What Do Cannabis Consumers Really Want?

A Constant in Cannabis Is That Consumers Seek Individualized Purposes

October 11, 2022

Which Archetypes Define Your Customers?

October 19, 2022By J.J. McCoy, Senior Managing Editor, New Frontier Data

Made available today, New Frontier Data’s latest report, Cannabis Consumers in America, Part Three: Identifying Key Archetypes, concludes a groundbreaking series providing newly detailed insights into the purposeful and intentional use of cannabis across the United States.

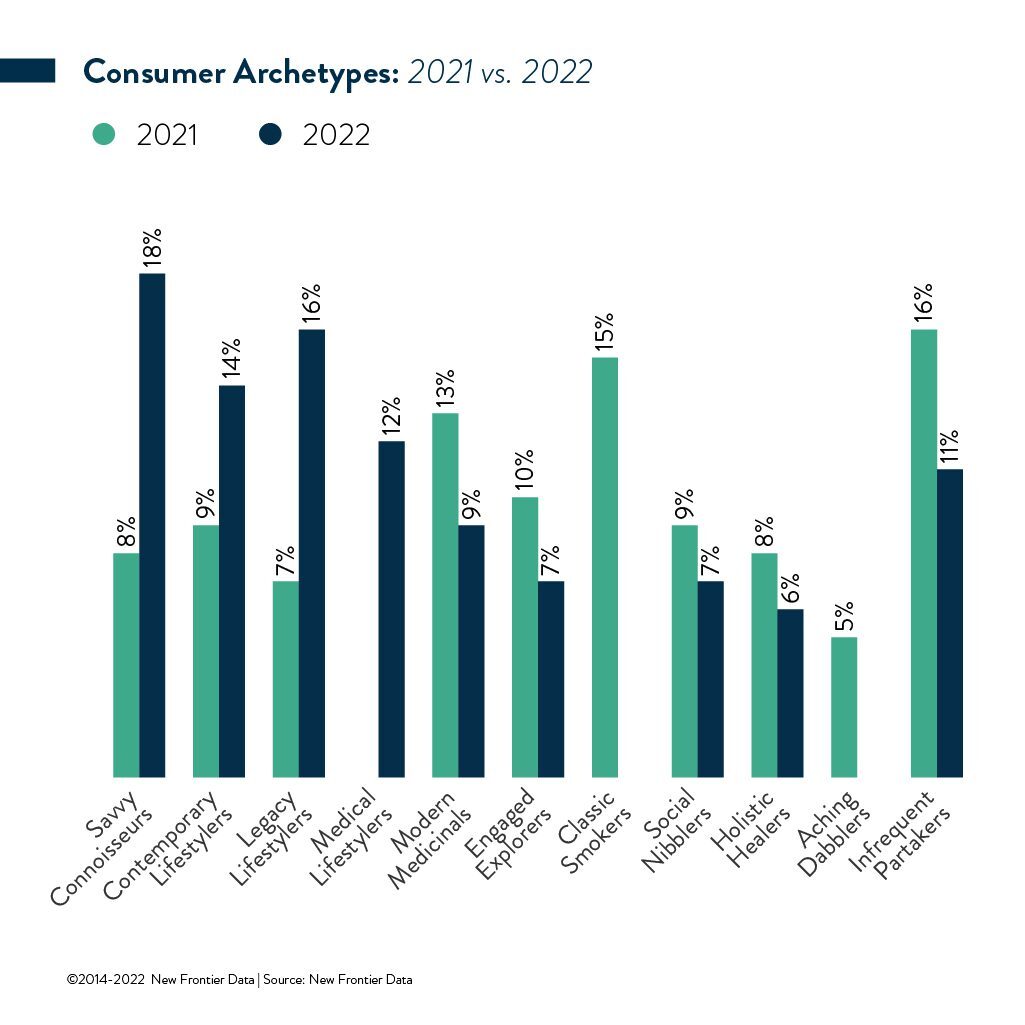

Informed by new survey data gleaned from U.S. cannabis consumers, New Frontier Data has updated our quantified consumer archetypes to reflect the evolving landscape of consumer trends, behaviors, and preferences. Two archetypes have been retired since last year (i.e., Classic Smokers and Aching Dabblers), and one new archetype has emerged: the Medical Lifestylers. Changes within each archetype between 2021 and 2022 are discussed at the end of each analytical section. All told, nine distinct consumer archetypes offer valuable takeaways from previously overlooked or under-examined consumption groups. In addition to usage patterns, the consumer categories also differ by their procurement sources, spending habits, preferred products, reasons for use, social openness, and other key variables.

