A Constant in Cannabis Is That Consumers Seek Individualized Purposes

Back to Nature: Cannabis Consumers Gain Satisfaction in Outdoor Settings

October 4, 2022

What Do Cannabis Consumers Really Want?

October 18, 2022By Amanda Reiman, Chief Knowledge Officer, and J.J. McCoy, Senior Managing Editor, New Frontier Data

This marks the second among a series of discussions about various findings shared in New Frontier Data’s recent report, Cannabis Consumers in America (Part II): The Purposeful Consumer. As the cannabis industry evolves, emerging products are targeting consumers looking for specific outcomes. Intentional consumption is the process of selecting cannabis products based on specific goals. What are the most common goals for cannabis consumers, and which products are most effective at meeting these goals?

Presented through partnership with cannabis discovery company Jointly, the report zeroes in on U.S. consumers and their intentions, preferences, and behaviors. Since Jointly launched its consumer data platform in 2020, some 80,000 cannabis consumers have rated and recorded their individual experiences. To date, more than 206,000 of them have documented experiences detailing goals, products, doses, product effectiveness, and flavor/aroma ratings. They include 140,000 experiences noting the time of day, duration since a previous session, the presence or absence of exercise, hours of sleep, hydration, fullness of stomach, and side effects.

Among the report’s key takeaways is recognizing the primacy of consumers’ purposes for choosing cannabis. Which of their common goals are most popular, and which product forms are considered to be the most reliable for achieving their success?

