Archetypes of CBD Nonconsumers in the European Union

Introducing: EU CBD Non-Consumer Archetypes

March 14, 2020

Cannabis Industry Leaders Worldwide Unite to Address Health and Economic Crisis

March 20, 2020By Josh Adams, Senior Industry Analyst, New Frontier Data

Europe’s hemp-derived CBD market is currently the second-largest CBD market after the United States’. Despite the growth in interest and accessibility, there remain significant gaps in understanding consumer perception, use, and attitudes about CBD. New Frontier Data recently released findings gathered from an expansive European survey that examined the rates of awareness and use of CBD among consumers in 17 countries across the European Union (EU).

That new release, EU CBD Consumer Report: 2020 Segmentation & Archetypes, continues New Frontier Data’s in-depth consumer research about CBD in the EU. It highlights purchasing and usage patterns for CBD across a range of consumer segments, to provide a granular understanding of the current European CBD consumer. Additionally, New Frontier Data has identified a spectrum of CBD consumer archetypes — including both current CBD consumers and nonconsumers — which define groups based upon their distinct patterns of behavior and consumption.

Through the identification and analysis of the consumer archetypes, New Frontier Data can provide a more informed understanding about those who purchase and consume CBD products, how and why they do, and about those who have yet to purchase or consume CBD. A recent article highlighted the five CBD consumer archetypes.

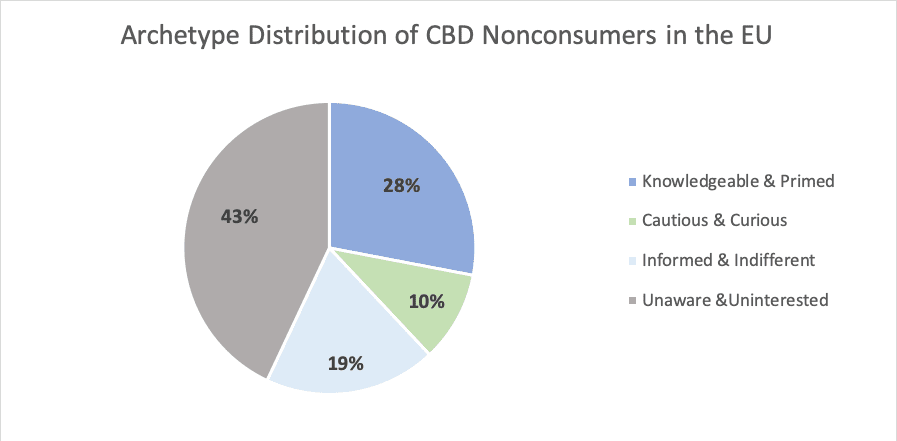

Based on analysis of rich survey data from the EU and U.S., New Frontier Data has identified four overarching archetypes among CBD nonconsumers. They include the Unaware & Uninterested, Knowledgeable & Primed, Cautious & Curious, and Informed & Indifferent. Each archetype represents a segment of nonconsumers who have yet to purchase or try CBD products and who have broadly differing levels of awareness and openness to CBD.

The Unaware & Uninterested represent the largest segment of CBD nonconsumers. As nonconsumers who are broadly uninterested in CBD, they have not seen any CBD products available in stores or online, and are uninterested in learning about it. They are not curious about trying CBD, and have no plans to purchase it. The Unaware & Uninterested are, broadly speaking, unlikely to try CBD products in the current market. However, as the accessibility of products increases and information about CBD becomes more widely disseminated, they might become open to experimenting with CBD.

The Knowledgeable & Primed comprise more than a quarter (28%) of CBD nonconsumers. They are the most curious about trying CBD, and have a broad awareness about CBD products. They have a positive impression of CBD and express a strong belief in the benefits and efficacy of CBD. The Knowledgeable & Primed also support broad access to CBD products for consumers. Additionally, they are the nonconsumers most likely to say that they will purchase a CBD product within the following six months. As such, the Knowledgeable & Primed are the mostly likely among nonconsumer archetypes to become CBD consumers.

The Cautious & Curious nonconsumers are moderately curious about trying CBD, but have not because they feel they do not know enough about it. They express general apprehension about the safety, efficacy, and legality of CBD. Still, such nonconsumers also want to learn more about CBD and some of them may become comfortable enough to try it.

The Informed & Indifferent represent a segment of nonconsumers who are most likely to have seen CBD in stores, to have had conversations about CBD, and are generally informed about CBD’s properties. However, they express little curiosity about trying CBD, and have no plans to purchase CBD products. Based upon their foundation of awareness about CBD combined with their continued abstention from using CBD products, those in the Informed & Indifferent archetype are among the least likely to be converted to consuming.

The European CBD survey is part of New Frontier Data’s ongoing series of CBD-focused research projects examining marketplaces in the United States and globally to provide in-depth insights on the growing CBD industry. To learn more about CBD consumer archetypes, download the EU CBD Consumer Report: 2020 Segmentation & Archetypes.