Cannabis Caucus Kicks off Cannabis Week With Industry Stakeholders on Capitol Hill

Washington D.C. Cannabis Market

May 13, 2017

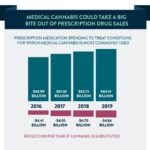

Medical Cannabis Could Take a Big Bite Out of Pharmaceutical Sales

May 21, 2017A half dozen House members gathered on Capitol Hill this morning for a press conference organized by the National Cannabis Industry Association to speak in favor of improving the federal government’s policy toward the cannabis industry.

Standing behind a lectern decorated with a sign declaring that 73% of Americans want the federal government to respect state cannabis laws, NCIA executive director Aaron Smith explained what his group wanted and what brought the lawmakers out to support them.

It is a “very simple message,” Smith said; “that we must be treated fairly.”

Smith and the Cannabis Caucus, a group of lawmakers drawn from states with some form of legal cannabis, criticized a fundamental obstacle for the cannabis industry: the inability to access the banking system like any other business.

“I have been working on [cannabis legislation] since 1972,” said Rep. Earl Blumenauer (D-Ore.), a founding member of the Cannabis Caucus. “I’ve never met anyone who thinks [the cannabis industry] should be all-cash.”

Blumenauer and several of his peers pointed out how being limited to working with cash raises costs for small business owners, along with security issues for operators, even when they fully comply with state laws.

“For me this is an issue of fundamental fairness,” Rep. Carlos Curbelo (R-Fla.) said. “We need to validate those businesses that are doing this the right way.”

The fear of a cannabis industry crackdown by federal law enforcement has grown this year. Remarks by Attorney General Jeff Sessions describing cannabis as only slightly less harmful than heroin, and an order from the Department of Justice pushing for harsher penalties for violators of drug laws, have brought up the question of whether state cannabis markets will face broader challenges from the federal government.

In a push to resolve that uncertainty, Rep. Diana DeGette (D-Colo.) announced that she was introducing the Respect States’ and Citizens’ Rights Act of 2017 to Congress. It marks an updated version of a bill she first submitted in 2012, all built around forbidding federal law enforcement from trying to prosecute cannabis businesses which otherwise are in compliance with respective state laws.

“We’ve seen nothing but troubling signs from the Trump administration,” DeGette said. “It’s really critical to get clarity on federal policy.”

IRS code 280E, adopted about 30 years ago, places a high federal tax burden on cannabis companies by disallowing (otherwise standard) business credits and deductions for income derived by the sale of controlled substances. Tax code reform is but one issue among many described in New Frontier Data’s Cannabis Industry Annual Report: 2017 Legal Marijuana Outlook, now available.

NCIA is sponsoring its seventh annual Cannabis Industry Lobby Days, when its members can present their case to lawmakers in Washington this week, coinciding with a national cannabis business convention in nearby Maryland.

“This is not controversial. This is not partisan,” Blumenauer said. “It’s common sense.”