Medical Cannabis Use Rising Among U.S. Consumers with Anxiety Disorders

Flush with Cash, Cannabis Companies Jockey for Prime Market Positions Amid Rush to Scale

July 12, 2021

For Many Cannabis Consumers, Home Is Where the Grow Is

July 26, 2021By Josh Adams, Ph.D., Senior Industry Analyst, New Frontier Data

As access to legal cannabis steadily increases across the United States, many consumers are exploring ways to incorporate cannabis products as part of their own health and wellness practices, with a particular emphasis on the medical value of cannabis.

Consumer spending on medical cannabis is projected to grow steadily in the U.S., increasing from $8.5 billion in 2020 to an estimated $16 billion in 2025. In a nationally representative survey of cannabis consumers from across the U.S., New Frontier Data found that as of 2020, 42% of respondents reported identifying as medical cannabis consumers.

Renewed interest from Washington was seen last week when Senate Majority Leader Chuck Schumer – along with Democratic Senators Cory Booker and Ron Wyden – released a draft of their Cannabis Administration and Opportunity Act legislation. The bill, if passed, would effectively decriminalize cannabis by removing it from the schedule of Controlled Substances, implement a federalist approach to cannabis legalization, expunge some criminal records for cannabis-related convictions, and establish programming and grants for those adversely impacted by the War on Drugs.

In addition to the new regulatory measures, the legislation also calls for increased research into the medical benefits and uses of cannabis to be overseen by the Department of Health and Human Services in conjunction with the National Institutes of Health. Similarly, the bill empowers the FDA to begin overseeing the regulation of cannabis and cannabis products. It would mark the first time for the federal government to explicitly call upon its scientific apparatuses to examine health benefits and medical applications of cannabis, in addition to having a regulatory agency oversee quality and standards for cannabis products. The draft legislation has not been formally introduced, but is open for public comment through September 1.

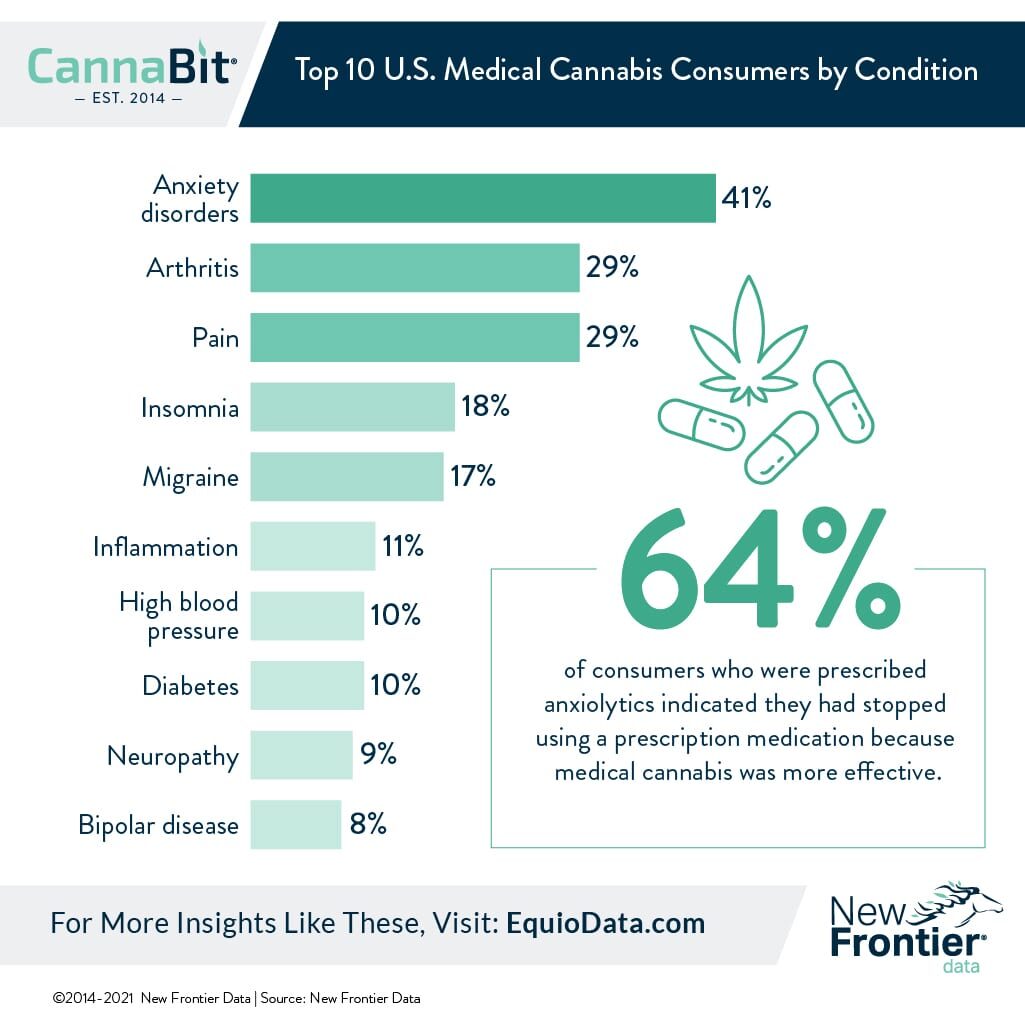

Americans are already turning to cannabis for a range of medical applications: Among the primary reasons cited by medical consumers is pain management, particularly as patients have become increasingly aware of risks associated with some other analgesics, most notably opioids. New Frontier Data’s recent report, Medical Cannabis & Pharmaceuticals: Growth & Disruption in U.S. Healthcare, further examines the myriad ways which consumers use medical cannabis. Another popularly viable application is for the management of anxiety.

Among medical cannabis consumers, 41% indicated having anxiety disorders. Anxiolytics — a class of drug used for the treatment of anxiety — are often associated with a potential range of undesirable side effects including confusion, drowsiness, nausea, memory problems, constipation, or muscle weakness. Cannabis has shown viability as a substitute for some prescription anxiolytics, and cannabis consumers appear open to trying it as such.

Among consumers reporting some anxiety disorder, 54% said that they had used cannabis to replace “some” or “all” of their prescription medications. Additionally, a majority (51%) of medical cannabis patients said that among their primary reasons to either reduce or transition from using prescription drugs was to utilize a more natural treatment option.

Those cannabis consumers seeking to transition from traditional pharmaceuticals also represent a significant — if currently unrealized — segment of the cannabis marketplace. To better understand the market potential for medical cannabis, New Frontier Data analyzed U.S. healthcare pharmaceutical spending on select conditions in 2016, when Americans spent roughly $9 billion on prescription pharmaceuticals for the treatment of anxiety disorders. Assuming a replacement rate of 1.6% (e.g., based on cannabis use rates in the U.S., and those consumers seeking to substitute cannabis for prescription medications) medical cannabis as a treatment for anxiety could account for up to $140 million in revenue.

The research draws extensively from New Frontier Data’s U.S. cannabis consumer survey, and is a continuation of its series of ongoing consumer research examining legal cannabis markets in the United States and globally.