A Cannabis Consumer’s Hedge Against Inflation: Legal Homegrowing Gains Ground

As U.S. Legal Cannabis Market Expands, Annual Consumer Spending on Homegrowing Could Near $4B by 2030

July 27, 2022

Cultivating the Homegrowing Consumer

August 9, 2022By Noah Tomares, Senior Research Analyst, New Frontier Data

To the extent that cannabis is widely considered to be recession-resistant, consumers across markets in the United States are feeling the squeeze of higher prices. With nearly 4 in 10 cannabis-consuming Millennials reporting daily use, demand for flower can be quite inelastic.

Common strategies to counter economic hardship include spending less per transaction for cannabis as part of a broader budget-saving strategy, or purchasing flower in bulk to take advantage of discounts on flower sold in units greater than a 1/8 ounce. A third option—more rarely considered — is to grow one’s own cannabis.

New Frontier Data’s latest report: The U.S. Cannabis Homegrow Market: Motivations, Processes, and Outcomes, examines an often underestimated but considerable segment in the legal cannabis industry. Approximately 6% of cannabis consumers report growing their own flower. With an estimated 52 million consumers in 2022, that translates to more than 3 million Americans cultivating their own supply, a number forecasted to reach nearly 4.1 million homegrowers in the country by 2030.

Despite the substantial number of homegrowers, and the significant amount of time, energy, and capital invested in their grows, little is known about that community, whether about their motivations, processes, or outcomes.

Nearly three-quarters (73%) of homegrowers cited the practice as a hobby, with a majority (53%) also noting its lower relative cost to purchasing at retail. Nearly half (45%) also reported being their own primary source of cannabis, with six in 10 (60%) saying that they grow all or most of what they consume.

By a conservative estimate, homegrowers will produce 11 million pounds of dried flower in 2022. Assuming an average prevailing market value of $1,250 per pound, cannabis output from U.S. homegrowers in 2022 would be valued at $14 billion. New Frontier Data projects that production to increase beyond 15 million pounds of dried flower by 2030.

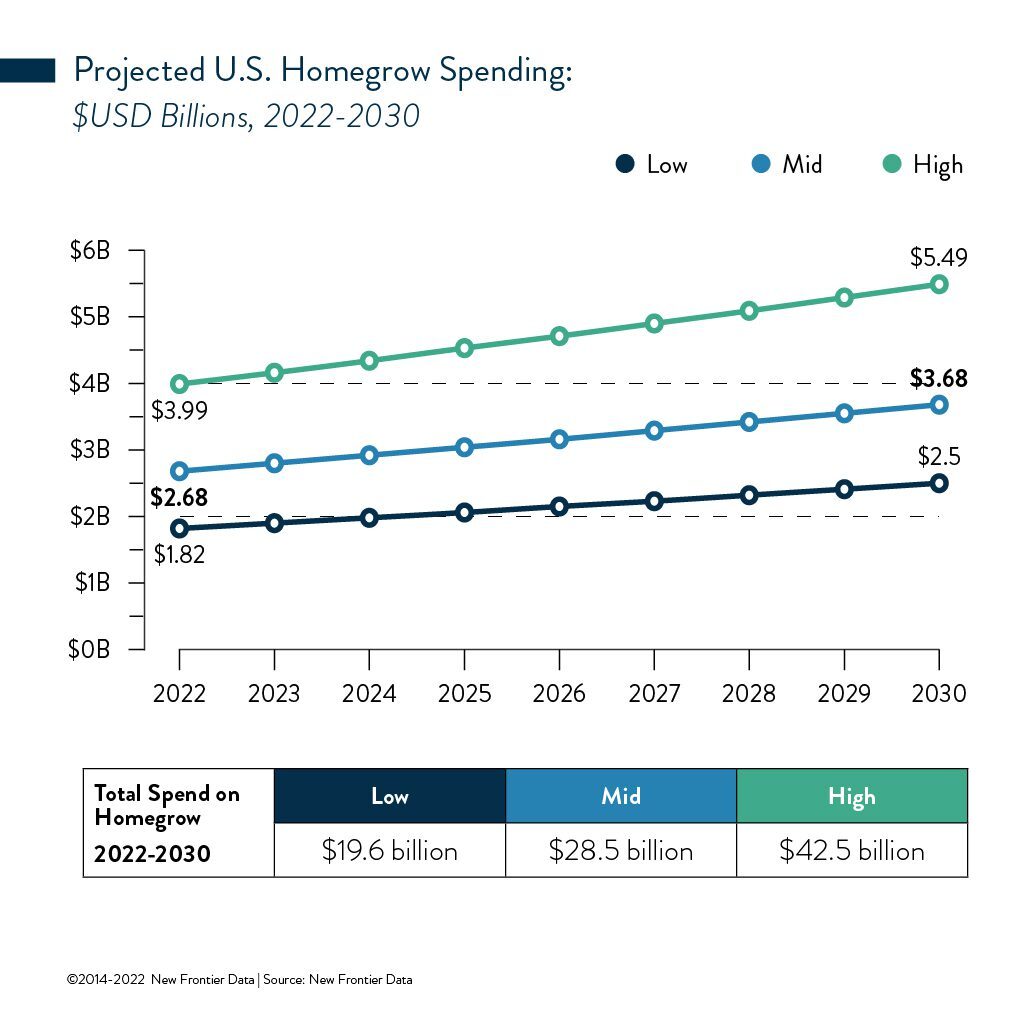

Based on estimated average costs for site set-up and cultivation inputs, annual homegrow spending is projected to increase 37% over the next decade, from $2.7 billion this year to $3.7 billion in 2030. Meantime, consumers will cumulatively spend nearly $30 billion on homegrow supplies.

Several factors will shape the trajectory of the market: how quickly states adopt full adult-use programs, respective regulations for homegrowing in each market (including plant limits), increasing access to consumer education, and innovations making homegrowing more accessible and risk/fail-proof, especially for beginner growers.

Laws surrounding cannabis obviously are critical for a consumer’s propensity to homegrow. Consumers are more likely to grow their own cannabis if they reside in adult-use markets (7%) than in medical-only (5%) or illicit (4%) markets. That suggests how, over the coming decade, as more states transition to full adult-use models, more adults will take up homegrowing for the first time. State regulations (and specifically, the allowance of homegrowing) will be critical to new state markets. As the stigma around cannabis recedes, we expect to see more states permit home cultivation in their regulatory framework.