New State Markets Could Boost U.S. Legal Cannabis Sales to $72B by 2030

Almost 1/5 of Americans Report Consuming Cannabis Each Year

March 15, 2022

New Frontier Data Projects Annual U.S. Cannabis Sales to More Than Double to $72B by 2030

March 22, 2022By Kacey Morrissey, Senior Director of Industry Analytics, New Frontier Data

Based on New Frontier Data’s latest analysis of state legalization efforts, the likelihood for several new cannabis markets to legalize by 2030 will drive combined U.S. legal sales past $72 billion in that year. Last year, the U.S. legal cannabis market was worth an estimated $26.5 billion, and this year it is expected to top annual sales of $32 billion.

Trending for 2022

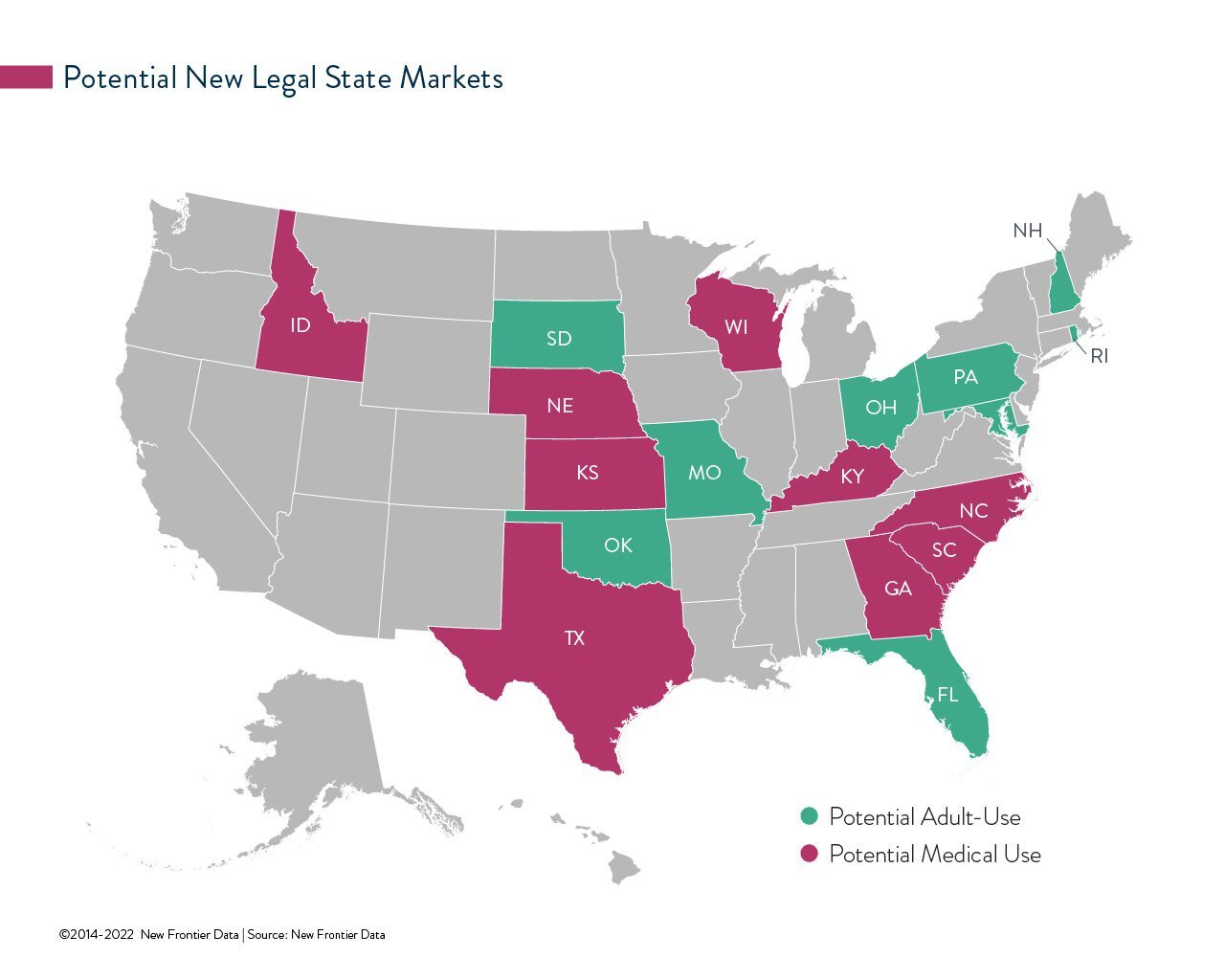

As detailed in 2022 U.S. Cannabis Report: Industry Projections & Trends, nine respective states are demonstrating strong momentum to legalize medical programs, while another nine seem likely to legalize cannabis for adult-use consumption by 2030. Should all of them succeed in those efforts, combined U.S. annual legal sales are projected to grow at a compound annual growth rate (CAGR) of 14%, to surpass $72 billion within eight years.

The report analyzes several key regulatory determinants of a legal market’s success, including qualifying conditions for medical cannabis patients, the number and activation speed of licensed operators, state and municipal tax rates, and whether home cultivation will be permitted. For comprehensive data and analysis, visit New Frontier Data’s online business intelligence portal Equio® to gain additional insights available within the U.S. Market Dashboard.

How Large Will Legal Markets Grow?

Without counting any additional states’ legalizing cannabis either for medical or adult use by 2030, annual total U.S. legal sales are projected to grow at a CAGR of 11%, reaching past $57 billion by 2030. It means that currently operational states will add an additional $25 billion in revenues over the next seven years, highlighting the continued growth opportunities even among well-established markets.

Given the increasing legalization of cannabis and its broader social/political acceptance, New Frontier Data expects more U.S. states and countries internationally to legalize full adult-use markets simultaneously with medical programs. As already observed, time lapses between adopted medical programs and subsequent recreational legalization in the same markets have shortened. Adoption of follow-on recreational markets has been happening more quickly, even before South Dakota became the first state to push for legalization of both on the same ballot.

New Markets Can Add to Majorities with Access

