Expanding Legalization and the Erosion of the Illicit Market

Cannabis Capital Raises Triple to USD $6 Billion in First Half of 2021

June 16, 2021

Bureaucratic Restraints Constrain Cannabis as a Commodity

June 28, 2021By Kacey Morrissey, Senior Director of Industry Analytics, New Frontier Data

Through the first half of 2021, as post-election actions bring a total of 19 states where high-THC cannabis is legal for adult use, and 38 where high-THC cannabis is legal for medical use, momentum toward cannabis reform continues apace, reaching historic levels of social use and acceptance. With a combined 141 million Americans living across those 18 adult-use states, 43% of American adults now have access to legal cannabis. Conversely, 93 million Americans (28% of the U.S. population) live in states where possession and use of cannabis remain illegal.

According to an April national poll by Pew Research Center, more than 90% of U.S. adults believe that cannabis should be legal for either medical or adult-use purposes.

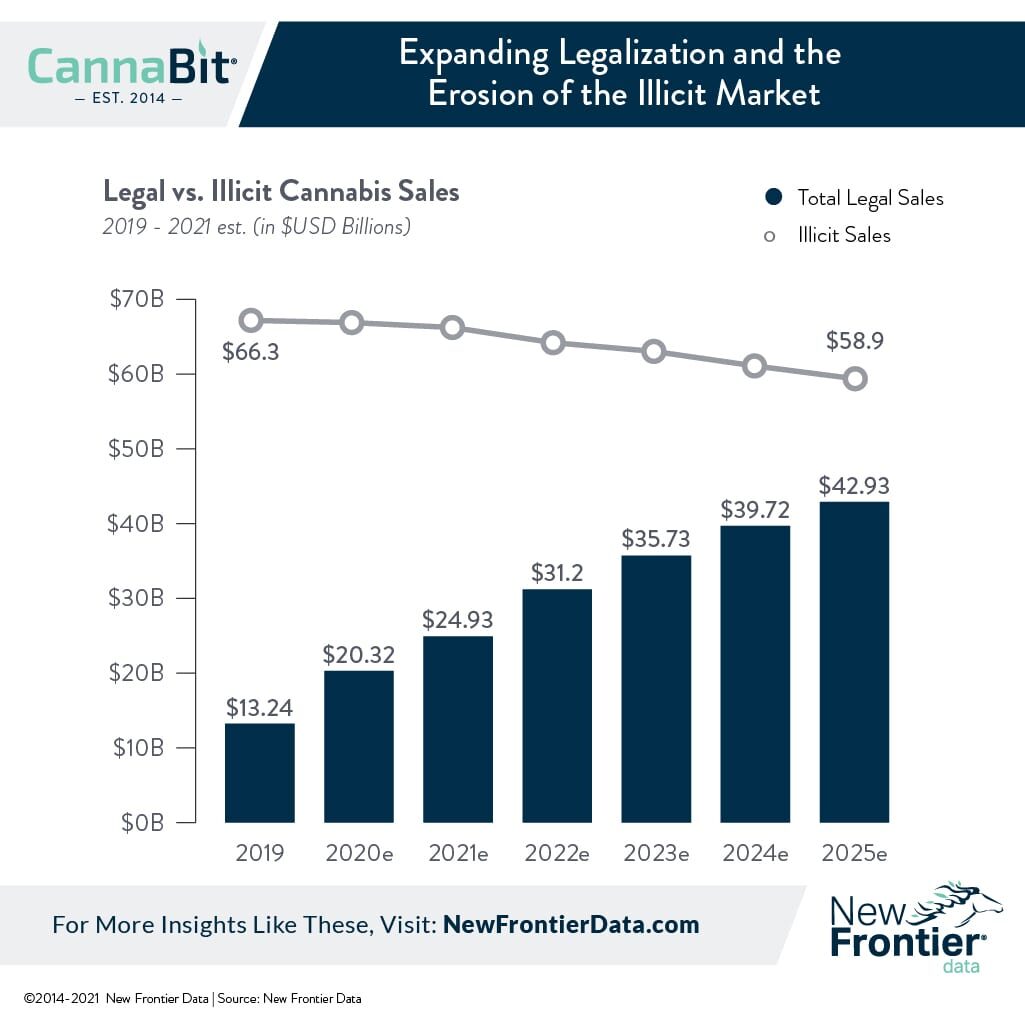

Despite strong performances seen in legal state markets (e.g., $20.3 billion in combined state legal sales for 2020), the illicit market continues to serve most of the national demand, with an estimated $66 billion spent on cannabis across illicit sources in the U.S. in 2020.

With continued growth in the number of cannabis consumers nationally, both legal medical and adult-use markets will increasingly erode the demand met by illicit sources. Population growth and rising usage rates will naturally lead to an increase in the size of the total addressable market for cannabis, though the illicit market will continue to serve most of the demand while most consumers in the U.S. live either in medical-only markets or states without legalized cannabis.

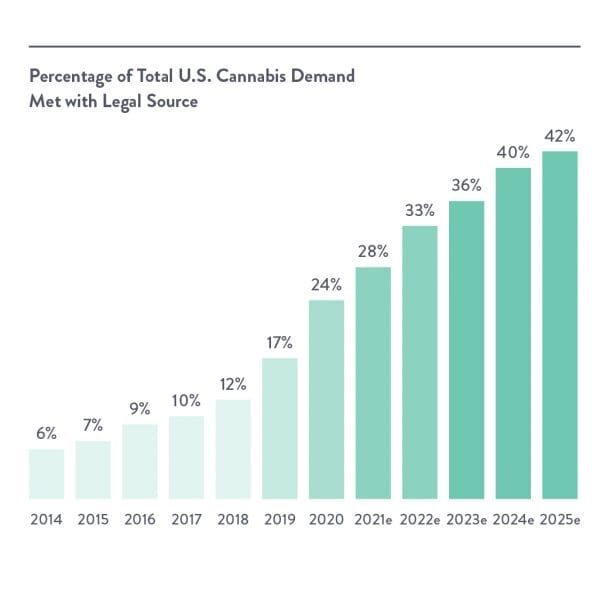

Yet, an unanticipated effect of the COVID-19 pandemic was the growth acceleration of legal cannabis markets in those states which have activated both medical and adult-use sales. With one key objective of legalization being to disrupt illicit markets, that end is being achieved in states where cannabis is legal. In 2020, an estimate 24% of U.S. cannabis sales were believed legal; by 2025, 42% of total annual U.S. cannabis demand will be met by legal purchases in regulated marketplaces. That upward revision to total projected legal capture is due largely to the legalization of adult-use programs in New York and Virginia in early 2021.

In 2020, an estimated 24% of U.S. cannabis sales were legal; by 2025, it is expected that 42% of total annual U.S. cannabis demand will be met by legal purchases in regulated marketplaces. As competitive forces and economies of scale will serve to drive down both wholesale and retail prices, increasing consumer demand should propel sustained growth in total legal revenues through 2025, when New Frontier Data estimates that more than one-third (34%) of total annual cannabis demand will be met by legal purchases in regulated marketplaces.

How lawmakers in Washington, D.C., will decide key market governance issues remains far from clear going into the summer of 2021, but decisions made in the halls of Congress, the White House, and in state capitals nationwide during the months ahead will impact the trajectory of the industry for years to come.

For more comprehensive analysis of where the U.S. market resides, and is heading for the near term and beyond, download a FREE copy of New Frontier Data’s Cannabis in the U.S. 2021 Mid-Year Market Update.