California Tax Rates Impede Legal Operators

Legal Cannabis Strongly Positioned for Another Milestone Year in 2022

January 10, 2022

Cannabis vs. COVID Study Illustrates U.S. Need for Key Research

January 24, 2022By John Kagia, Chief Knowledge Officer, New Frontier Data

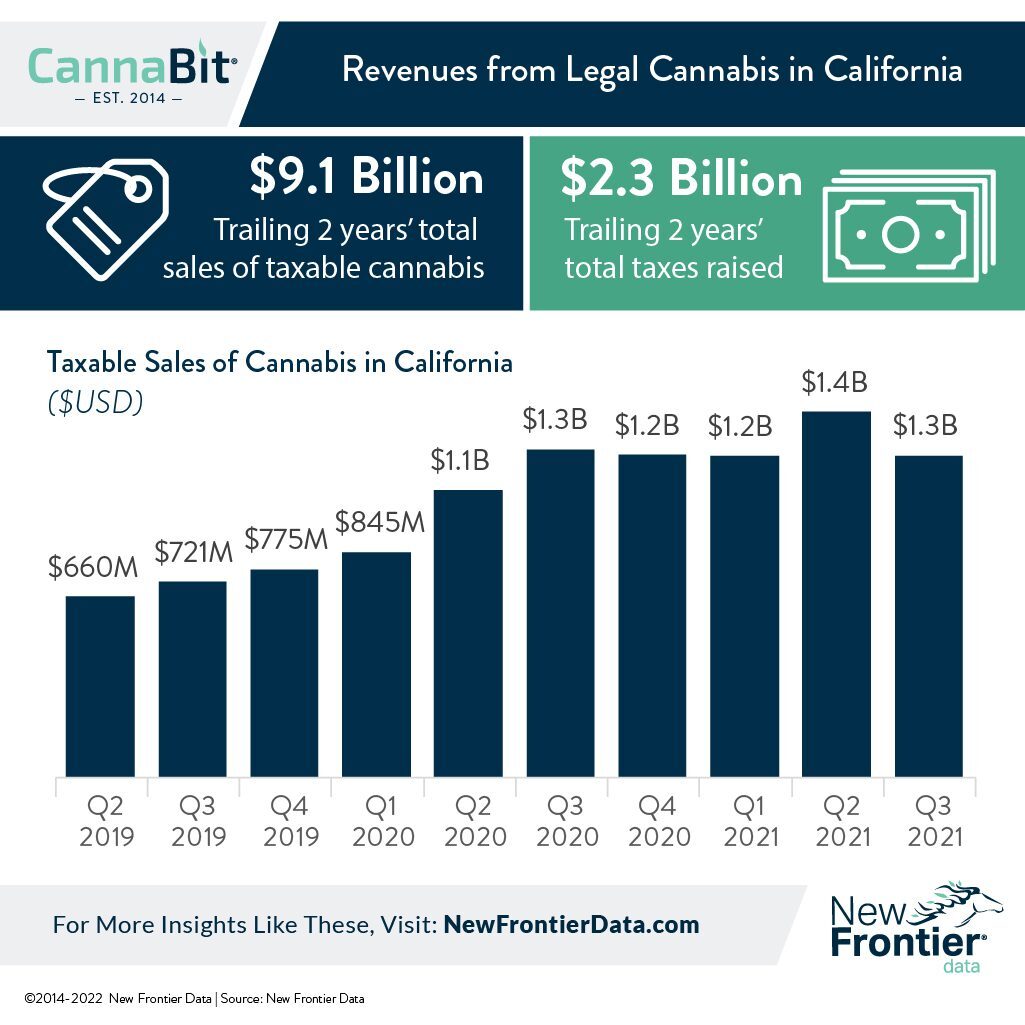

From September 2019 to August 2021, California raised $2.3 billion in tax revenue from $9.1 billion in sales. Since Q3-2020, however, tax revenues plateaued to average $321 million over four quarters, suggesting that the rate of ingress by consumers to the legal market has begun to slow.

Despite earning significantly more revenues than other legal markets due to the state’s large population, California continues to underperform relative to other states for revenue per capita. Several factors are contributing to the slowing of California’s legal market:

- With the highest cannabis retail taxes in the country, California’s price-sensitive consumers have little incentive to transition to the legal market, especially for flower (which remains widely available at dramatically lower prices, but with quality rivaling the legal market’s offerings);

- The state’s very well-established illicit market is capitalizing on the tax-driven pricing differential; with limited enforcement resources, the increasingly savvy illicit operators have been able to disincentivize consumers from legal purchases; and

- County and municipal ordinances which prevent legal cannabis businesses from operating in large swaths of the state have meant that consumers in many counties must travel long distances to make legal purchases. For those who had well-established sources in the illicit market, participating in the legal market is not worth the effort.

The widespread availability of high-quality flower has pushed demand in California to value-added products, which are more difficult to effectively produce at scale in the illicit market. Among established adult-use markets, flower (excluding pre-rolls) in California accounts for a smaller share of total sales (36%) than in other markets — including Nevada (49%), Michigan (48%), Massachusetts (45%), and Colorado (41%).

With the state poised to further raise cannabis taxes in 2022, legal market consumers are bracing themselves for further pain at the cash register. The dynamic is described in more detail in New Frontier Data’s latest report, 22 for 2022: Cannabis Industry Assertions & Predictions: “As of January 1, 2022, California’s cannabis tax rates have increased again. The cultivation tax — initially $9.25 per dry ounce of flower, then raised to $9.65 in 2020 — now stands at $10.08 per dry ounce. Since it is applied at the beginning of the production chain (where it can already represent roughly 25% of the wholesale cost of flower), the cultivation tax is compounded at every step of production, each of which has an additional tax.”

In a speech last week, California Governor Gavin Newsom expressed commitment to resolving the state’s cannabis taxation issues, but it remains to be seen by which forms those interventions will take. Regardless, the longer that the state continues to delay in addressing its cannabis taxes (which are the highest in the U.S.), operators will continue to underperform, the illicit market will become more difficult to dislodge, and the Golden State will continue to earn far lower revenues than it could through a more effectively modulated tax policy.