For Many Cannabis Consumers, Home Is Where the Grow Is

Medical Cannabis Use Rising Among U.S. Consumers with Anxiety Disorders

July 19, 2021

New Frontier Data Releases First Comparative Study on EU and US Cannabis Regulations

July 28, 2021By Noah Tomares, Research Analyst, New Frontier Data

In the course of researching the maturation and evolution of the legal cannabis industry, much attention is given to milestones. Record sales, product innovations, the opening of new markets: such are the eye-catching harbingers both of normalization and the new, proverbial Next Thing to drive reform and revenues.

Yet, essential to understanding how far something has come is to understand whence it came. So it can be instructive in a time that cannabis is legally available from a licensed dispensary to consider what motivates a significant proportion of consumers to instead grow their own cannabis for personal consumption or gifting.

Rules permitting homegrown cannabis, as with so many other elements of legal cannabis programs, vary widely state-by-state. In Michigan, where cannabis has been legalized since 2018, adults over the age of 21 can cultivate up to 12 cannabis plants in their respective homes. A cannabis caregiver’s residential grow operation has a limit of 72 plants.

Homegrowing was a point of contention during negotiations surrounding New York’s legal adult-use laws. It was eventually decided that an individual could cultivate up to 6 plants (three mature, three immature), with an overall limit of 12 per household for multiple adult residents.

Connecticut recently became the 19th state to legalize cannabis for adult use. Patients participating in its medical program are permitted, like New Yorkers, to cultivate up to 6 plants (three mature, three immature) beginning in October. Adults not participating in the program will have to wait until July 2023.

Approximately 6% of cannabis consumers grow their own flower. Among those surveyed, more than 6 in 10 homegrowers were men. Homegrowers skew slightly younger than do consumers overall, with nearly 1/3 (31%) of them being among ages 18-34, and nearly half (49%) being among ages 35-54. More than 2/3 (67%) respectively live in a legal market (either medical or recreational). Just over half (56%) of homegrowers claimed to cultivate cannabis indoors, with nearly one-third (31%) utilizing outdoor grows, and as 10% make use of greenhouses.

Nearly half (48%) of respondents reported having been cultivating for a year or less. One-quarter (25%) reported growing but one or two plants at a time. Another 35% asserted growing 3-6 plants (i.e., the legal limit in several states). Homegrowers, unsurprisingly, consume their own cannabis. Nearly three-quarters (72%) reported either exclusively or mostly consuming flower which they have grown for themselves.

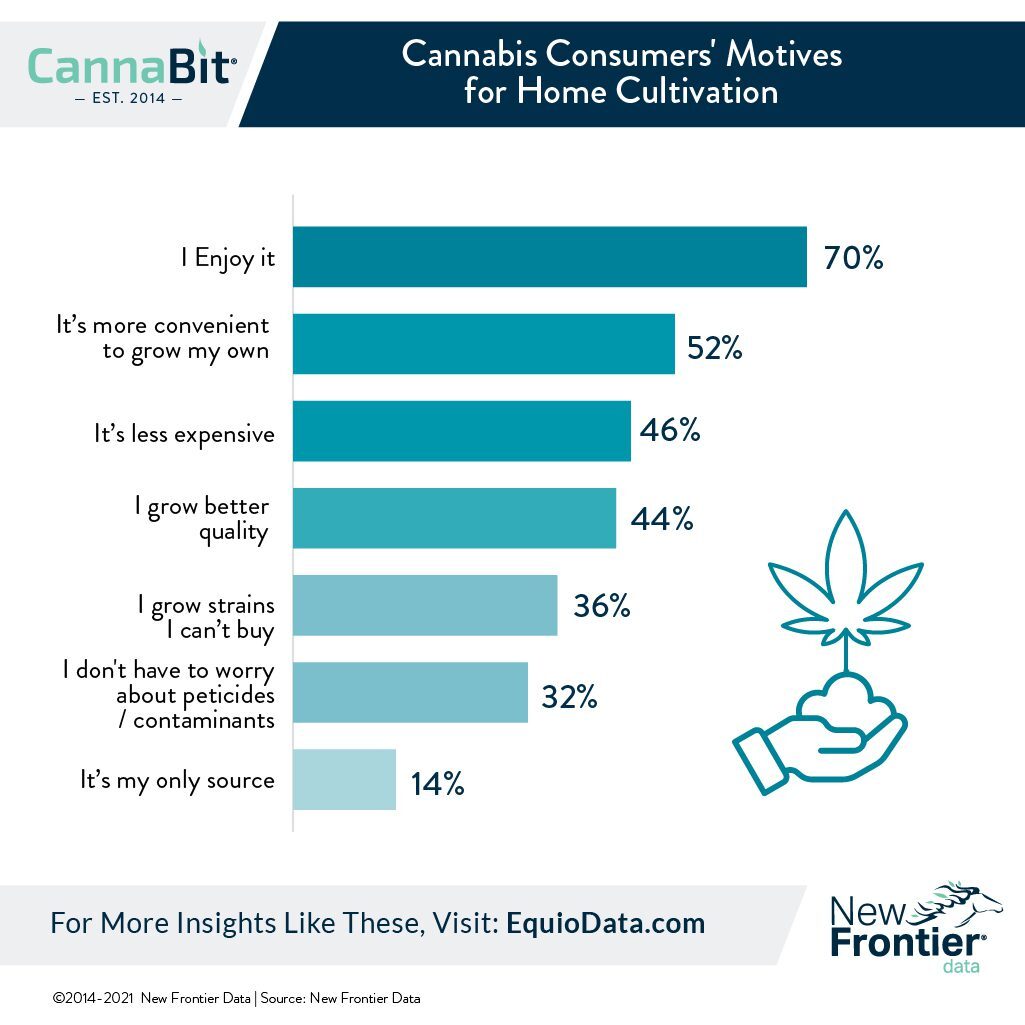

Homegrowers cultivate cannabis for a variety of reasons. Some opt-in due to a lack of other sources (14%), or to grow strains which they otherwise could not find to purchase (35%). Quality is another key consideration. Nearly one-third (32%) grow to avoid worries about contaminates such as pesticides, while 44% feel that they grow better-quality flower than they could find elsewhere. For others, it is a matter of convenience (52%), or less expense (46%). Nevertheless, a larger majority of homegrowers (70%) report growing cannabis because they enjoy it as a hobby.

Such enjoyment, more than any other factor, is indicative of a niche that will continue to grow even as legal access to cannabis expands. For consumers eagerly awaiting the introduction of a legal market in their particular states, it may seem that the grass is greener on the other side. But for many homegrowers, the grass is at its greenest when grown for themselves.

For more information to help navigate the complex and evolving landscape of consumer preferences, check out New Frontier Data’s 2021 U.S. Cannabis Consumer Evolution report.