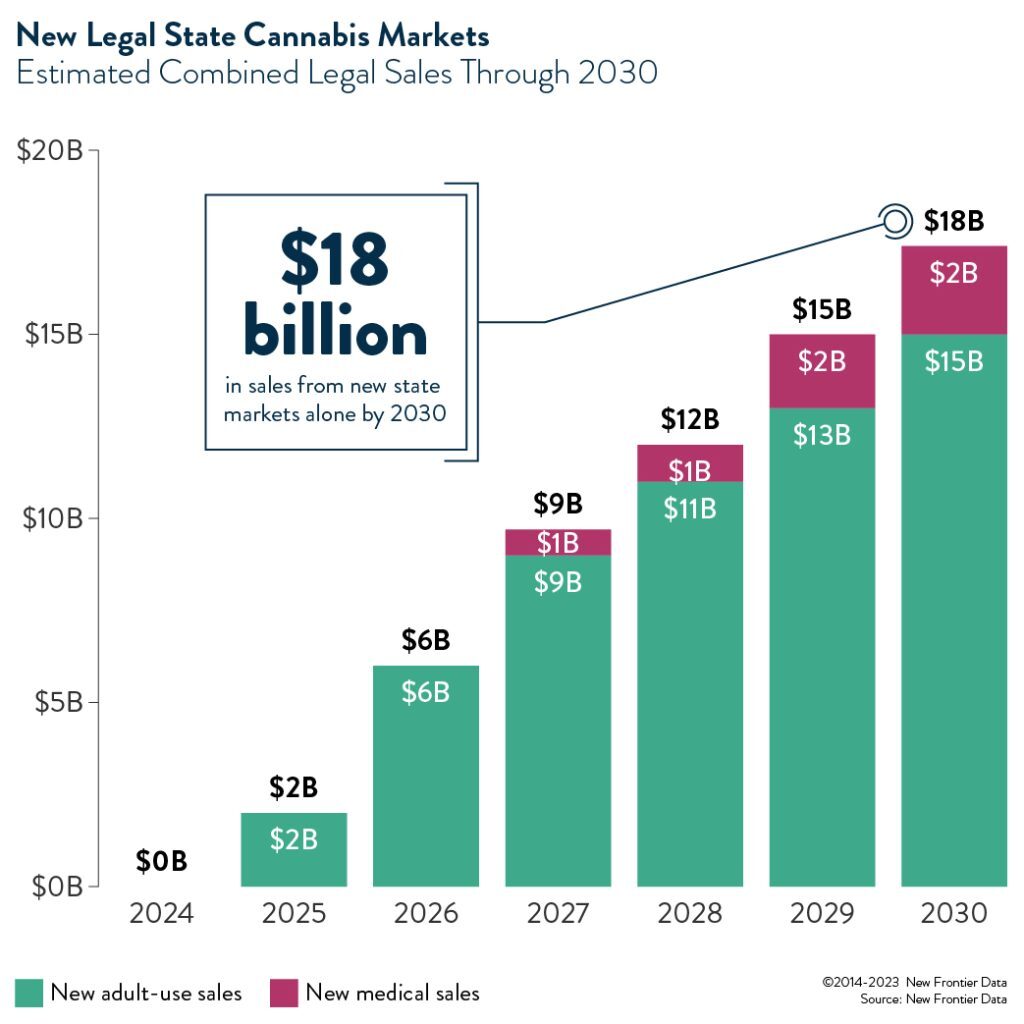

New state markets could inject an additional $18 billion annually into U.S. legal cannabis market by 2030

Want to grow the industry? Start local

February 7, 2023

Medical cannabis use and identity: The role of state laws

March 7, 2023By Dr. Amanda Reiman (Ph.D., MSW), Chief Knowledge Officer, New Frontier Data

