Generational Differences Among Cannabis Consumers

The Cannabis Consumer: New Archetypes Reveal Who Influences the Market, and How

April 19, 2021

The Medical Cannabis Consumer in 2021

May 2, 2021By Molly McCann, Ed.D., Director of Industry Analytics, New Frontier Data

The cannabis consumer is evolving. Many recent changes in consumer behavior and attitudes are adaptations to a shifting market context; regulatory reforms have brought the share of American adults now living in an adult-use states to 43%, and rapid innovation in the industry has brought about new product forms and formulations, brand messaging, and shopping and payment technologies.

An equally important driver of consumers’ evolution resides in generational differences. In the analysis of a New Frontier Data survey examining the motivations, preferences, and behaviors of 4,600 cannabis consumers, age was the demographic variable on which consumers most reliably and widely differed. Below is examined some key ways in which current consumers (defined as annual+ users) differ across generations.

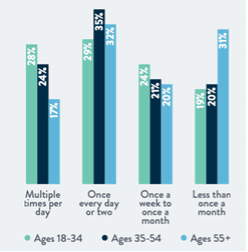

Behavioral Differences Above and Below Age 55

Among current (annual+) consumers surveyed, 26% were aged 55 or older, and New Frontier Data’s survey found stark differences between that quarter of consumers and their younger counterparts on key variables, including how frequently they use, and how they acquire cannabis. About three in five consumers under age 55 report using cannabis at least once every couple days (i.e., 57% of consumers aged 18-34, and 59% of those aged 35-54), compared to nearly half (49%) of consumers aged 55+.

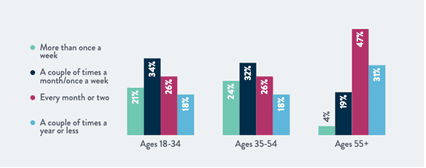

When looking at how frequently consumers purchase or otherwise acquire cannabis, there is an even greater contrast between consumers under or over age 55. Among consumers ages 18-34 and 35-54, more than half (56% of each group) acquire cannabis at least once a month, compared to less than one-quarter (23%) of consumers 55+ acquiring that frequently.

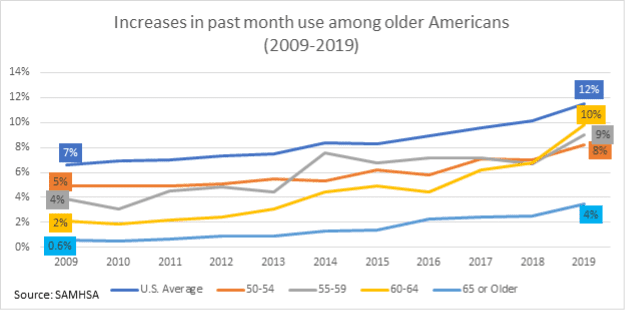

Nevertheless, the findings do not indicate that older consumers are not changing in their behaviors — from 2009-2019, rates of monthly cannabis use increased most among some of the oldest Americans. Over that time, monthly cannabis consumption among Americans ages 55-59 increased 131% (from 3.9% to 9.0%), use among ages 60-64 increased 367% (from 2.1% to 9.8%), and consumption among ages 65+ increased 483% (from 0.6% to 3.5%).

