Another Year, Emerging Markets: How International Finance and Investment Continue Taking Root Across the Legal Cannabis Industry Worldwide

Germany’s Expected Legalization Offers Momentum for Reform, New Markets in Europe

November 29, 2021

$10B+ in Cannabis Capital Raises to Exceed Pre-Pandemic Levels

December 15, 2021By Kacey Morrissey, Senior Director, Industry Analytics

Last month, incumbent members of Germany’s new coalition government announced their having reached an agreement to fully legalize cannabis, joining the rapidly growing list of countries globally that have chosen to permit its volitional use by adults.

As Europe’s largest and most influential economy, Germany’s conversion regarding cannabis marks the latest milestone to pique investor interest since Canada in 2018 became the first G7 nation to nationally legalize cannabis for adults (following Uruguay, which five years earlier became the world’s first sovereign nation to do so).

Continuing its established analysis and keen anticipation of how the markets have been evolving since recent respective elections in the U.S. and Europe, New Frontier Data reviews the integral aspects of both established and emerging legal marijuana markets in its latest release, Cannabis Capital: 2021 Global Finance & Investment Trends.

Available on December 14, and introduced during a December 15 webinar, the report will include comprehensive data and metrics including each national and state-level market sizing and revenue projections, respective federal and state/provincial regulatory policies, product and industry trends, developments in public markets, medical cannabis research and innovation, potential impacts of new governmental administrations, and the expansion of legalization across international markets.

In 2020, according to New Frontier Data’s latest modeling, cannabis consumers globally spent an estimated $25 billion in legal markets, though total demand in both legal and illicit markets was closer to $400 billion. The wide gulf between the current legal market and the 20x larger total addressable market illustrates the growth potential as more countries establish regulated markets. While much of the industry’s operational and capital activity has centered in North America, the growing list of countries softening their position on cannabis has affirmed the mid- and long-term growth opportunities for companies establishing themselves in other regulated markets, and the industry’s strong tailwinds have driven unprecedented capital inflow as investors have proven eager to take part in funding the next stage of industry growth.

The first half of 2021 saw a spate of record cannabis deals in virtually every industry sector, as companies raced to enter new markets, expand operational capacities, and acquire novel intellectual property in the wake of the rapidly growing industry.

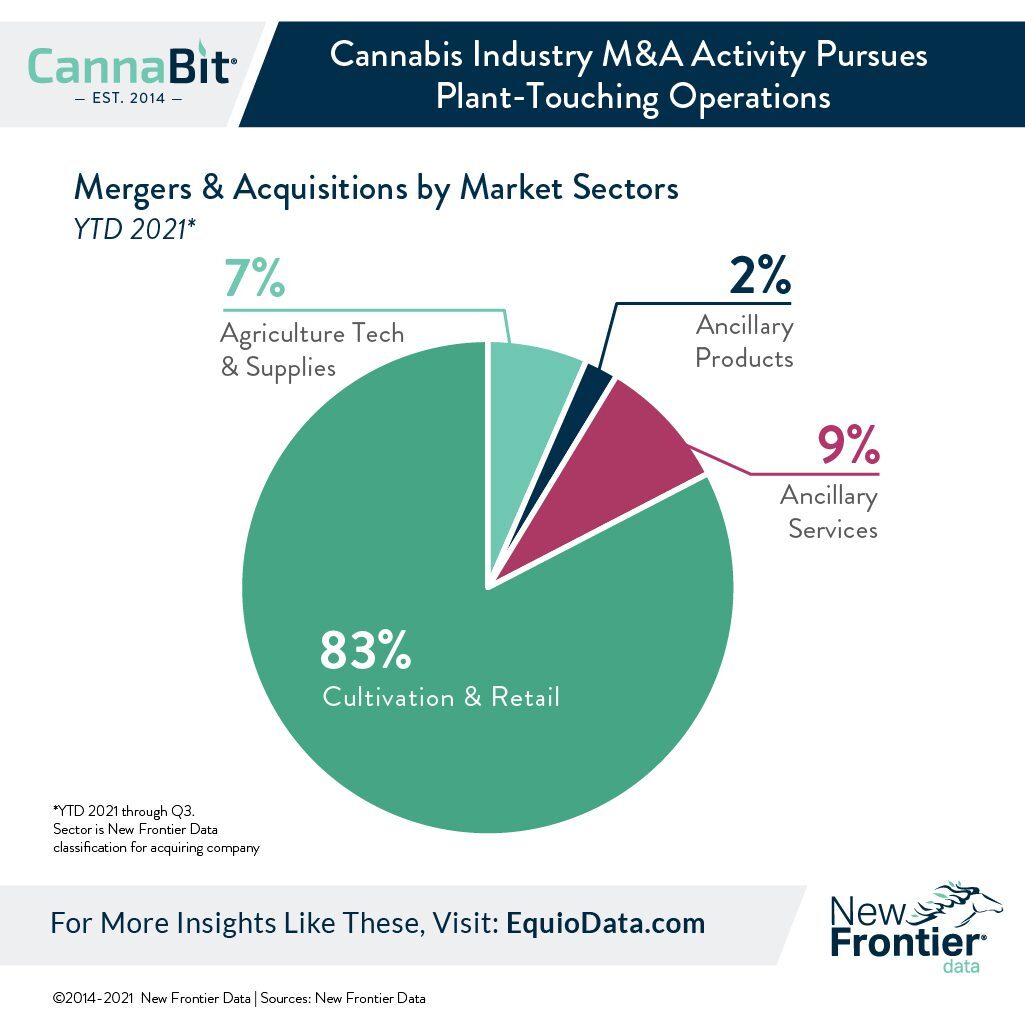

Through the third quarter of 2021, the year’s largest mergers and acquisitions (M&A) were split between the acquisition of companies with U.S. operations, and acquisitions among Canadian licensed producers (LPs), but the bulk of activity was within the production/cultivation/retail space, as companies focused on gaining footholds in newly legalized markets and expanding existing capacity.

From Tilray’s $2.4 billion purchase of Aphria in April, and Trulieve Cannabis Corp.’s $2.3 billion buy of Harvest Health & Recreation in October, to AYR Strategies’ $198 million purchase of Garden State Dispensary, and Cresco Labs’ Cultivate Licensing in September, virtually all of the acquiring companies in the year’s 10 largest-value cannabis M&A deals featured plant-touching operators.

The infusion of capital has served to open up the market, but the sudden freedom for additional capital in the market comes with structural impediments which increase costs for businesses currently operating in fragmented state models, and in the U.S. small operators who are just getting started will be challenged to survive the medium term should the national market be opened with any immediacy.