New Legalization Efforts Trending for 2023

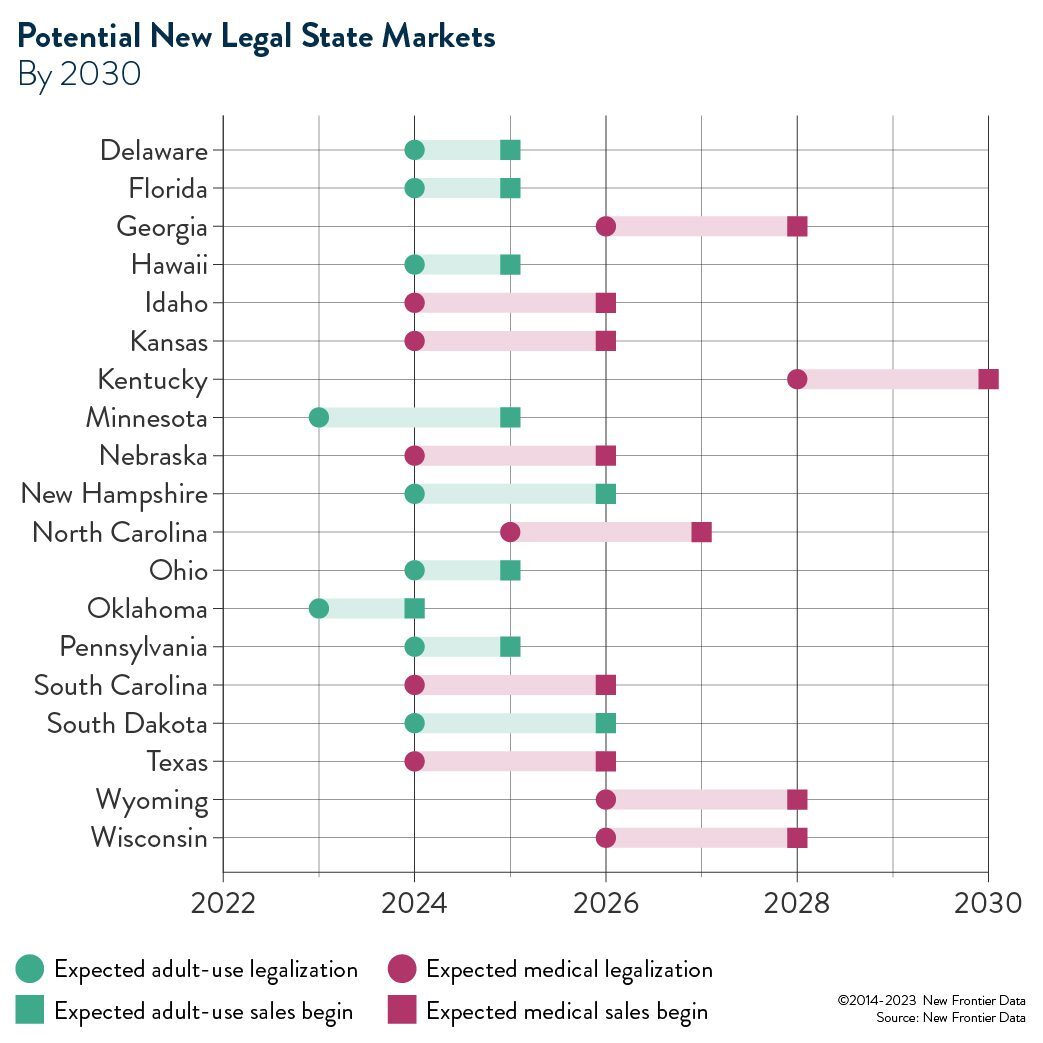

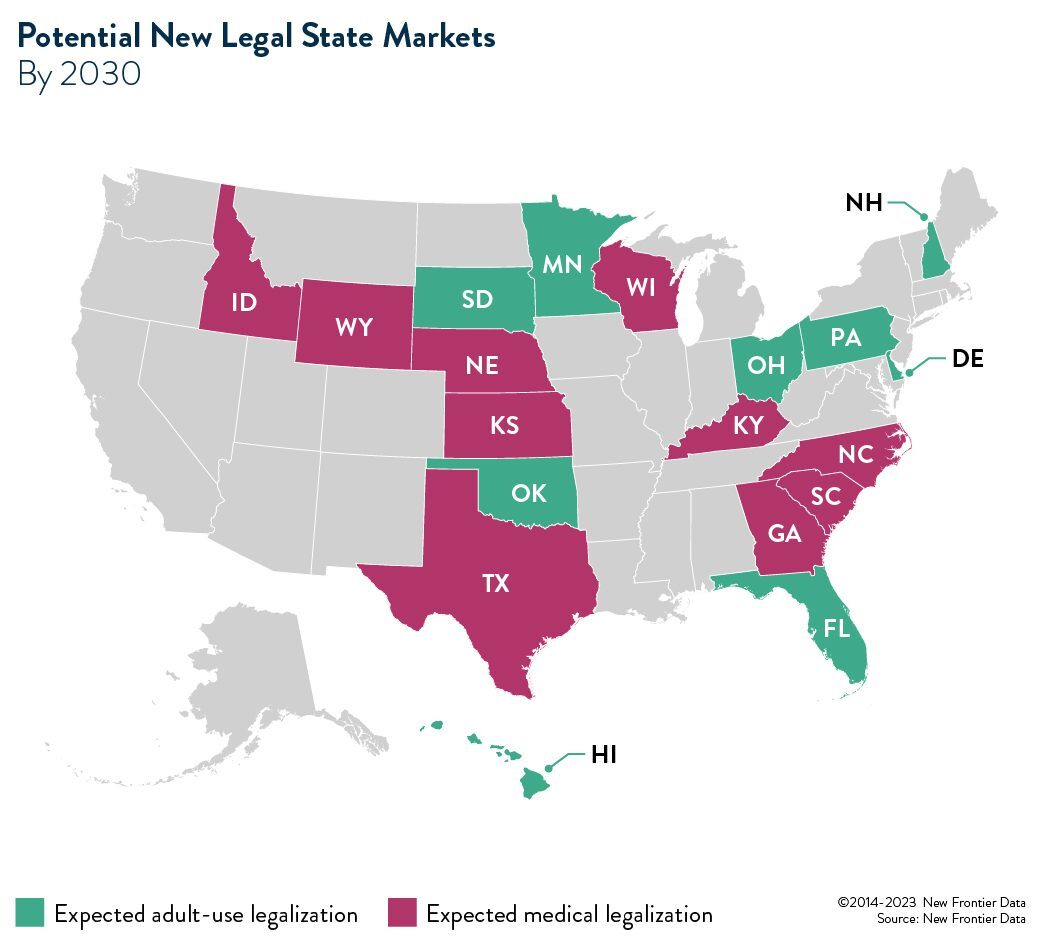

As detailed in the upcoming 2023 US Cannabis Report: Market Updates & Projections. Last year, the U.S. legal cannabis market was worth an estimated $29 billion in annual sales combined across states where sale is legal for adult use and/or medical purposes, and this year sales are expected to top $34 billion. Based on New Frontier Data’s analysis of state legalization efforts, nine states are demonstrating strong momentum to join the market and legalize adult-use cannabis prior to 2030, while another nine seem likely to legalize medical cannabis. Should all of them succeed in their efforts (and on the timeline projected by New Frontier Data), sales in just those new states alone would be an estimated $18 billion annually by 2030. Without counting any additional states’ legalizing cannabis either for medical or adult use by 2030, current legal markets will add an additional $29 billion in annual revenues over the next seven years, highlighting the continued growth opportunities even among well-established markets.

The report summarizes changes in legal cannabis market activity in the last year and analyzes several key regulatory determinants of a legal market’s success to estimate market projections for legal and illicit cannabis sales through 2030. For comprehensive data and analysis, visit New Frontier Data’s online business intelligence portal Equio® to gain additional insights available within the U.S. Market Dashboard.

State-Level Legalization Expected to Remain the Standard in the Near Term

The initial excitement about movement on federal cannabis reform from new Democratic leadership has dwindled in the absence of tangible action, and the prospect of federal action to address the country’s disconnected patchwork of state regulations (specifically banking reforms to enable the cannabis industry to fully participate in financial markets) remains elusive in 2023. Without federal action on rescheduling or banking reform in the near term, the current patchwork model of state legalization is expected to remain.

