Cultivating the Homegrowing Consumer

A Cannabis Consumer’s Hedge Against Inflation: Legal Homegrowing Gains Ground

August 2, 2022

Home Is Where the Flower Is: Cannabis Homegrowers on the Rise

August 16, 2022By Noah Tomares, Senior Research Analyst, New Frontier Data

Cannabis consumers’ homegrowing represents massive market potential for the legal industry in the United States. Opportunities are vast, both in terms of capacity to produce flower and in capturing the substantial sums which growers annually spend to support their hobbies.

New information about the homegrowing niche in the market is available through New Frontier Data’s latest report: The U.S. Cannabis Homegrow Market: Motivations, Processes, and Outcomes.

For example: Among operators interested in tapping into the especially engaged niche of the industry, it is keenly important to consider who homegrowers are as consumers. They follow a similar age distribution to the general consumer population, and live largely domesticated lives. More than half (51%) are married, and nearly two-thirds (65%) have children. Rather than a college-aged amateur, the average homegrower is more likely to be a middle-aged parent — an imperative consideration for any brand interested in marketing to homegrowers or producing hydroponic equipment.

Though growers are proportionally distributed across the socioeconomic spectrum, income plays a role (as with most hobbies) in one’s relative expenditures to establish a grow. Half (50%) of those surveyed reported spending less than $500 for their equipment. However, more than half (51%) of growers earning more than $100,000 annually reported spending $1,000 or more on their equipment, compared to but 13% among those earning less than $50,000 who do.

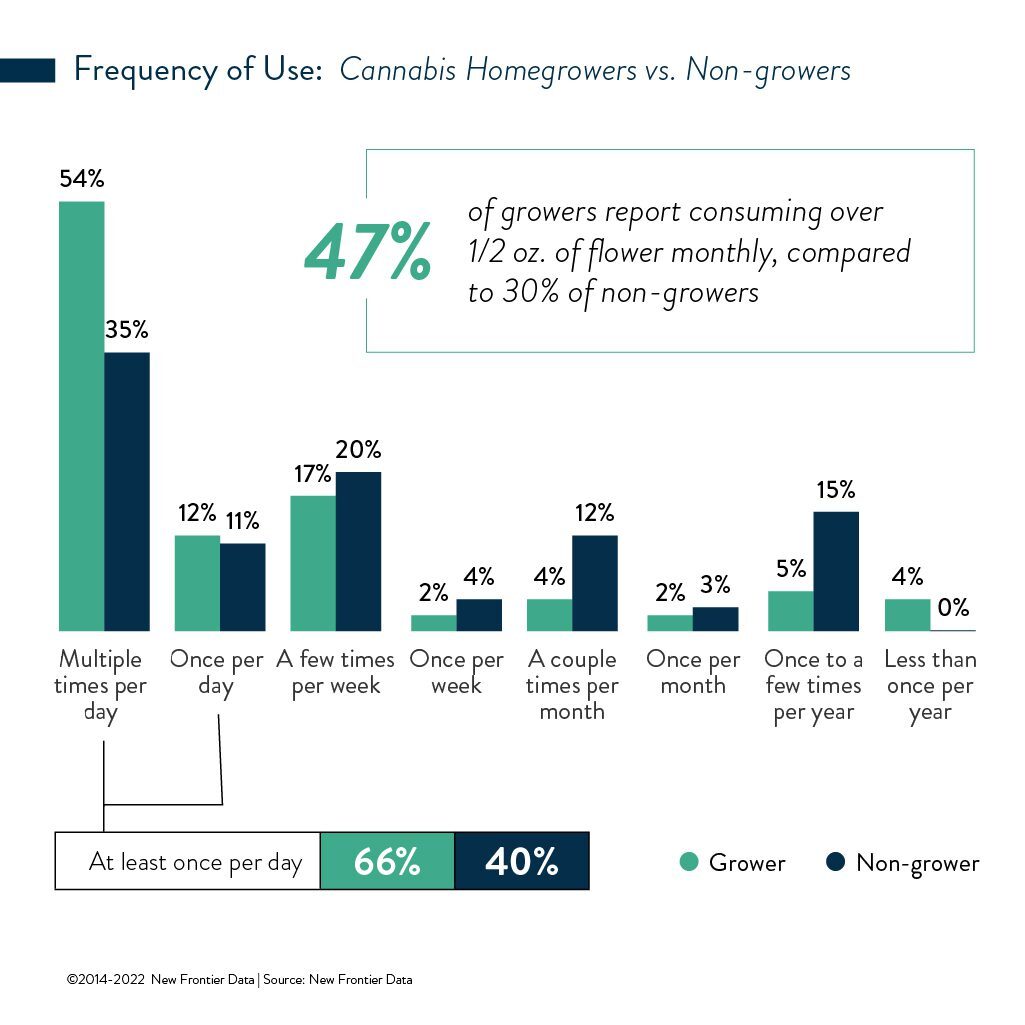

What truly separates homegrowers from the general consumer population is their prolific flower consumption. Nearly 8 in 10 (77%) of cannabis growers identify flower as their most frequently used form, compared to less than two-thirds (64%) of non-growing consumers who do. Growers were also far likelier (66% to 40%) to consume cannabis daily, and to consume more than ½ oz. of cannabis each month (47% to 30%). Similar insights about the trending top flower products, purchase trends, and consumer behaviors are available online through the U.S Cannabis Dashboard of New Frontier Data’s Equio business platform.

A consumer’s increased flower consumption is likely facilitated by their personal supply. Six in 10 (60%) among homegrowers report growing all or most of the cannabis that they consume, and 45% say that what they grow is their primary supply.

Brands interested in capturing the excess demand for flower which growers do not fulfill by themselves would do well to more carefully consider how their flower is marketed. Two in 3 (66%) among growers self-identify as both medical and recreational consumers. Those claiming to use cannabis for both reasons tend to be more intentional in their use, and nuanced about which products they choose to achieve specific effects or outcomes. Brands which can articulate their products’ effects and identify best-use cases will enjoy greater success in targeting and capturing those intentional consumers.

Producers of agricultural equipment and homegrowing supplies eager to expand their reach to customers might do well to consider other DIY production methods. Homegrowing consumers report being much likelier involved in other “green-thumbed” activities (i.e., gardening for vegetables/fruit/herbs, or homebrewing, beekeeping, etc.) when compared to non-growers. Identifying consumers who are already engaged in those activities may help target future homegrowers.

Moreover, non-consumers who engage in some of those activities were more likely to report interest in homegrowing cannabis. The orientation to gardening and enjoyment of tending to plants suggests natural messaging for both non-grower consumers and non-consumers interested in homegrowing. Nevertheless, given the challenges in producing high-quality cannabis — even if compared to producing fruits and vegetables — consumer education represents a substantial hurdle; it is imperative that information about unique challenges and opportunities in growing cannabis be both readily available and easily understandable for prospective growers.