Presented through partnership with cannabis discovery company Jointly, the report zeroes in on U.S. consumers and revised data about their intentions, preferences, and behaviors. Since Jointly launched its consumer data platform in 2020, some 80,000 cannabis consumers have rated and recorded their individual experiences. To date, more than 206,000 of them have documented experiences detailing goals, products, doses, product effectiveness, and flavor/aroma ratings. They include 140,000 experiences noting the time of day, duration since a previous session, the presence or absence of exercise, hours of sleep, hydration, fullness of stomach, and side effects. As a result, this report reveals distinct consumption trends and purchasing behaviors which product manufacturers and retailers can leverage within a U.S. legal cannabis market projected to exceed $57 billion by 2030.

Through specific case studies and overarching demographic cohorts, the report illustrates primary differences and overlapping priorities among consumers’ motives for choosing and consuming cannabis. Based on analysis of the respective points, the results reveal not just the respondents’ consumer preferences, but also their behavioral habits. That lends depth to the subjects beyond just medical use or adult use, etc., to illustrate both how evenly split their usage patterns proved to be, yet how similar they were generally.

The particular proclivities and preferences – and market shares – represented by each Savvy Connoisseurs (18%), Legacy Lifestylers (16%), Contemporary Lifestylers (14%), Medical Lifestylers (12%), Modern Medicinals (9%), Engaged Explorers (7%), Social Nibblers (7%), Holistic Healers (6%), and even Infrequent Partakers (11%) offer key insights. Once that essential consumer differences are addressed, similarities can then be shared: Which goals are most popular, and which product forms are considered the most reliable for achieving success?

Cannabis Product Types

The shift towards dual use of flower and non-flower products (as opposed to the exclusive use of flower) differs by archetype. Contemporary and Legacy Lifestylers, for example, are both overrepresented in the flower consumption group, while underrepresented in the other consumption groups. Newer consumers in a market (e.g., Engaged Explorers) tend to prefer products that are easy to consume in a wide variety of places, like edibles and vape pens. Even those who consume infrequently express a preferred product type.

Medical vs. Recreational Consumption

Except for Savvy Connoisseurs, archetypes consist almost exclusively of either self-described medical or self-described recreational consumers. Evolving legalization may impact how infrequent consumers interact with the market: The infrequently consuming archetypes are rarely registered patients, whether due to their infrequency of use or living in illicit markets.

If those markets turn legal, consumers may transform to higher-frequency, medical or wellness-based archetypes; since medically focused groups are seeking non-flower products, they regularly patronize regulated businesses to acquire their products.

Who Are Today’s Legal Cannabis Consumers?

To industry outsiders, trite memes too often reflect tired stereotypes ranging from Cheech and Chong to Harold and Kumar. But to stakeholders competing in a burgeoning industry projecting to exceed $57 billion by 2030, ascertaining the properly framed realities is to drink from a Holy Grail for marketing and brand development.

As example: Among Savvy Connoisseurs, 64% like to share cannabis with family and friends; 52% source from a business, and 95% acquire cannabis at least once a month, making them natural evangelists for their preferred cannabis products and dispensaries. Contemporary Lifestylers all live in legal markets, and therefore are much likelier (44%) to buy cannabis in-state than is the average consumer (36%). For their part, Legacy Lifestylers are also frequent consumers, but are recreationally focused, with most (60%) living in illicit markets.

Self-reported usage rates have risen sharply since 2012, and if the trending is sustained, the number of U.S. consumers will grow from 47 million in 2020 to 71 million by 2030.

U.S. medical markets continue to expand, with the number of registered patients forecast to increase to 5.7 million in 2030 (1.6% of the adult population).

Assuming legalization in all 18 potential markets by 2030, 47% of total demand will be met by legal cannabis purchases (up from 27% in 2021), indicating continued disruption within illicit markets.

Despite strong state-level momentum, the near-term prospects for federal reform are dim, but given President Biden’s call to reschedule cannabis marijuana, some limited measures (e.g., cannabis banking reform) seem in play following the 2022 midterm elections.