Catching Cannabis Coming and Going: How Law Enforcement Profits from Illicit and Legalized Marijuana Businesses Alike

73 Million Americans Likely to Purchase CBD Before Year’s End

June 18, 2020

Law Enforcement Benefits From Both Cannabis Prohibition and Regulated Cannabis Businesses

June 21, 2020By Josh Adams, Ph.D., Senior Industry Analyst, New Frontier Data

Amid national protests against the killing of George Floyd, police brutality, and racial inequality, reports emerged of cannabis businesses being robbed and looted. At first blush, they could be discounted as the same instances of opportunistic looting that occurred at retail outlets across the country. But with emerging details about robberies being executed by armed professionals seeking cannabis products and cash, deeper vulnerabilities of the legal cannabis industry were exposed.

Cannabis businesses are desirable targets of theft for two distinct reasons: First, they stock a high-value product that is easy to sell with higher margins in the unregulated market. Second, since cannabis remains federally prohibited, access to dependable and consistent banking services is limited, resulting in cannabis businesses being cash-intensive.

The regulatory and legal frameworks that make cannabis businesses prime targets for theft also serve to perpetuate and reinforce other systemic inequalities. Specifically, they impose burdensome financial conditions for cannabis business operators, siphon money out of the communities where those businesses operate, support a pretext for greater policing of both cannabis businesses and the communities where they operate, and generate additional funding for law enforcement agencies. The combination creates an unwieldy environment where government agencies – particularly law enforcement agencies – profit from both the legal and unregulated cannabis markets.

How Law Enforcement Profits From both Legal and Unregulated Markets

Research has shown clear inequities in the policing of communities of color across the U.S. This is particularly true for cannabis-related offenses, where black Americans are 3.5x more likely to be arrested on marijuana charges than are white Americans. For the cannabis industry at large, a confluence of factors – from increased examination of the biases inherent in law enforcement, to calls for greater social equity across the industry (particularly for communities disproportionately impacted by America’s war on drugs) – has led many to deeply scrutinize the role of the industry. Thus, it is a cruel irony that the revenues from the legal cannabis are being used to perpetuate those same inequalities.

As individual states moved toward legalizing cannabis, the needs to build political coalitions and popular support were imperative for the success of legalization initiatives, whether achieved through voter referendum or legislative action. In almost all cases, the greatest point of leverage for proponents of legalization was the promise of new tax-based revenues for states and state agencies. Indeed, tax revenues from regulated markets across the U.S. have found their way into police budgets, often under the guise of public safety.

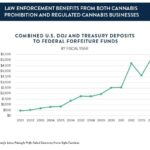

The regulated market is not the only cannabis-based revenue stream for law enforcement. Civil asset forfeiture represents a significant source of revenue for federal, state, and local law enforcement alike. In its simplest form, civil asset forfeiture is the seizing of property that police putatively suspect to be involved in a crime – regardless of whether an individual is ever convicted of, or even charged with, any crime.

Drug offenses are often the pretext for seizing either cash or property. For example, a report from the Justice Department Inspector General in 2017 found that “the DEA seized more than $4 billion in cash from people suspected of drug activity over the previous decade, but $3.2 billion of those seizures were never connected to any criminal charges.” Research has also indicated that civil asset forfeiture disproportionately impacts low-income and minority communities. Relying on the suspicion of a crime allows law enforcement to seize cash and property almost entirely without accountability, often under the pretense of thwarting drug related activity.

Another way the government (and by extension, its law enforcement appendages) benefits simultaneously from continued prohibition and the regulated cannabis industry is through the tax structure, namely Section 280E. Internal Revenue Code §280E prohibits any individual who is engaged in trafficking Schedule I and II controlled substances from deducting ordinary business expenses from their gross income.

As cannabis remains a Schedule I controlled substance, plant-touching cannabis businesses – even regulated, state-licensed businesses – cannot deduct ordinary business expenses. That results in an effective tax rate of up to 70% for legal cannabis businesses, making legal cannabis a lucrative business for the federal government.

America’s War on Drugs

It is estimated that the U.S. federal government spends roughly $33 billion annually prosecuting the war on drugs; state and local governments spend nearly $30 billion to the same end. The expenditures are often described as a “cost to taxpayers”; however, they could just as easily be understood as allocations to federal, state, and local law enforcement budgets. In a competitive budgetary environment, law enforcement demonstrates its efficacy through arrests, seizures of cash and assets, and drug interdictions – all of which both justify and perpetuate the continuing war on drugs. Such actions also serve as the foundation for sustaining or increasing budgets.

The U.S.’s continued prosecution of the drug war also brings the revenue streams of law enforcement full circle. Some portion of the $63 billion allocated to law enforcement across the U.S. comes from the tax revenue generated by regulated cannabis businesses; a further portion comes from the additional taxes generated by §280E. Some law enforcement budget is supplemented by funds generated from civil asset forfeiture locally, as well as monies from participating in the federal Equitable Sharing Program. Whatever the totality of their operating budgets, law enforcement agencies have positioned themselves to profit from every aspect of the cannabis industry, from legal businesses to unregulated operators.

For an industry that is struggling to begin repairing the damage done by the war on drugs, to rebuild impacted communities, and effectively enable broad and equitable access for those who have suffered the most from over-policing and criminalization, the structural barriers represent real obstacles to achieving those goals. With significant revenues being diverted away from businesses and communities into the coffers of law enforcement, it is increasingly difficult to begin the process of rebuilding, making success for small-cannabis businesses ever more elusive.