Dogged CBD Demand Seems Destined to Run On

Virginia’s Adult-Use Legalization May Open Up More Mid-Atlantic Markets

March 15, 2021

Annual U.S. Hemp-derived CBD Spending to Reach $6.26 Billion by 2025

March 24, 2021By Trevor Yahn-Grode, Data Analyst, New Frontier Data

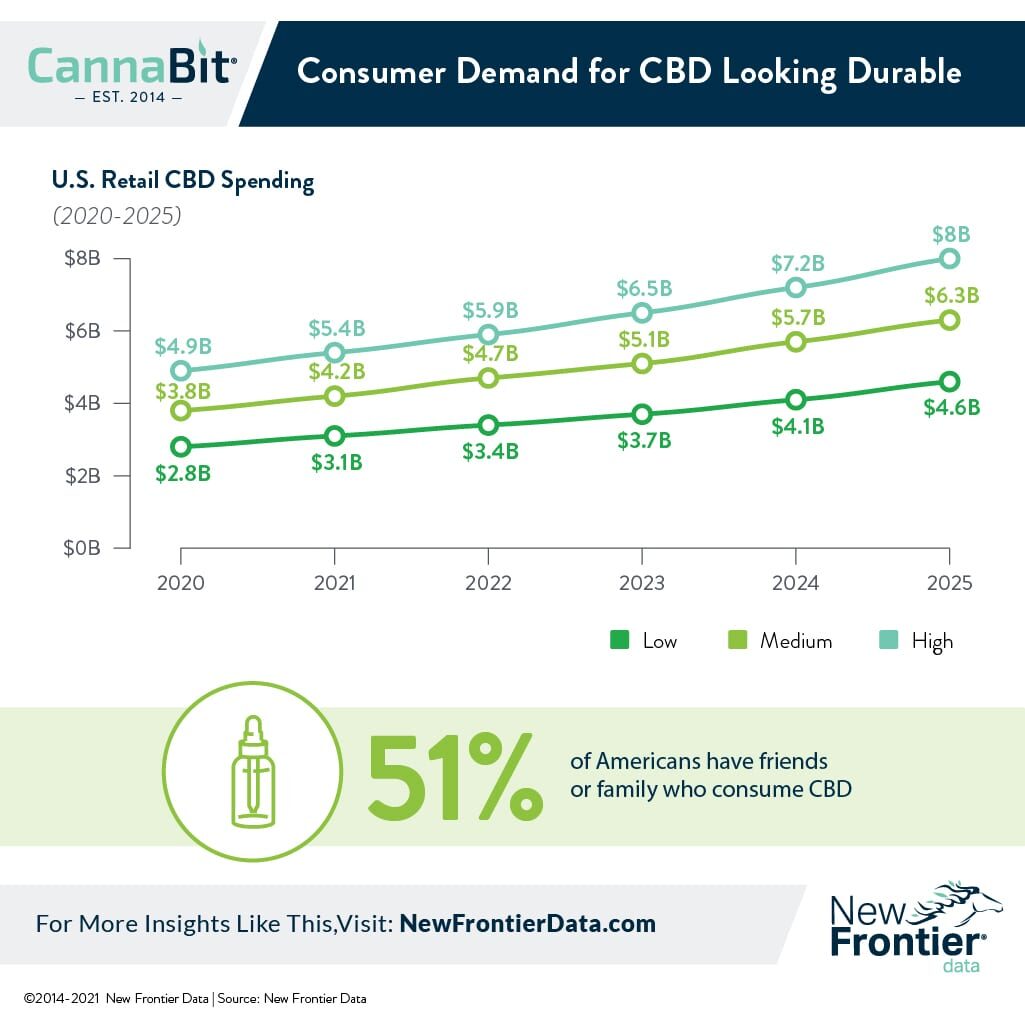

As the dust from the tumultuous year of 2020 settles, it looks increasingly clear that consumer demand for CBD is here to stay. After a meteoric rise to national prominence beginning with the inception of state hemp pilot programs in 2014, U.S. consumer spending on CBD reached $3.8 billion USD in 2020.

