Keeping a Cool Head About California’s Post-Wildfires Market and Prices

CohnReznick Partners with New Frontier Data

October 17, 2017

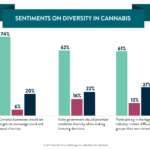

Sentiments on Diversity in Cannabis

October 22, 2017By Beau Whitney, Senior Economist of New Frontier Data

Amid this month’s devastating California wildfires has also spread news of cannabis growers’ suffering partial if not total losses right when they would otherwise be reaping their fall harvests.

As tragic as those incidents could be, however, it is incumbent upon the industry, regulators, and the media at large not to lose perspective about what such losses mean either to the state’s market or its consumers, either in the near term or foreseeable outlook.

While the California Grower Association reported that several dozen farms were destroyed, there are possibly more than 20,000 farms in Humboldt County alone, some 2,200 of which are expected to participate in the adult use market coming online in January. So, all else being equal, even if 50 farms were completely destroyed, and every one of them dedicated to the new market, they would still represent less than 2.3% of the supply overall. And even that, being out of one county in the nation’s largest cannabis-yielding state.

Under the best of conditions, cannabis prices are nevertheless impacted by seasonality. They are annually at their lowest levels during mid-Q4 and early Q1. In order to see overall market prices increase by 10% (much less 20%), not only would prices have to rise enough to mute the effect of seasonality, but then would also have to rise and additional 10% above the state wide average. Supply would have to be so severely constrained that 1) demand would actually exceed it, or 2) the suppliers impacted by the wildfires would have to have been large enough to already be providing for most of the state’s retailers overall. The market might see price increases were there were only a few suppliers, but given how many suppliers there are, and given how each retailer has their own micro-supply chain (localized, relationship-based suppliers), the likelihood of an entire market experiencing a price increase is extremely remote.

There is one way to see price increases: If all suppliers choose to support the export market (shipments to other states) rather than to the California market. But as California itself is the largest market in North America, is this realistic?

Looking at it in a different way: If a retailer is looking for product, sales reps who are worth their pay will hear about it, and find a way to support that demand. All suppliers are looking for shelf space and new opportunities. If a legitimate company is looking to capture market share in the new California adult use system, and hears that a retailer is impacted by the wildfires, what better an opportunity could it be than for them to come to the aid of those retailers and save the day? The retailer appreciates it, the new supplier is viewed favorably, and once the old supplier is knocked off the shelf, it becomes a difficult and expensive proposition to get back there. Such wholesale support will pay dividends as the adult use market opens up.

Product will be available: There is already supply in warehouses throughout the state, there are also all those other viable Northern California farms, and cultivators in Southern California — barring any similar, immediate calamity – who are meanwhile harvesting their own crops. Supply will still exist.

What remains yet unknown is the extent of second-tier damage from smoke. Windblown ash from the wildfires was known to travel considerable distances, and the effects of proximate smoke upon crops in the field is also ruining some harvests. Clear answers about the overall extent of damage will not be determined until after growers send their harvested crop samples for testing, likely within the next two to three weeks.

Regardless of whatever extent that product quality is ravaged by smoke, suppliers will not destroy anything that retains even the most minimal value. They have limited insurance opportunities to cover their losses, yet they still have bills to pay. They will literally hold “fire sales” and drop prices as necessary to get rid of anything that exists and can be financially salvaged.

Any remaining skeptics to this point might also note that this is not the first time California has experienced a disaster. About a year ago, remnants of a tropical cyclone hit Northern California and Southern Oregon, likewise wiping out crops in the worst-hit sections of those regions. Yet, this year has mainly been good for growing, and prices have already been seen dropping in the Oregon market.

For consumers, a silver lining already existed for 2017 simply because this fall marks California’s final season before the legalized market’s regulations really clamp down in 2018. As happens in virtually any other retail market, cannabis suppliers will open their doors and empty their shelves to sell anything and everything they can to enjoy one last unfettered payday. This, too, has been seen before, such as when Oregon prepared to open its adult use market two years ago.

The economic moral of the story is this: Theoretically, given that the elasticity of demand is around two, any corresponding price increase would correspondingly decrease demand by twice that amount. Thus, a 20% increase in price at the retail level would result in a 40% decrease in demand; since there is a substitute supply on the illicit market, that dynamic would simply send legal demand over to the illicit suppliers. Given that there is more supply than demand in the market, it is illogical to expect retailers to pass any price increases on to the consumer.

Beau Whitney, Senior Economist of New Frontier Data

Beau Whitney is the Senior Economist for New Frontier Data. Whitney has a unique blend of high tech business operations skills, economics and pollical analysis, as well as cannabis industry experiences.

While at Intel and TriQuint Semiconductor, Whitney honed his business operations skills associated with quickly ramping products from low volume to high volume. This is a skill he has since transferred to the cannabis industry. He is the former chief operations officer and compliance officer of one of the largest vertically integrated, publicly traded cannabis company in North America. His experiences incorporated growing, extraction, edible manufacturing and wholesale and retail distribution operations.

As an economic and policy analyst, his Whitney Economics white papers analyzing the cannabis market have been referenced in Forbes Magazine, USA Today, as well as in cannabis industry publications and across the Associated Press wire. Whitney has provided policy recommendations at the state and national levels and is considered an authority on cannabis economics.