Colombia Hemp Market Offering Inroads to the South and Central American Regions

As the North American CBD market continues aswirl with activity and some attempts at clarity, hemp companies keep looking for new markets to establish operations. One geographical region being recognized for its possibilities is South America.

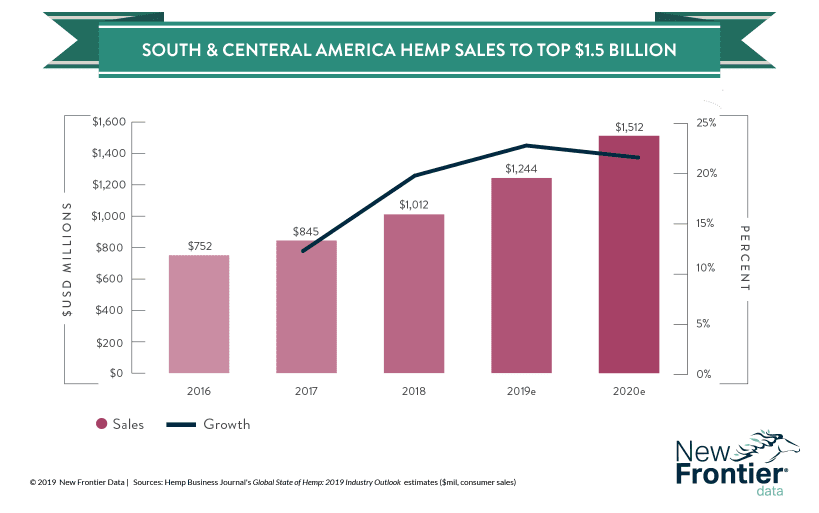

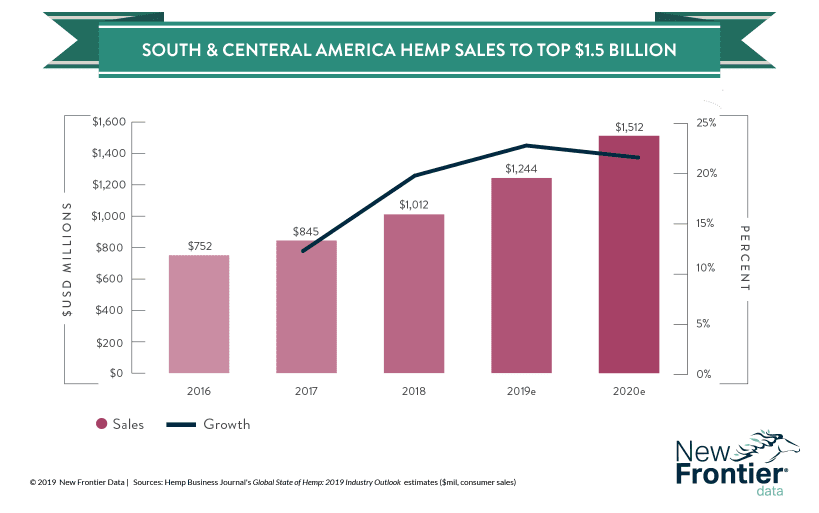

With long histories of cannabis cultivation, South and Central America offer dynamic markets that are rapidly evolving. According to the Hemp Business Journal, the combined South and Central American hemp market is expected to be worth $1.5 billion by 2020. Most of the current hemp market in the region is dedicated to industrial applications, followed by those for hemp-derived CBD, food products, and consumer textiles.

While countries such as Mexico and Brazil represent potentially lucrative hemp markets, the nation with perhaps the greatest potential is Colombia, according to Greg Gershengorin. He is the co-founder of QualCann, a licensed Colombian-based grower, extractor, and exporter of hemp and medical cannabis products.

From his perspective, Colombia has three distinct advantages over its regional neighbors.

The first is political: As one of the oldest democracies in the region, Colombia is more politically stable than its neighbors including Brazil and Venezuela. Coming off a civil war which lasted for more than five decades, Colombians are eager to turn previously illicit crops such as hemp and cannabis into legitimate industries, and they hope to improve stability by adopting pro-business policies.

“They certainly see the perils of political violence and the waves of people from Venezuela on their streets,” said Gershengorin. “They never want to be in the same position, which means they want to be pro-business and attract foreign direct investment.”

Colombia’s second advantage is its nutrient-rich land: As detailed in the Hemp Business Journal’s Global State of Hemp: 2019 Industry Outlook, Colombia’s unique growing conditions and soil accommodate development of uncommon cannabinoids and terpenes, which can command higher prices on the international market.

“In terms of biodiversity, there are not many markets that are competing,” added Gershengorin.

The country’s third, and perhaps most significant advantage is its human capital: The country has a large, well-educated workforce, which — when combined with a low cost of living — makes Colombia incredibly attractive to foreign employers.

“We have highly educated and skilled people — agronomists, scientists, chemists, and so on,” Gershengorin explained. “The costs associated with those people are staggeringly low.”

He noted that since Colombia’s labor costs are low, foreign companies are better positioned to offer generous compensation plans, which in turn promote retention of those highly skilled employees. By comparison, in markets like the United States, it is relatively difficult to keep skilled workers when the labor market is so competitive.

While there are many advantages to operating in Colombia, there are also some obstacles preventing its hemp industry from achieving its full potential.

Colombian law does not distinguish between cannabis and hemp. Instead, regulations are determined based on whether plants have a THC level of 1% or less, a standard making hemp cultivation much more tightly regulated than in North America.

As a result, the consumer market in Colombia is likewise restricted. Much of Colombia’s hemp-CBD market is limited to cosmetics (including imports from China) and topicals. While there is significant consumer demand, consumable CBD products are not yet widely available.

Tight restrictions also translate into a complex patchwork of government agencies that regulate different parts of the hemp production process. In order to cultivate it in Colombia, companies must first obtain a license through the Ministry of Health and Justice.

Companies must also gain approval from the Instituto Colombiano Agropecuario (ICA), Colombia’s federal agriculture department. The procedural process involves a full cultivation cycle, statistical analysis on variants, and innumerable tests.

Given its biodiversity, Colombia features a few distinct microclimates which the ICA assiduously maintains. Splitting the country into 12 zones, the ICA requires companies to undergo a separate approval process for each zone, i.e., any company wanting to cultivate hemp in 12 different zones would have to go through the approval process a dozen times.

Further complicating matters is a backlog of license applications. Because of Colombia’s ecological protections, a significant number of applications are required to cultivate various crops there. While both the ICA and the Colombia government encourage hemp cultivation, the bureaucracies are hard-pressed to keep up.

Nevertheless, North American hemp and cannabis companies have not shied from the Colombian market. Canadian licensed producers including Tilray (NASDAQ: TLRY), Aphria (NYSE: APHA), and Aurora Cannabis (NYSE: ACB) have each set up shop in Colombia. Similar to their operations in Europe, many of the companies view Colombia as a staging ground to launch into the wider region as hemp and cannabis laws are relaxed throughout South and Central America. Besides the regulatory kinks to work out, the hemp market in Colombia and the wider regional market looks bright.

William Sumner

William Sumner is a writer for the hemp and cannabis industry. Hailing from Panama City, Florida, William covers various topics such as hemp legislation, investment, and business. William’s writing has appeared in publications such as Green Market Report, Civilized, and MJINews. You can follow William on Twitter: @W_Sumner.