Growth Strategy for the Green Ocean

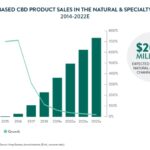

Natural and Specialty Retail Hemp-Derived CBD Sales Projected to Grow by More Than 600% by 2022

August 24, 2018

Can Cannabis Offer Remedy to Chronic Economic Woes Among Native American Communities?

August 26, 2018Setting a new path for market entry into the cannabis industry

Cannabis operators who want to shape the future of legal consumption in the United States want to create innovative new products, reach broad new customer sets, and promote positive uses for cannabis to meet the $80 billion market opportunity the industry is chasing. While cannabis surely faces some unique challenges in the form of financial access, regulation, and value chains, many operators can position their companies for multi-dimensional growth and lasting success by creating a defined strategy, developing efficient operations, and maintaining rigorous compliance processes.

As an industry, cannabis has inherent advantages that firms can tap into as they begin to develop operations and enter the marketplace. Exceptional and growing emotional engagement of consumers, regulatory hurdles for competitors, high margins, and a value chain that can leverage advances in the digital realm to outsource key components to help set foundations that promote growth and position for scale are just some of these inherent advantages.

To take advantage, firms need a cannabis-centric plan and a mission. At CohnReznick, we define four broad stages for devising and executing your business strategy that cannabis operators must integrate into their strategic planning: entry, scaling, acquisition, and innovation.

Entry

Unlike many other growth industries, it is critical for cannabis firms to get out of the starting gates with a robust, professional foundation of operations and laser focus on growth. Whereas their tech counterparts have the luxury of multiple pivots and a business plan that can stumble upon success, cannabis firms must grab market share in a rapidly-saturating space, and build structures that defend against consolidation and regulatory challenges that may cripple unprepared businesses (such as quality compliance or FDA regulations on facilities and testing).

The entry phase establishes the foundation and structure of the company and answers the most fundamental set of questions around the direction of the business. It demands that cannabis firms:

- Strategically develop a technology-driven business model. (What powers our success?)

- Identify market points of entry. (Where are we best positioned to succeed?)

- Craft a go-to-market strategy. (How are we going to execute on position?)

- Formulate a product-launch and people-launch roadmap. (What and where are we going to create or sell?)

Firms also should identify and deploy technology pillars based on their own operational need, and develop professional, scalable, and compliant operational practices and structures. Given the scope of these initiatives, leading cannabis operators are leveraging 100-day plans, program management offices, and go-to-market teams prior to launch.

New technology for a new industry

Because the legal cannabis industry is new, companies are being built on a digital-first platform. That means cannabis startups can take advantage of modern-technology architectures to build flexible, agile foundations from the start, that are positioned for growth.

One key example is the growth of seed to sale systems – designed to power cannabis operations across the lifecycle. Some are stand-alone tools for operational or tracking requirements, while others are building toward true enterprise resource planning (ERP) systems designed to power growing businesses. It’s a budding discipline, however, and truly comprehensive and effective solutions are works in progress.

At the same time, loyalty and digital marketing, two of the most influential components of brand growth, can still be selectively leveraged with the right guidance and toolkits. While most major digital marketing platforms and major channels pose regulatory challenges to cannabis companies seeking to market to consumers en masse, firms can take advantage of emerging performance marketing tools and channels to reach the right customers, provided the programs match state laws.

Another essential technology for cannabis companies is data analytics, which can deliver insight into customer preferences, operational inefficiencies, and performance management. Analytics are particularly critical for an emerging market like cannabis due to a dearth of current and historical data on customers, products, and sales. Getting a head-start analyzing these data points may help operators capture a complete picture of customer preferences, market opportunities, and overall business performance.

New types of talent

Cannabis companies often struggle to recruit the right talent, in part because certain roles, such as retail sales associates, are new.

Budtenders and associates are pivotal in educating customers about products, brands, effects, and equipment. Their knowledge, however, is often limited. Walk into a recreational store, for instance, and you’re likely to find that “budtenders” are knowledgeable only about the products they have personally sampled, or provide a preference benchmark based on their own buying behavior.

It’s a deficiency that cannabis operators should be prepared to address. Brands must do a better job creating product information and training materials, as well as organizing sales enablement mechanisms that educate clients on product families and competitive positioning. For their part, retailers and dispensaries will need to create formal learning and loyalty programs and workshops for their employees.

To take part in this developing market, firms will need to build a platform of people, process, and technology excellence. A carefully executed entry stage that focuses on the complexities of cannabis will help establish a first-mover advantage.

This has been prepared for information purposes and general guidance only and does not constitute legal or professional advice. You should not act upon the information contained in this publication without obtaining specific professional advice. No representation or warranty (express or implied) is made as to the accuracy or completeness of the information contained in this publication, and CohnReznick LLP, its members, employees and agents accept no liability, and disclaim all responsibility, for the consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this publication or for any decision based on it.

For more information on Cannabis Tax, please click here.