Broader Macro Factors Could Impact Near-Term Revenues

While total sales across the US as a whole were buoyed by the addition of new state markets (and their naturally high levels of associated sales growth in the initial years of legal program launch), legal cannabis sales in the most mature adult-use markets (CO, WA, OR) were down in 2022, showing signs of negative growth for the first time since the activation of adult-use sales in those states.

High levels of inflation, high taxes, and competing illicit (and border-state) markets, are compounding the price pressures seen in mature legal markets. Additionally, the potential convergence of broader economic developments (potentially a recession) would negatively impact cannabis consumer spending and sustain these pressures into the medium term. New Frontier Data’s cannabis consumer research has shown cannabis spending to be highly recession-resilient, meaning that cannabis spending is among the last items which consumers cut when facing tightening financial conditions. Though consumption levels may remain unchanged, consumers reduce their spending by bargain hunting (i.e., seeking value purchases affording them to obtain similar quantities for less) or by reverting to the illicit market where some products, particularly flower, are generally less expensive than in the legal market.

If an economic contraction is sustained through year’s end, total 2023 revenues may return lower than forecasted. However, the reallocation of spending would revert to the baseline as consumers regain their spending power in the following years, and as the legal market continues to grow in size and offer compelling (and increasingly cost-competitive) alternatives to the illicit market.

Taken collectively, near-term uncertainty on the broader economic climate, along with medium-term uncertainty on precisely when the next crop of states will legalize or when federal reform might happen, will have minimal impact on the surging levels of demand for legal cannabis, and do little to deter the broader transition of consumers in legal market from purchasing within regulated channels.