How to Evaluate Valuations in the Cannabis Marketplace

Oregon as Informal Case Study: Some Lessons Learned from the Rush in the Pacific Northwest

March 17, 2018

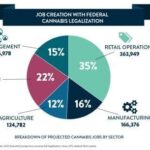

U.S. Federal Cannabis Legalization = 1.04 Million Jobs

March 18, 2018By Andrew Lines, MAI, Principal

What We Have Learned: In valuing the business operations of companies in the cannabis industry, risk is a significant factor that can dampen even the most optimistic outlook and projections.

Valuations within the growing cannabis industry don’t always seem to be consistent with operator or investor expectations; this can be due to lack of available transaction data, or misinterpretation of perceived risks – CohnReznick’s Valuation Advisory group can help identify how these risks should be quantified.

With regards to Real Estate Valuation of Grow Facilities and Dispensaries, the lack of available transactional data has led to undervaluation of tangible assets in the Cannabis Industry. As many facilities have historically been acquired in all cash purchases and built-out at the operators own cost, it can be difficult for local appraisers to extract meaningful sales and lease information. In lieu of actual data points, many appraisers have opined that the risk associated with potential federal seizures exacerbates capitalization and discount rates – CohnReznick has reviewed appraisal reports where the effective capitalization rate has been doubled, and well outside conventional rates observed in all other asset classes. We believe that while there is some risk attributable to operations, this risk can be quantified and not be a “guess”. Our reconnaissance indicated that total seizures by the Federal government are mostly de minimus, assuming the business operates in full compliance with State and local municipal laws (see Cole memo). The reality is that most grow houses should have higher values than typical industrial facilities, given the additional requirements for power and interior build-out; not unlike smaller data centers, which often have similar power, utility safeguards and redundancy, and security needs. Data Centers typically have lease rates 2 to 3 times that of average industrial rents, which is also consistent with lease rates for grow-houses we have observed in the marketplace.

Likewise, in valuing the business operations of companies in the cannabis industry, risk is a significant factor that can dampen even the most optimistic outlook and projections. The high perceived risk of a business achieving its financial goals increases the rate of return that a buyer requires to invest in that business (in some cases to venture capital rates as high as 30% or 40%). This perceived risk is elevated due to a lack of peer group performance benchmarks and visibility of transaction pricing metrics. A higher required rate of return translates into lower value. Factors that can lead investors to conclude there is a high level of risk in such investments include:

- Little or no track record of operations

- Limited banking and lending options

- Regulations, licensing and fees vary greatly by state & local markets

- Potential enforcement of federal regulations

- Punitive tax regulations

- Limitations on marketing and promotion

- Risk of audits (IRS and other)

- Increasing competition and market dynamics

Business owners have more control over some of these issues (i.e. compliance with operating regulations, classification of expenses for tax reporting, implementation of financial systems, cybersecurity) than others (i.e. crop failure, enforcement of federal regulations, changing state and local requirements). Proactive attention to the controllable issues can serve to reduce risk in the eyes of an investor and consequently, increase the value of the business operations. The effective use of systems, controls, and reliance on professionals with expertise in the industry is at the top of the list of things a business owner can do to reduce risk.