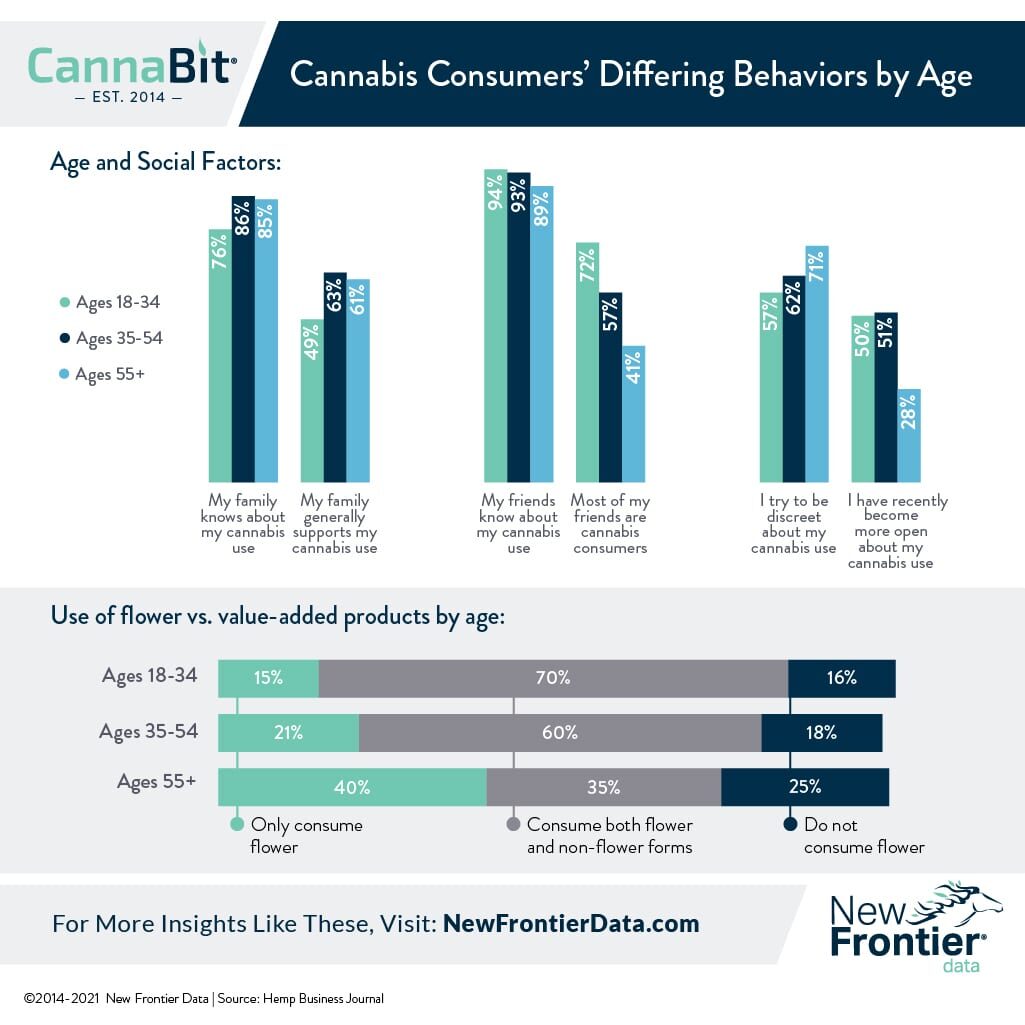

Younger Consumers Use More Product Forms

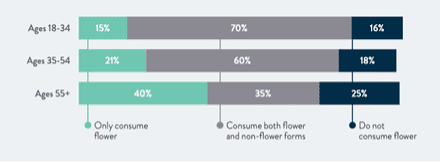

Among the clearest differences in cannabis consumption behavior between age groups is the use of different product forms. Consumers ages 18-34 are twice as likely as those ages 55+ to consume both flower and non-flower forms (e.g., edibles or vapes), by 70% to 35%, respectively. The largest share of consumers aged 55+ report consuming only flower (40%), never any value-added products. That segment of mostly recreational, less frequent, older consumers may be receptive to other product forms such as edibles or infused beverages, if brands are able to effectively communicate to them and educate them about their product offerings.

Family, Friends, and Openness about Use

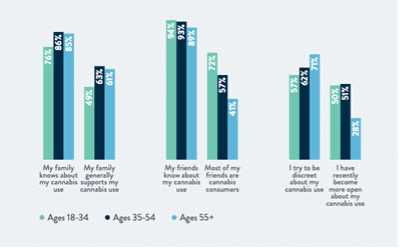

The age-55 divide appears again when considering consumers’ self-reported openness about cannabis use. Older consumers are more likely to be discreet about their consumption (e.g., 7 in 10 of ages 55+ versus roughly 6 in 10 of consumers under age 55), and are less likely to have recently become more open about use (e.g., 28% of ages 55+, versus roughly half of consumers under 55).

Regarding consumers’ openness with family, we see a divide above and below age 35. Ages 18-34 are slightly less likely to be open about their cannabis use with their family than are older cohorts, and they report lower family support for their use. That is likely generational—i.e., the youngest group’s family skews older, while older consumers’ family skews relatively younger (i.e., likely more accepting).

Although consumers of all ages are about equally likely to be open with friends regarding their cannabis use (e.g., approximately 9 in 10 consumers), there are major generational differences in whether consumers report their cannabis use among a majority of their friends. Younger consumers are considerably more likely than are older consumers to report that most of their friends are also cannabis consumers—72% of consumers ages 18-34 say that most of their friends are cannabis consumers, compared to 57% among consumers 35-54, and just 41% of consumers ages 55+.

Those differences in exposure to other cannabis users and their experiences may help explain younger cohorts’ more extensive use and awareness of newer product forms, and have important effects in terms of consumer education and stigma reduction.

Age and Public Opinion

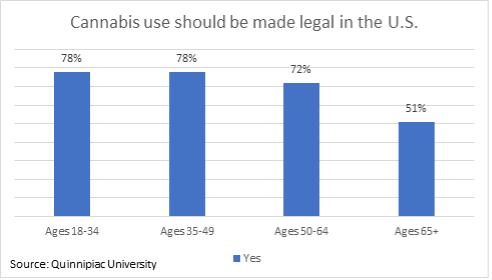

Age differences are consequential not just among consumers, but among the general public. In a mid-April Quinnipiac poll, while a record-high 69% of American adults overall believed that cannabis should be made legal in the U.S., major differences emerged among the four age groups surveyed. While nearly 4 in 5 Americans (78%) under age 50 believed that cannabis should be made legal, support dropped to nearly half (51%) among Americans aged 65+.

You can read more about consumers’ differing behaviors and experiences by age and other variables in New Frontier Data’s latest report, 2021 U.S. Cannabis Consumer Evolution: Archetypes, Preferences, and Behaviors.