Germany’s Expected Legalization Offers Momentum for Reform, New Markets in Europe

Notes from the Frontier: Seven observations from the leading edge of the cannabis industry

November 22, 2021

Another Year, Emerging Markets: How International Finance and Investment Continue Taking Root Across the Legal Cannabis Industry Worldwide

December 6, 2021By J.J. McCoy, Senior Managing Editor, New Frontier Data

Almost no sooner had one of the European Union (EU)’s smallest nations, the Grand Duchy of Luxembourg, decided last month to proceed apace with its cannabis reforms than its western next-door neighbor Germany – having nearly 134x more residents – announced preparing for change after its recent elections. Turns out, with each the Social Democrats, FDP and Greens sharing power through a coalition government, Germany’s most solid political similarity may be a common desire to legalize cannabis.

During a recent roundtable from the European Monitoring Centre for Drugs and Drug Addiction (EMCDDA), the body’s legal analyst Brendan Hughes described “winds of change” blowing through the Americas and reaching the shores of Europe as international prohibition stances against cannabis have failed. It reflected a theme expressed in New Frontier Data’s The Global Cannabis Report: Growth & Trends Through 2025, which outlined how “cannabis has undergone a sea change in liberalization, normalization, and commercialization” underscored by two key themes: growing acceptance of the plant’s therapeutic value, and recognition of the industry’s potential as a catalyst for economic growth. Major impetus was provided in December 2020 when the United Nations (UN) voted to reschedule cannabis, thus downgrading it by one level from the list of the world’s most dangerous drugs, and marking the most significant change in 60 years to the UN’s policy regarding the plant. A process of acceptance, widespread if however incremental, is following from that.

