How Cannabis Industry Participants Would Benefit if 280E is Rolled Back

California Cannabis Regulators Ramping Up Enforcement

April 28, 2018

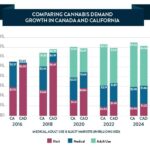

Comparing Cannabis Demand Growth in Canada and California

April 29, 2018By Michael Harlow, CPA, Partner

280E is the Internal Revenue Code section that has been the focus of every tax discussion related to the cannabis industry for the past 15 years. It is the Code section that prohibits cannabis companies from deducting any ordinary and necessary business expenses from gross profit when calculating federal taxable income. It may be a barrier to growth in this industry.

In February, we noted that the elimination of 280E seemed like a distant dream. Major tax reform was enacted in December 2017 without any reference to 280E. The likelihood of stand-alone legislation related to 280E seemed remote. As California moved forward with the roll out of their adult-use program in January 2018, U.S. Attorney General Jeff Sessions rescinded the Cole Memo (the one that de-prioritized the use of federal funds for anti-cannabis enforcement), and the two sides — the federal government and the states — appeared further apart than ever.

But recently, U.S. Sen. Corey Gardner (R-CO) reached agreement with President Trump to advance federal legislation to protect state-regulated cannabis exchanges from federal interference. Also in the news was that former House Speaker John Boehner and former Massachusetts Governor William Weld had joined the advisory board of Acreage Holdings. Given Boehner’s prior vocal opposition to anything cannabis, this was a real stunner. Not to be outdone, Senate Minority Leader Chuck Schumer (D-NY) announced his proposed legislation to decriminalize cannabis on a national level. Suddenly, representatives of both major political parties are demonstrating their support for the cannabis industry. Could discussions about doing away with 280E be in the works?

The elimination of 280E would change the federal tax landscape for the cannabis industry and open several tax planning opportunities previously off limits to plant-touching businesses.

Here is a short list of other items that cannabis business owners and investors should have on their radar for the future:

- Section 199A – The Tax Cuts and Jobs Act (TCJA) introduced a new 20% deduction for “qualified business income” from flow-through entities (S-corps, partnerships and LLCs) and Schedule C businesses.Several industry groups have requested guidance from the IRS and U.S. Treasury regarding the use of this deduction by the cannabis industry, because of 280E’s prohibition of deductions. While no guidance has been issued, the elimination of 280E would appear to enable Section 199A to apply to the cannabis industry, with no additional limitations beyond those applying to any other industry.

- Cost Segregation Studies (CSS) – These studies assign building costs to separate identifiable components with accelerated short-lived depreciable lives for tax purposes. The benefit comes from identifying/maximizing property costs that qualify for short tax lives (5, 7, and 15 years) versus longer-lived building property (39 years). This allows for larger depreciation deductions in earlier tax years, resulting in a deferment of taxes and freed-up cash flow earlier in the life of the property. TCJA grants a 100% immediate deduction for certain capital expenditures (bonus depreciation). 280E does not allow for bonus depreciation, so if it is eliminated for cannabis, it would increase the ability of a startup business to write off the cost of initial capital expenditures in calculating taxable income.

- Research and Development Tax Credits – Given the amount of R&D activity in the cannabis industry, the federal R&D income tax credit is one of the most significant opportunities for tax savings, should -280E be rolled back.

- Cash Method Reporting – The TCJA greatly expanded the eligibility for taxpayers to use the cash method. Now, a C-corporation or a partnership with a C-corporation owner can use the cash method if it has average annual gross receipts of $25 million or less. This is a 5-fold increase from the previous $5 million limit. The TCJA also allows businesses that meet the $25 million test to not account for inventory, and to use alternative means to deduct inventory costs. This typically results in a tax simplification for most business, but not for plant-touching cannabis businesses, as current 280E requirements to track inventory and account for cost of goods sold eliminate that benefit. Hence, eliminating 280E would enable the cash method reporting benefits to cannabis as well.

Overall, it is important to keep an eye on the future of 280E so that current tax structuring, which typically involves focusing on 280E compliance, does not prevent your ability to take advantage of any of the opportunities outlined above.

Recently, the National Cannabis Festival hosted the NCF Policy Summit in Washington D.C. Of interest to cannabis-industry participants was a morning session titled, “Tax Fairness & Cannabis”. A key takeaway from this panel discussion was that there is an understanding of the importance of tax policy and how it impacts small business and economic growth. For this reason, we may see 280E take a more prominent position in their discussions going forward.