National Arrests for Cannabis-Related Offenses 1996-2016

July 8, 2018Beware! Are you in compliance with your cash payments?

July 22, 2018

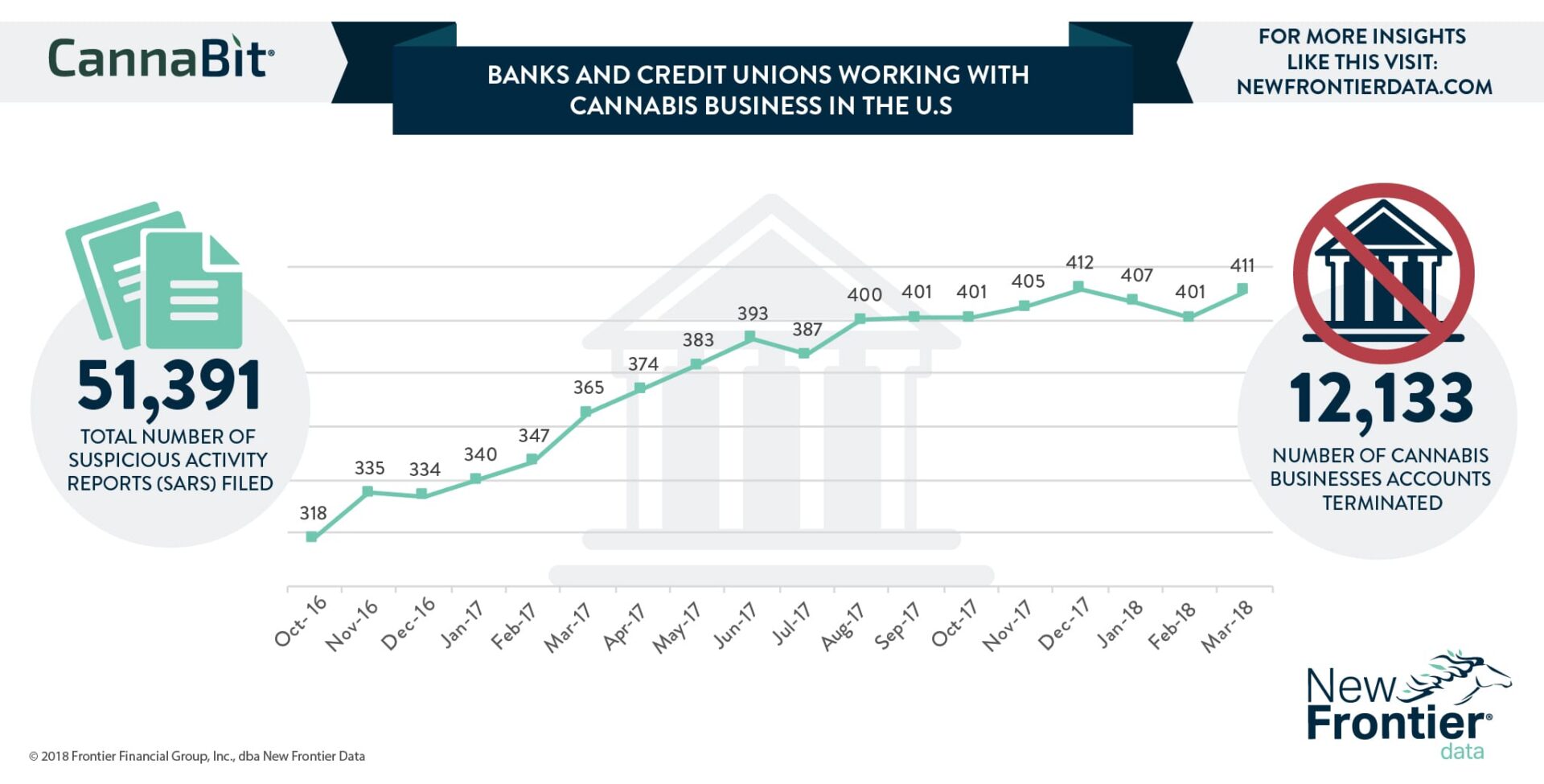

- Despite federal prohibition of cannabis, the number of U.S. financial institutions serving the industry increased more than 29% in 18 months.

- Most institutions are state-chartered banks and credit unions; national banks avoid plant-touching businesses pending formal clarity of federal rules regarding cannabis businesses.

- Financial Crimes Enforcement Network (FinCEN) guidelines compel institutions dealing with a “marijuana-related business” to file suspicious activity reports (SARs) of all plant-touching business transactions, regardless of whether the businesses are violating federal guidelines or state laws.

- As of March 2018, institutions serving the industry filed 51,391 SARs, including 12,133 account terminations. Notably, the number of cannabis business account terminations doubled from 5,865 terminations in Q1-2017.