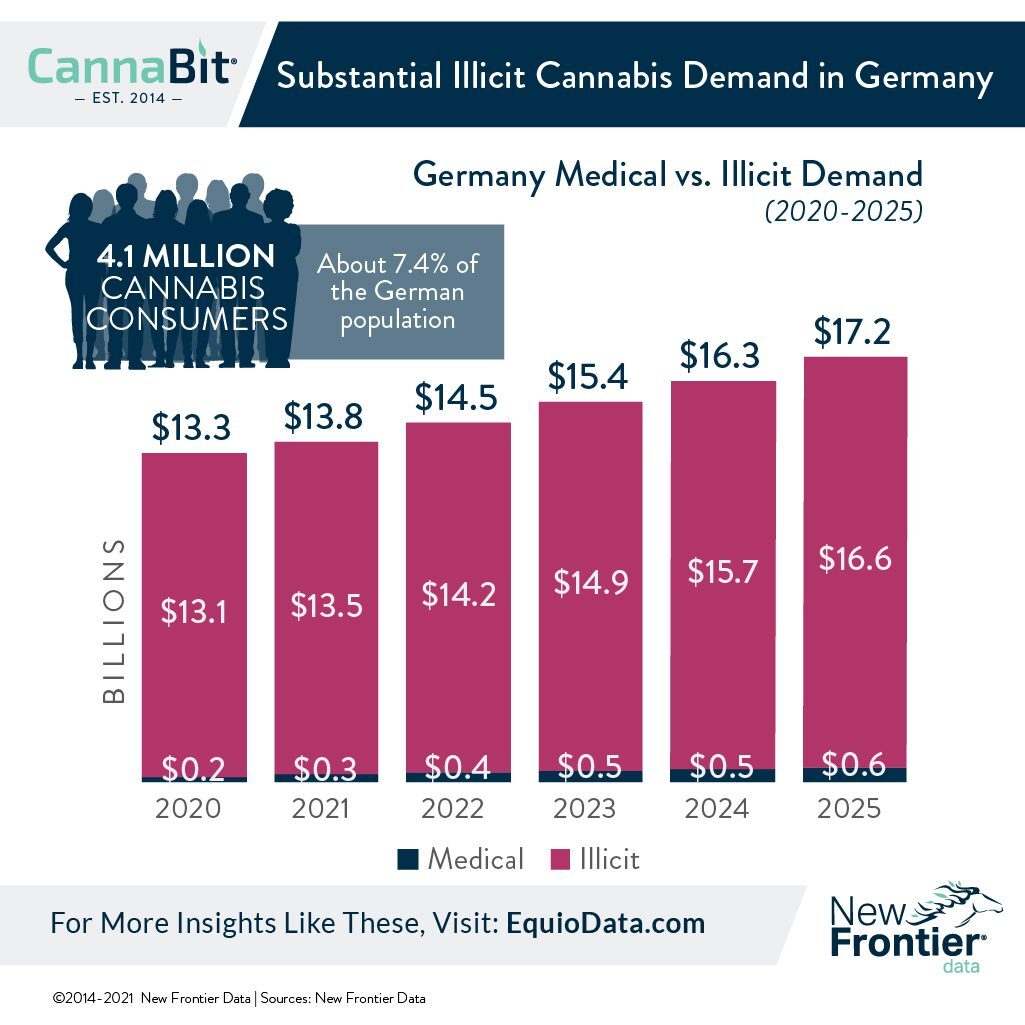

As the EU’s largest economy, Germany’s passage of legalization would naturally reverberate throughout the continent (Germans account for nearly one-fifth [17%] of total European demand, and 3% of global demand), and the nation’s progress and perturbations alike will be closely watched by cannabis policy reform advocates near and abroad. New Frontier Data projects that Germany’s legal cannabis market will grow from $13.3 billion last year to $17.2 billion by 2025. Though nearly all (98%) of its current demand is met by the illicit market, cannabis consumers represent 7.4% (5.3 million) of Germany’s population. The success of pro-reform German candidates will likely encourage political candidates in other countries to leverage cannabis policy reform to galvanize young, reform-minded voters in particular.

Some have argued that Europe should learn from various snags seen in the U.S., such as staying clear of high cannabis taxes — one factor in encouraging consumers to patronize illicit markets even where legalization has occurred. Already, some poor messaging and a lack of European coherence has led to confusion: In Portugal, a 20-year-old policy of decriminalization led to people’s interpreting that cannabis is already legalised there, which is not the case.

Ultimately, Europe’s historically laissez-faire attitude toward cannabis (epitomized by social clubs and cannabis cafés in Spain and the Netherlands, respectively, and in Portugal’s decriminalization of all drugs) is slowly transitioning toward formalization and regulation of medical markets. While Germany leads the continent with the largest medical cannabis program, other nations (including the Netherlands and the U.K.) are working to lower traditional barriers to participation, and to increase their citizens’ access to medical cannabis. Even with continued robust growth, constraints to patient participation have meant that the medical market will not materially impact Germany’s total demand in the near future.

The EMCDDA’s round table stressed the difficulty of having international boundaries with different languages and legal systems, even under the commonality of the EU. Nevertheless, Germany’s actualizing reforms would suggest imminent, continent-wide changes coming in cannabis legalization, roughly following the model in the United States. The U.S. legal cannabis industry was estimated to be worth $13.6 billion in 2019, with 340,000 jobs. Europe still lags far from those levels, but by dint of the EU and other pan-European bodies it has the opportunity to establish a universal regulatory and legal framework to avoid many thorny issues presented by the U.S.’s sclerotic scenarios with a respective state’s legalization rubbing up against federal illegality, leading to profound knock-on issues including access to banking for cannabis companies.

As summarized in New Frontier Data’s report, countries that have moved most smoothly toward more liberal cannabis policies have generally built strong and diverse coalitions across health care, law enforcement, finance, and law, engaged notable policymakers and influencers, and proposed frameworks that are well aligned with the respective local social, economic, and political contexts. Generally speaking, attempting to model a cannabis program from another market without local contextualization has resulted in less effective legalization efforts, and underperforming regulated markets.

What remains certain is that while the shadow of Germany’s strides in legalization will almost instantly outpace its neighbor Luxembourg’s right out of the gate, the little Grand Duchy can always keep bragging rights for having gotten there first.