Gender differences and cannabis purchasing behavior

The Game-Changing Data Platform for the Cannabis Industry

March 8, 2025

Cannabis Infused Beverages: The New Frontier of Intoxicating Libations?

April 1, 2025It’s no secret that both men and women consume cannabis. Traditionally, use by women was underreported because of the threats posed by prohibition. Namely, child custody and incarceration as a primary caregiver. However, children aside, women have faced a stronger stigma for all substance use, alcohol and cannabis included. The recent emergence of personas like “wine mom” and “weed mom” have helped soften the objections to women using these substances, as has legalization. Removing the threat of incarceration or child removal makes women feel more comfortable not only using cannabis but admitting it. This is good news because cannabis can be extremely beneficial for a variety of women’s health issues, from PMS to endometriosis and menopause. According to the New Frontier Data consumer survey, 96% of women who use cannabis to treat a women’s health issue say it is effective at managing their symptoms, with 40% saying it is very effective.

But the emergence of women as a cannabis consumer power group has been slow to catch on in dispensaries and product branding. Save for a few exceptions, cannabis products focus on potency, and have branding that is many times over the top, and still pandering to the “stoner” image perpetuated in the 1980’s. Thinking about dispensary visitors, it makes sense to consider that what might be appealing to men, may not be appealing to women. Also, women may have different shopping and spending habits and may be motivated towards and away from dispensary loyalty for different reasons. We analyzed data from the New Frontier Data consumer survey to note gender differences when it comes to the cannabis shopping experience.

The first thing we noticed, was that women acquire cannabis less frequently than men. Thirty two percent of men said that they acquire cannabis at least a few times a week, compared to 25% of women. Twelve percent of men say that they acquire cannabis a few times a year or less, compared to 19% of women. It should be noted that this includes cannabis consumers across market types, so the reduced acquisition frequency among women may be driven by the risks of buying in an illicit market discussed above.

Women also spend less on cannabis. Again, looking at consumers across state markets, 6% of women say they never pay for cannabis, compared to 3% of men. Thirty five percent of men and 43% of women typically spend less than $50 when they purchase cannabis. And although only 1% of each gender typically spends $400+, 29% of men say they typically spend over $100, compared to 21% of women. The fact that women report acquiring cannabis less frequently and paying less when they do, suggests that they are more intentional about their decision to buy cannabis and are likely buying in smaller quantities.

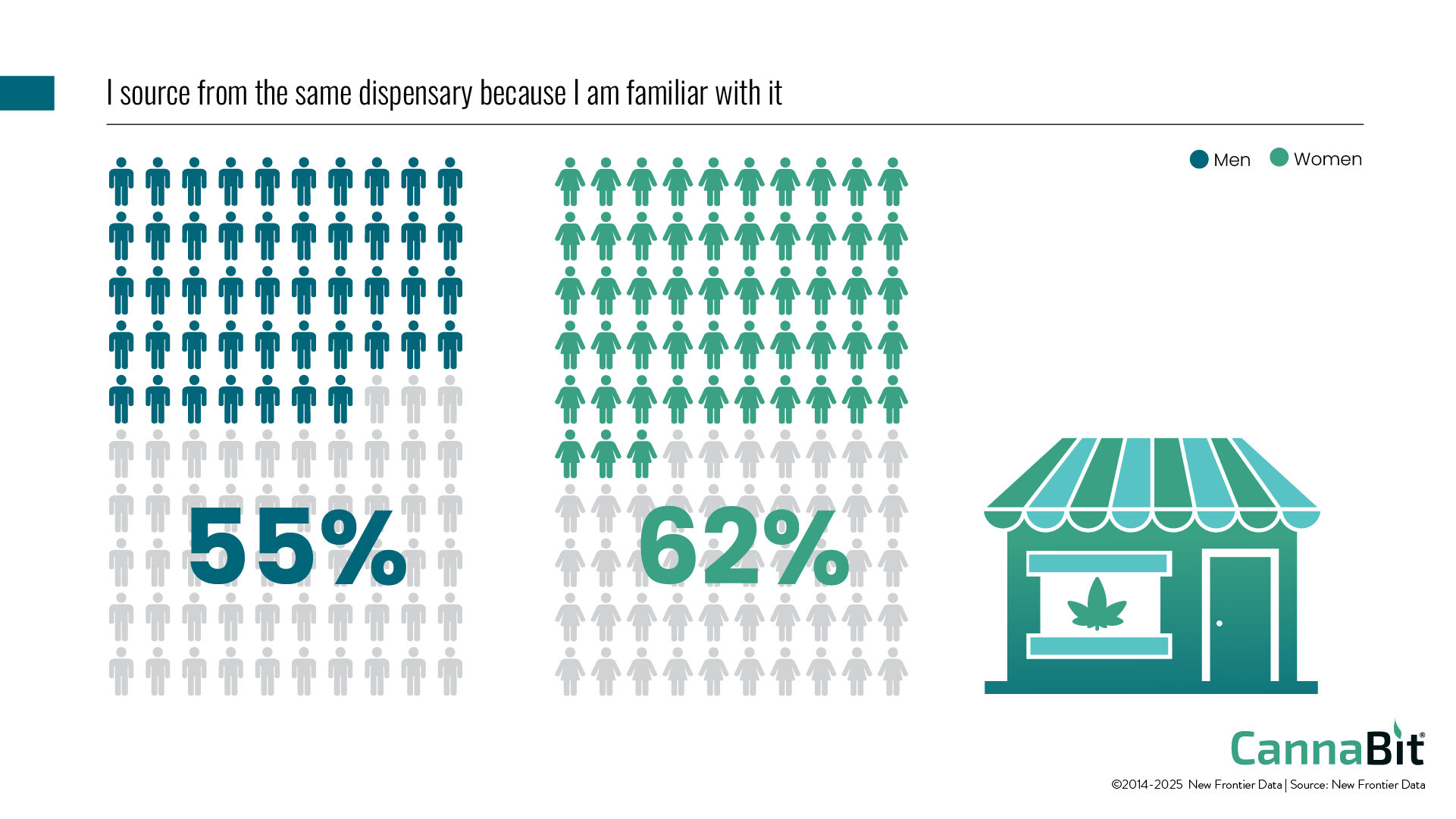

Overall, there are no gender differences in the number of consumers that choose to stick with the same dispensary or shop around. Fifty five percent say that they always go to the same shop, 30% say they usually do, and 15% say they rarely visit the same shop and like to try different places. However, the factors that they report either building loyalty or encourage shopping around differ by gender. Women are more likely to say that they stick with the same dispensary because they are familiar with it (62% vs. 55%), and men are more likely to say that they shop around to find unique products and strains (35% vs. 30%). The impact of stigma during prohibition may be impacting the effect of comfort when it comes to women choosing places that are familiar to them. And increased acquisition frequency and typical spend may influence a man’s decision to shop around and look for something unique.

Do you know the gender breakdown of your dispensary visitors? Understanding visitor demographics can be important in deciding what products to stock, what price points to focus on, when to bring in a unique product, and how to create an atmosphere of comfort and familiarity. shopEQ by NXTecK gives you a look into your visitor gender, age and income breakdown, as well as their shopping habits, visit frequency and more. If reading this article made you think about how your retail shop is meeting the needs of your visitors, imagine what an in-depth analysis could do. Visit equio.ai to request a demo and bring data into your business strategy.

Download the Infographic