Growing the Legal Market

Safety in Numbers

October 17, 2023

5 Steps to Maximize Holiday Profits for Your Dispensary

December 5, 2023

By Dr. Molly McCann, Senior Director of Consumer Insights at New Frontier Data

In our upcoming and final consumer report of the year, New Frontier Data examines characteristics and preferences of untapped consumer segments in legal markets to determine ways to grow the regulated market. Here, we’ll briefly explore the behaviors of at-least-monthly consumers in adult-use markets who primarily source from dealers as opposed to from legal retail channels.

More than one quarter (27%) of consumers in adult-use markets who use cannabis at least once a month primarily source cannabis outside of regulated retail channels (typically from friends, family, or dealers). Those relying on dealers are the heaviest and most frequent consumers, and their lack of participation in the regulated market is limiting its success.

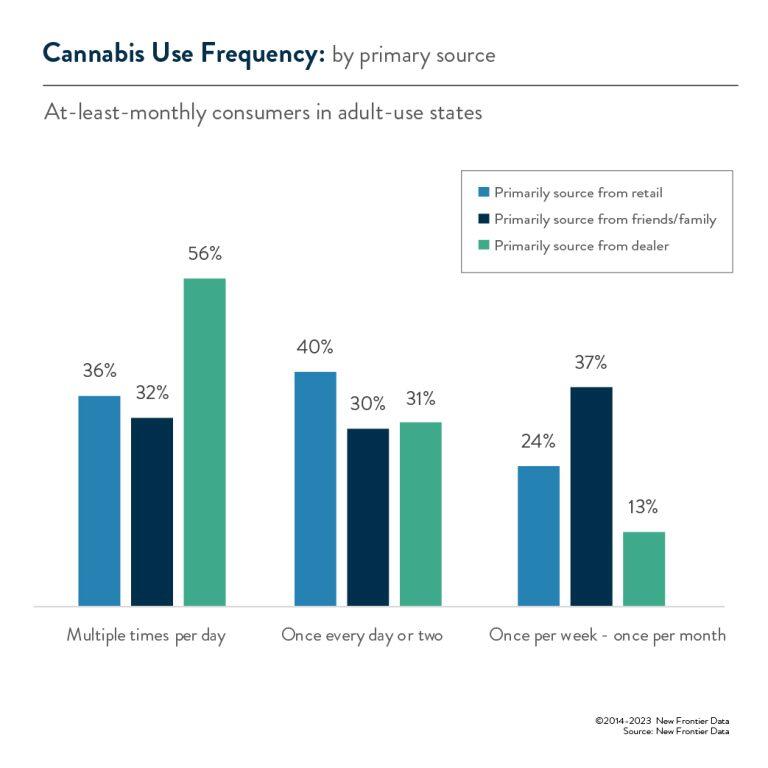

Among at-least-monthly consumers in adult-use markets, a clear pattern of sourcing and use frequency emerges. Those who source from dealers tend to be the most frequent users—56% use multiple times per day. For those consuming this frequently, cost is a major concern, and this is reflected in their acquisition patterns; frequent consumers who source from dealers acquire cannabis much more frequently on average than their counterparts who source from retail and friends/family and tend to spend less per purchase occasion. Dealers are cheaper than regulated retail, and this is important not only because using more frequently will lead to higher costs, but consumers who source from dealers are more price sensitive as they tend to have lower household incomes than those who source from friends/family, who in turn have lower incomes on average than those who source primarily from retail.

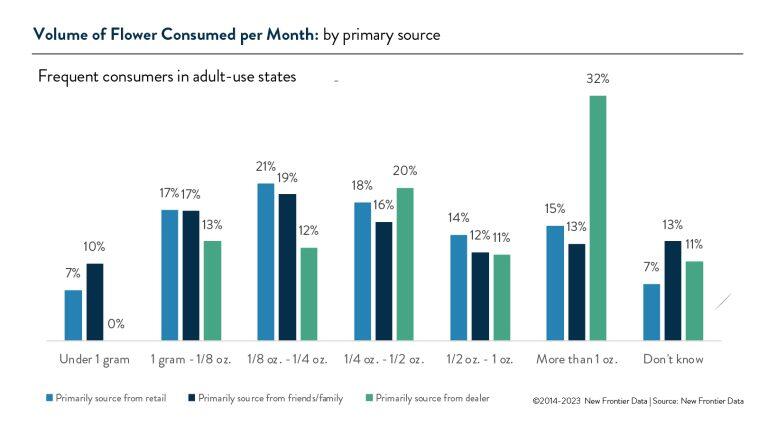

A majority of all frequent consumers say that smoked flower is the form of cannabis they use most often, but there are differences in how large that majority is by which source consumers primarily use: 83% of frequent consumers who source from dealers consume flower most frequently, compared to 70% of those sourcing primarily from friends/family and 57% of those sourcing primarily from retail. Frequent consumers sourcing primarily from dealers also consume the highest volume of cannabis flower per month by a wide margin: roughly a third (32%) consume more than an ounce of dried flower per month, while only 15% of those sourcing from retail and 13% of those sourcing from friends consume as much.

This tendency toward flower among consumers sourcing from friends/family and especially dealers is likely a result of both preference and access. Consumers sourcing from friends/family and dealers report very limited access to any forms of cannabis other than flower or prerolls. Some of those who don’t primarily source from retail will occasionally shop from retail, probably in response to limited access from their primary source. About 1/5 (18%) of frequent adult-use consumers who source from dealers and 1/4 (24%) who source from friends/family say they also sometimes purchase cannabis from regulated dispensaries. These are likely the purchase occasions when consumers are buying manufactured (non-flower) products which are unavailable or have limited selection from their typical source.

For further discussion of this and other consumer groups that are under-participating in the regulated market and recommendations for converting gray-market consumers, keep an eye out for our upcoming report, Cannabis Consumers in America 2023 – Part 3: Growing the Legal Market. For analysis of U.S. consumers in general, check out Cannabis Consumers in America 2023 – Part 1: An Overview of Consumers Today, and for a detailed dive into consumer types, see Cannabis Consumers in America 2023 – Part 2: Exploring the Archetypes.