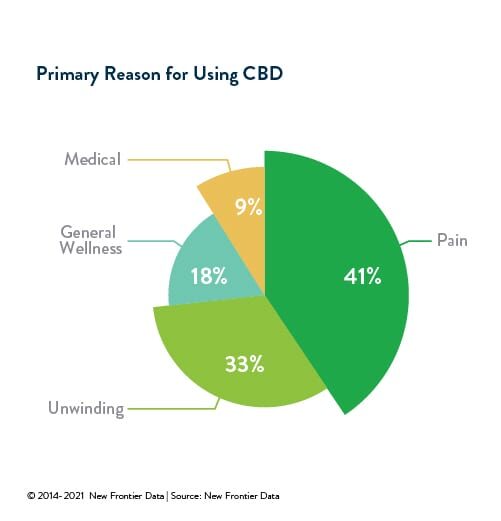

CBD and other minor cannabinoids have gained acceptance from an ever-expanding segment of consumers who see the compound as both a functional and effective means to treat myriad ailments. A reported 41% of American CBD consumers surveyed use it primarily for pain, while 33% cited anxiety relief as their primary motivation. All in all, more than half (51%) of all Americans surveyed reported having friends or family who regularly consume CBD. Increasingly, confidence in the medical efficacy of CBD appears to have solid scientific footing. Epidiolex, the first pharmaceutical product based on cannabidiol, accounted for more than half-a-billion dollars’ worth of sales in 2020, with more research and development of pharmaceutical products sure to follow.

The biggest factor restricting growth in the consumer base is regulatory uncertainty from the U.S. Food and Drug Administration (FDA), which for now maintains the position (if largely unenforced) that CBD as an additive in food and beverage products violates the Federal Food, Drug and Cosmetic Act (FD&C Act), citing what it deems as undue health and safety risks. At the end of 2020, the Federal Trade Commission (FTC) launched its Operation CBDeceit crackdown against allegedly unproven and overbroad representations that CBD products could treat diseases and serious medical conditions ranging from COVID-19 and cancer, to heart disease, diabetes, Alzheimer’s disease, and more.

Meanwhile, the failure among federal regulatory agencies to provide transparent guidelines for the legal manufacture and distribution of CBD-infused products casts an air of uncertainty over the future of the industry, with significant implications for short-term outlooks. For so long as the FDA considers further regulations for more widespread use of CBD products, cease-and-desist orders and warning letters will continue to act as de facto guidance for CBD companies.

A positive regulatory change from the FDA would have an immediate and positive impact on growth in the industry by drastically increasing the range of product categories available to customers, and by allowing large national chains to stock products in their stores without fear of legal jeopardy or liability.

Minor Cannabinoids

While THC and CBD are likely to remain the most well-known and widely used cannabinoids, other minor cannabinoids are reaching informed consumers. For now, public awareness about minor cannabinoids ranks low, but (regulations permitting) the market will grow rapidly, building on a framework akin to how consumers came to learn about CBD. Because of minor cannabinoids’ low natural concentrations in cannabis plants, much of the supply will likely continue to be synthesized (e.g., from yeast or CBD), rather than derived from plants.

Delta-8 THC, in particular, has attracted a great deal of recent consumer attention as a legal source of intoxication, with 2020 sales exceeding $10 million USD while seemingly out of nowhere. Though Delta-8 THC is technically not a controlled substance, and initially considered legal under the 2018 Farm Bill, legal posturing has emerged in the wake of the Drug Enforcement Administration (DEA)’s interim final rule, with the agency arguing that “all synthetically derived tetrahydrocannabinols remain schedule I controlled substances” — including Delta-8 THC. At present, legal challenges to Delta-8 THC are ongoing.

Considering the size of the market opportunity, there would seem plenty of market space for synthetic and naturally derived cannabinoids to coexist. Ultimately, opportunities will hinge on intended applications, with marketing focuses differentiated by each product’s provenance (i.e., whether organic or lab-designed, etc.).