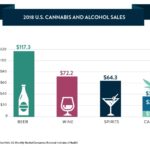

On St. Patrick’s Day, Signs of Cannabis’ Displacing Alcoholic Beverages

US Cannabis and Alcohol Sales

March 17, 2019

Uruguay’s Great Evolving Cannabis Experiment Continues

March 24, 2019By J.J. McCoy, Senior Managing Editor, New Frontier Data

The first recorded St. Patrick’s Day parade was held in Boston (not in Ireland) in 1737. Across the 282 years of parades since those origins, the holiday for the patron saint of Ireland has established itself as the third-most popular annual drinking day in the United States, where revelers consume an average of 4.2 alcoholic servings on the day, after Mardi Gras Fat Tuesday (4.6) and New Year’s Eve (4.4), according to Alcohol.org.

This weekend, as projected by WalletHub, 55% of Americans plan to celebrate the holiday and will spend a combined $5.6 billion (an average of $40) doing so. Nearly 1/3 (32%) of men and 1/5 (20%) of women say that they binge drink on the holiday, as defined by consuming either (by men) 5 or more, or (by women) 4 or more drinks over a two-hour period on a day when American revelers overall consume 152.5% more beer (and 819% more Guinness, specifically) than on an average day.

That’s quite a party for someone who died 1,558 years ago today. Yet, regardless of how the tradition managed to develop (e.g., suspension of Lenten restrictions on food and alcohol), it has obviously become entrenched in American culture. But for how long? Will the popularity of, say, vaping ever rise above that of green beer? Among other findings of cannabis consumer behavior, preferences, and emerging trends as detailed in New Frontier Data’s 2018 Cannabis Consumer Report are groundbreaking insights regarding alcohol and cannabis consumption, including preference and usage.

Frequency of alcohol use correlates to frequency of cannabis use (daily consumers of alcohol are also among the likeliest daily consumers of cannabis daily, while those who consume alcohol once per week are more likely to consume cannabis once per week compared to any other cannabis-frequency profile), and now a new supplement drawn from those findings provides a deeper dive into the nexus of cannabis and alcohol, including usage frequency, policy viewpoints, and the degree to which cannabis is cannibalizing alcohol sales.

A preference for cannabis over alcohol by consumers of both explains in part why major alcohol brands are aggressively entering the cannabis market: They recognize that increased access to legal markets and the elimination of the punitive risks of cannabis use will likely lead to some displacement of alcohol use by cannabis for a broad base of consumers.

In a survey last October, New Frontier Data found that nearly half (45%) of cannabis consumers who also drank expected to eventually replace at least some of their alcohol use with cannabis. For those who enjoyed the taste and traditions yet worried about the health effects of alcohol, a new profusion of non-alcoholic, cannabis-infused beer and wines are (where legally available) offering some intriguing potential replacements.

The new, wide-ranging array of cannabis products suggest some new standards for how and why cannabis is consumed, thus increasing opportunities to displace alcohol as the legal market matures. With the new raft of cannabis products offering convenience (e.g., no need either to roll a joint nor pack a pipe), discretion (odorless and highly portable options), tailored experiences (replicable, effect-based experiences such as “energy” or “calm”), and rapid uptake (faster onset than the typical 30-60 minutes from edibles), New Frontier Data projects that such products will present significant new and attractive opportunities for alcohol substitution relative to when consumers predominantly smoked flower.

And 4/20 is just six weekends away.