Appealing to CBD Consumers’ Interests in the Cannabinoid

Frequency of Use Among U.S. CBD Consumers

May 31, 2020

New Frontier Data Expands Scientific Reporting with Appointment of Prominent Cannabis Scientist, Reggie Gaudino, as Chief Science Advisor

June 2, 2020By Noah Tomares, Research Analyst, New Frontier Data

Even as the FDA wrestles yet with its policy positioning regarding CBD, science and society are playing through: A convergence of scientific research supporting both cannabis’ therapeutic properties and its relatively low-risk profile — along with widening public support for relaxation of cannabis laws — are introducing expanding, multisectoral opportunities for cannabis.

CBD is particularly well positioned to take advantage of such, given that the cannabinoid faces fewer regulatory constraints than does THC, with the former’s nonpsychoactive properties presenting lower barriers to adoption.

In a recent survey, New Frontier Data found that Americans have a high awareness of CBD. With about 1 in 5 (18%) of respondents reporting having consumed it, nearly 9 in 10 (86%) expressed familiarity with the cannabinoid, and almost half (48%) of those surveyed regarded it positively.

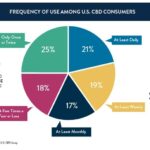

Among consumers, about 1 in 5 (21%) reported using CBD at least daily, with nearly twice as many (40%) doing so weekly. On the other end of the spectrum, one-quarter (25%) of respondents said they had consumed CBD only once or twice.

Men were slightly more likely than women to consume CBD on a daily or weekly basis. Women were conversely more likely to have consumed it but once or twice. Older consumers (i.e., ages 55+) were nearly 2x as likely to be daily consumers than were those among ages 18-34 (27% vs. 14%, respectively).

CBD consumers partake for a variety of reasons. Older consumers reported being more likely to seek pain management. Similarly, medical consumers were the most likely group to consume CBD on a daily basis, while those looking to unwind or use CBD for general wellness were less consistent in their use.

The survey found that a consumer’s social circle can play a critical role in one’s attitude and behavior. Consumers who first used CBD comparatively recently were reportedly more likely to continue their participation in the market.

More than 4 among 10 (41%) of daily consumers claimed to have first tried CBD in the last month, with more than half (56%) reporting doing so within the previous six months. By comparison, under half (49%) of those claiming to have only consumed CBD once or twice first tried it between 1 to 3 years earlier.

Approximately 3 of 10 (28%) among daily CBD consumers claimed to have first tried it in the previous month, while less than half (46%) reported doing so within the prior six months. Less regular consumers were far likelier to report having first consumed CBD between 6-12 months earlier.

Previous consumers represent a substantial potential market for CBD producers attempting to capitalize on surging interest in new wellness products. Notably, the industry’s most ardent supporters tend to be its most recent adopters. While it remains to be seen how long consumers will remain engaged in what remains a generally new marketplace, long-term success for CBD will predictably depend on how well the industry engages the enthusiastic and the apathetic, alike.