Catching Cannabis Coming and Going: How Law Enforcement Profits from Illicit and Legalized Marijuana Businesses Alike

June 21, 2020Guilty Until Proven Innocent

June 29, 2020

- U.S. Code §280E can result in up to a 70% effective tax rate for cannabis businesses, or 2x what other legal businesses pay. (Source: New Frontier Data)

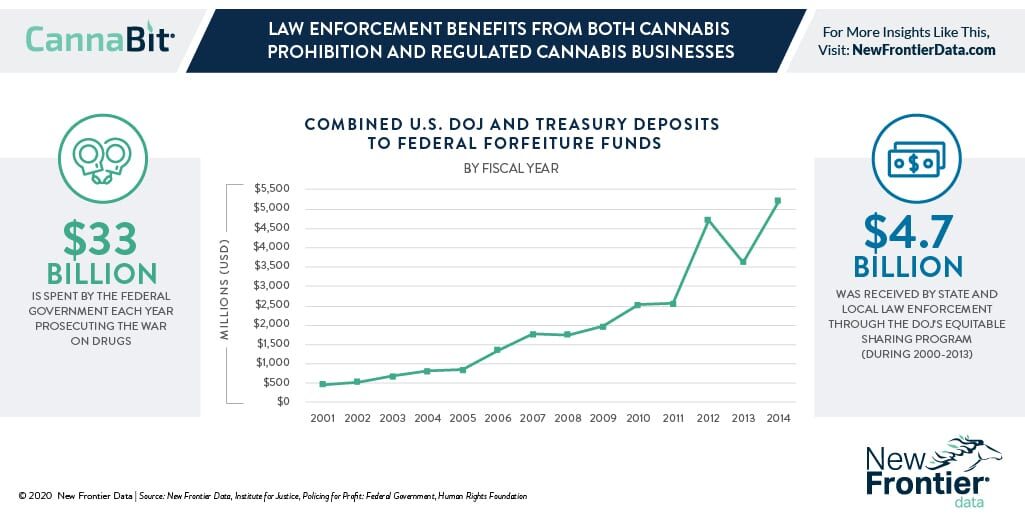

- Between 2000-2013, state and local law enforcement received $4.7 billion from the Department of Justice via its Equitable Sharing Program. (Source: IJ).

- The federal government annually spends $33 billion to prosecute the war on drugs, with state governments spending another $30 billion. (Source: Human Rights Foundation)

- Lack of reliable banking access increases cash-intensive cannabis businesses’ risk for theft: In 2019, approximately 180 credit unions (3.3% among 5,442 in the U.S.) and 559 banks (10.8% among 5,177 nationwide) served the legal cannabis industry. (Source: New Frontier Data, Statista.com, FDIC)