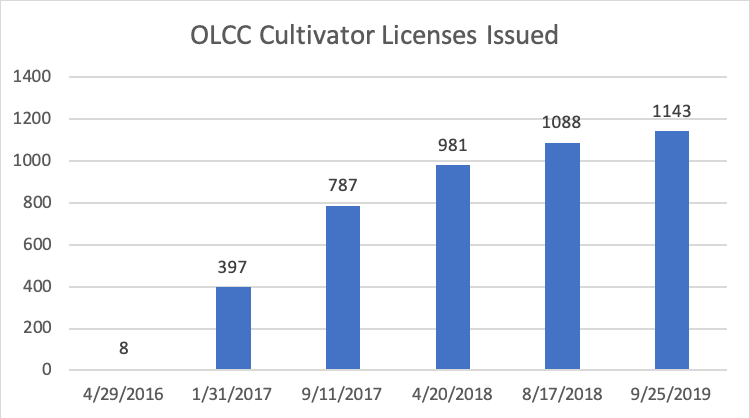

Source: OLCC, proprietary modeling

That projection is based on favorable growing conditions in Oregon, and an increase in the state’s number of licensed cultivators.

“On average, this year’s harvest will not be close to the record harvest of 2017 on a per-license basis, but will be higher than last year’s output,” Whitney explained. “2019 is looking to be a solid harvest. The weather has been good, rains have been sufficient but not too heavy, and the recent rains in the Willamette Valley have not impacted the emerald triangle south of Roseburg” in the southwest part of the state.

As the growing conditions have been favorable, harvests would have been stronger than 2018’s, but given the increase in licenses, New Frontier Data is forecasting an even larger volume of supply, also.

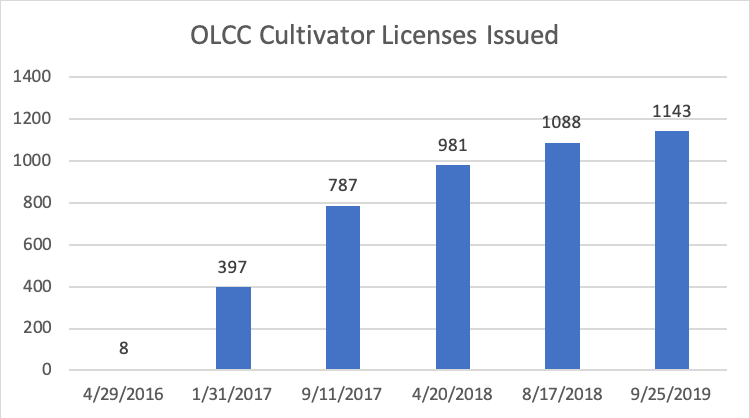

As illustrated in the chart below, OLCC-issued producer (cultivation) licenses have steadily increased since the first were issued in April 2016.

Source: OLCC

Prices in Oregon have experienced a recent uptick for some strains (in some instances in excess of 100% year-over-year), but the potential of a significant harvest has some cultivators concerned. With the increase in prices, the market for flower in 2019 remains highly competitive entering the fall harvest period. While increases in flower prices have given growers reason for optimism, the prospect of additional supply in Q4-’19 will add uncertainty in pricing for the foreseeable future.

The question as Oregon heads into the harvest is whether the increased supply will make the bottom drop out again for wholesale prices, or that the market reached the bottom where prices have stabilized and will only fluctuate with normal seasonality?

As growers anticipate this year’s “Croptober” with hopes to see normalcy restored to the market, a bumper crop means risk of another significant drop in wholesale prices.