Should all 18 potential state markets enact legalization measures by 2030, they would not only accrue an additional $14.5 billion of U.S. legal retail sales, but add immeasurable political pressure for federal reform. Those new markets would increase the percentage of Americans living in states with some form of legal cannabis access to 96%, and of those living in states with legal access to adult-use cannabis to 64%.

Claiming certainty about U.S. federal legalization has proven to be an elusive enterprise. Yet what seems clear is that continued expansion of legal markets will add to the momentum for reform measures, and socioeconomic pressures for lawmakers to pay heed.

Broader Macro Factors Could Impact Near-Term Revenues

The convergence of several broader economic developments could potentially impact near-term legal cannabis revenues. U.S. consumers were already enduring generationally high inflation levels with the Federal Reserve wielding limited options by which to bring inflation under control. High inflation, combined with the war in Ukraine disrupting supplies to key industrial and agricultural inputs (including oil and wheat), and a global resurgence of COVID-19 — including in the Chinese city of Shenzhen, a major export hub — are compounding worse triggers of rising consumer prices.

Sustained macroeconomic disruptions would negatively impact cannabis consumer spending, and lower legal market revenues over the near term. New Frontier Data’s cannabis consumer research has shown cannabis spending to be highly recession-resilient, meaning that cannabis spending is among the last items which consumers cut when facing tightening financial conditions. Though consumption levels may remain unchanged, consumers reduce their spending by bargain hunting (i.e., seeking value purchases affording them to obtain similar quantities for less) or by reverting to the illicit market where some products, particularly flower, are generally less expensive than in the legal market.

If an economic contraction is sustained through year’s end, total 2022 revenues may return lower than forecast. However, the near-term reallocation of spending would revert to the baseline as consumers regain their spending power, and as the legal market continues to offer compelling (and increasingly cost-competitive) alternatives to the illicit market.

Taken collectively, near-term uncertainty on the broader economic climate, along with medium-term uncertainty on precisely when the next crop of states will legalize or when federal reform might happen, will have little impact on the surging levels of demand for legal cannabis, and do little to deter the broader transition of consumers in legal market from purchasing within regulated channels.