Utilizing Legal Cannabis for Sustainable Stimulus Begins Taking Root in Africa

Missouri’s Medical Cannabis Program Proceeding Apace

June 9, 2019

Employment and Revenue Opportunities in Zimbabwe

June 9, 2019By Beau R. Whitney, Vice President and Senior Economist, New Frontier Data

Africa has seen an accelerating wave of cannabis reform over the past 24 months, much of the movement so far anchored to the south, in Lesotho’s and South Africa’s respectively legalized markets. Meanwhile, many other countries in the continent have taken a more cautious approach to legal reform, waiting to see the approaches their neighbors will take.

Cannabis reform and regulatory deployment rely first and foremost on education and data. Policymakers in Africa simply are uncertain about what questions to ask, and which issues to address. New Frontier Data has been instrumental in providing data and insights about the global cannabis market to African leaders, to help inform their decisions on behalf of their citizens through economic and social benefits.

As detailed in New Frontier Data’s recently published Africa Regional Hemp and Cannabis Report: 2019 Industry Outlook, the continent has one of the highest usage rates (at 11.4%) of any region. That is nearly double the global average of 6%. It is notable that even with such high levels of usage, Africa has nevertheless been far behind other markets in terms of legalization and reform. Now that Africa has a better understanding of the opportunities associated with each adult-use, medical, and industrial cannabis, reforms are coming — and quickly. Apart from South Africa and Lesotho’s legalized adult-use and markets, countries including Zimbabwe, Liberia, Uganda, and Kenya are opening programs for both medical and industrial cannabis.

Recently, New Frontier Data and several other members of the InnerCannAlliance held a two-day Africa Symposium in Victoria Falls, Zimbabwe, to meet with cabinet-level ministers, governmental officials, and hemp and cannabis business leaders and investors.

Among the more generally compelling aspects of the African market is that Africa has the fastest population growth rate of any of the world’s seven geographical regions (including Asia, the Caribbean, Europe, Latin America, North America, and Oceania). Africa’s current population of 1.26 billion is projected to double to 2.53 billion by 2050; as such population growth occurs, there will be significant increases in health-care spending, and persistent needs of finding new opportunities to drive employment and economic growth.

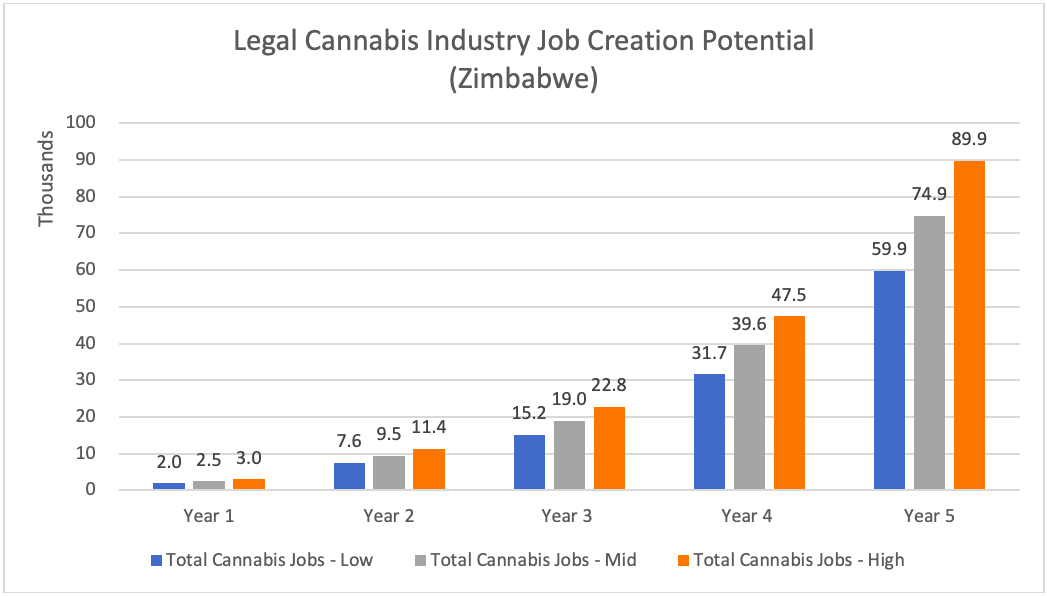

Cultivating and producing adult-use, medical, and industrial cannabis could contribute positively to the African economy. Based on a recent analysis of such market opportunities, even with a modest deployment mainly centered around hemp, Zimbabwe could create between 60,000 and 90,000 jobs within five years of deploying a legal program, and (including exports) could generate in excess of USD $300 million in revenues.

Many of the benefits of deploying cannabis in Africa would be seen in the agricultural sectors. In Africa, agriculture represents a generally larger percentage share of economic importance than in other regions, contributing significantly to the continent’s overall gross domestic product (GDP) both in terms of employment and output. Noting that, regional policymakers constantly seek ways to protect or expand the agricultural sector.

For Zimbabwe specifically, among the risks to its agricultural markets is the declining demand for tobacco. As one of the world’s top-10 largest producers of tobacco, it represents a significant threat to the Zimbabwean economy, and political leaders are scrambling to address it before the impact is fully felt. Zimbabwean leaders recognize cannabis as a sustainable alternative to serve as a rotational crop now, and potentially employ displaced tobacco farmers later.

Whether for generation of employment or revenue, or as a means for economic and social development, cannabis is making inroads across the continent. While not a panacea, the legalized cannabis industry is certainly attracting the attention of policymakers globally, with momentum carrying well into Africa.