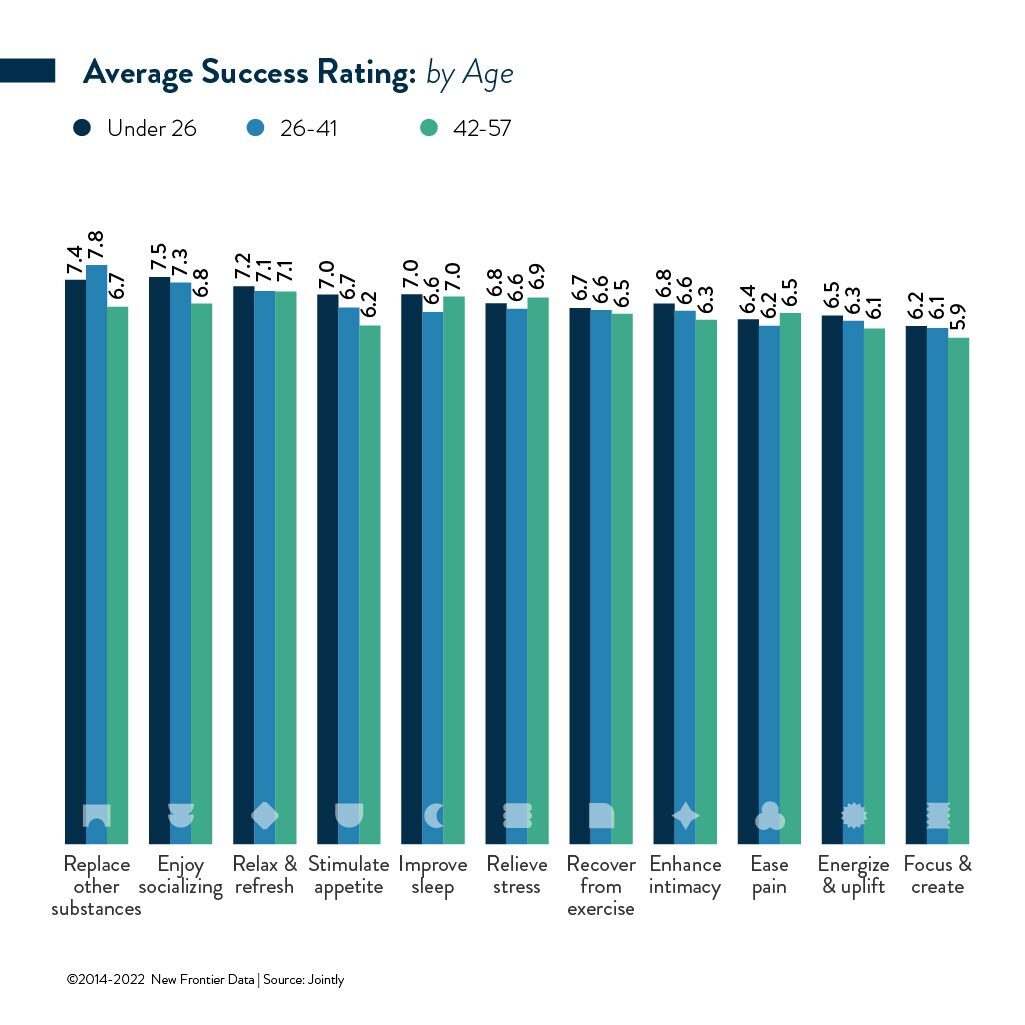

For example: Relaxation and relief of everyday stress were the most prevalent goals reported in a survey of consumers, while replacing other substances was the least common priority cited. However, replacement for other substances had the highest success rate across goals. That may be due to the act itself defining success, regardless of outcome.

Beverages were most popular for the goal of replacement. Concentrates, specifically, were rated most effective, though they were otherwise considered the least effective for all other goals.

For a long time, it was assumed that cannabis consumers were a monolith, that they were all interested in the same thing out of their experience, that it really did not matter which product they chose so long as it had THC in it. The new report offers new insights to why people consume cannabis, how they consume it, and how brands, marketers, and retailers can provide education about the plant and products to their customers so that everyone can achieve their goals.

Identifying Customers and Expectations

An essential goal for any cannabis business is to identify and understand consumers’ purchasing behaviors in the market, especially their favorite products and experience preferences. During our most recent webinar, “The Purposeful Consumer”, New Frontier Data’s Chief Knowledge Officer Amanda Reiman joined Jointly’s CEO and Co-Founder David Kooi, and Sara Payan, Public Education Officer at The Apothecarium in San Francisco, about findings in the report.

They considered how cannabis producers are targeting consumers looking for specific outcomes: Intentional consumption is the process of selecting cannabis products based on specific goals. What are the most common goals for cannabis consumers and which products are most effective at meeting these goals? As the cannabis industry evolves, emerging products are targeting consumers looking for specific outcomes.

“The proof is in there that cannabis is a complex plant that can be used for many different purposes, that it affects everyone differently, and that you can create the conditions that improve your results,” explained Kooi. “When you add all those things together, it’s a proof that the stigma is false and a proof for this industry that we have a really interesting future for this industry as more and more people get to know those truths and get to understand those [as] brands and retailers, but especially consumers.”

“Nearly every cannabis consumer is a purposeful consumer,” he added. “All you need to do is peel back one layer and it shows that even for the person who’s shopping just for the most THC per dollar” they intend to relax, sleep better, or be more creative.

From the sales side, Payan explained, the data laid out in the report can help in terms of training retail and dispensary staff to engage those customers, and to enrich the relationships with consumers – not only to make a sale, but to talk and listen to them about their goals, and how to create safe and enjoyable experiences as they figure out which dosages work best for them. “Conversation is normalization,” she said, “so if somebody has that chocolate-covered blueberry that helps them sleep and they talk to a friend about it, it may not be the same product, it may not be the same dosage, but it’s piqued the interest, and it’s created an action.”

The recorded webinar is available along with the video library on Equio®, our cannabis business intelligence platform. Download a complimentary copy of the report. Interested in accessing Part I of our Cannabis Consumers in America report series? Purchase an Equio® subscription to gain access to New Frontier Data’s entire library of Analyst Reports, and our five dashboards of interactive data widgets connecting you to the best-in-class retail, consumer, and market intelligence.