The Key to a Profitable Harvest? Getting a Handle on the Retail Supplies Market

Cultivation Licenses in Colorado

December 10, 2017

Cost Segregation and Cannabis Business Owned Real Estate

December 16, 2017By Rob Kunvinka, Manager of Data Science for New Frontier Data

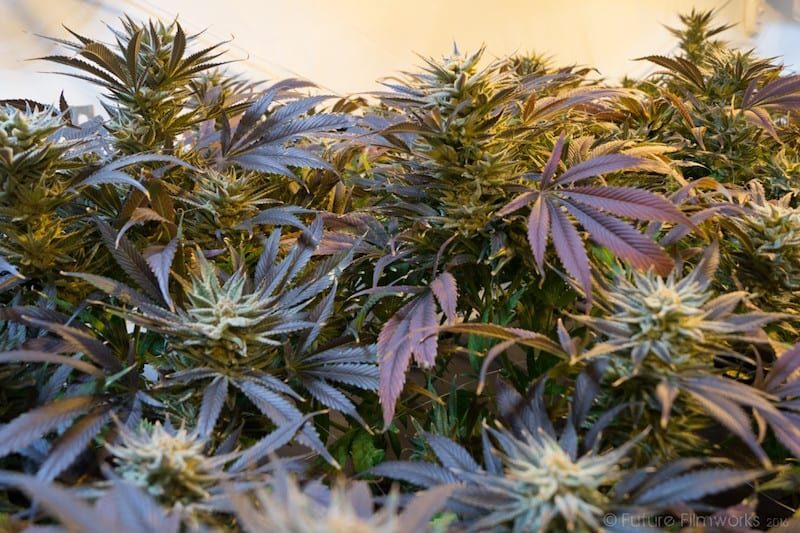

Cannabis cultivation is reaching new levels of sophistication and efficiency as commercial operations become larger. In the earliest years of post-legalization, facilities larger than 50,000 square feet were rare. Now, state-of-the-art cultivation facilities can exceed 500,000 square feet, more than a 10x increase from earlier medical and nascent adult-use operations. Given such increases in production capacity, the retailers and suppliers equipping such operations have likewise seen substantial growth.

A new report by New Frontier Data, in partnership with Denver-based cultivation supplies retailer GrowGeneration (GrowGen), provides original analysis into market sizes, growth trends, pricing, and brand popularity in the market, from a specialized but quickly evolving sector of the cannabis growth story. GrowGen owns and operates 14 cannabis-specific retail organic and hydroponic gardening stores spread across Colorado, California, Seattle and Las Vegas.

The retail supplies market comprises five major product categories: Ranked by revenue share, these categories are Medium (22.3%), Nutrients (21.8%), Grow Lights (12.8%), Pest Control (4.8%), and Organics (4.7%). Sales from dozens of other categories make up the remaining share (33.7%). In Colorado, despite being the most mature adult-use market, we estimate that the supplies market will grow more than 30% in 2017.

Utilizing GrowGen’s unique perspective and lessons learned, Cannabis Cultivation Insights: Retail Supplies Market offers business intelligence including:

- What can be learned about the number and ratio of cannabis cultivation licensees dedicated to medical and adult-use sales;

- What may be gleaned from differentiating dozens of product categories (and which consistently hold the top shares by revenue generated);

- How each of the major product categories have profited, and due to which factors they have enjoyed the most growth;

- Which product categories are continually used throughout the grow cycle, and which are more volatile due to seasonality, price points, and positioning as one-off purchases; and

- The extent to which brand competition is most intense, while providing ample opportunity for both smaller and new players to run as category and market leaders.

“Cultivators are getting much more sophisticated at scaling their businesses and navigating through the various compliance issues,” explains Michael Salaman, GrowGen’s president and cofounder. “This year was a year when products were taken off of shelves because of regulatory issues; for example, some fertilizers that were not in compliance. And we are going to see more of that as states get more involved in how the plants are being cultivated, and what fertilizers are being used. We see the trend moving more towards organics in not only Colorado, but in California, Nevada, and Washington.”

Of course, since business development varies state-to-state (along with agricultural and climactic conditions), things take time based on the pace of how licensing is granted. “Even though a state may legalize adult use,” Salaman notes, “it takes, in some cases, a year or more for those licenses to actually become effectuated. It also takes time to do the build-out and get operations up and running. In Colorado, we started to see the trend accelerate in the number of commercial customers within a two-year period from legalization. Our business is servicing a larger number of commercial customers, and that requires more capital, inventory, pricing, purchasing, sourcing, and accounting. It’s becoming big agricultural business, and in the future, there will be some operations with millions of square feet of greenhouse and cultivation – operations that will be very sophisticated in terms of technology. Everybody is tweaking how they feed the plants to create optimal yield for the lowest cost, and I do believe there is going to be a trend towards organic growing.”

Rob Kunvinka, Manager of Data Science for New Frontier Data

Rob Kuvinka was brought on as Manager of Data Science for New Frontier Data. Kuvinka has data science and market research experience in both the private and public sectors, in industries ranging from video games to criminal reform. He holds a Master’s of Information Management and System degree from University of California, Berkeley and a Bachelor’s degree in Mathematics and Mathematical Economic Analysis from Rice University.