Expansion of legalization across U.S. states provides pockets of momentum despite North American M&A activity being down significantly in 2022

Rethinking Cannabis Potency: Are Low Dose Products the Appropriate Choice for Most Consumers?

April 4, 2023

The Power of Medical Cannabis in Changing Public Perceptions

May 2, 2023By Kacey Morrissey, Senior Director of Industry Analytics, New Frontier Data

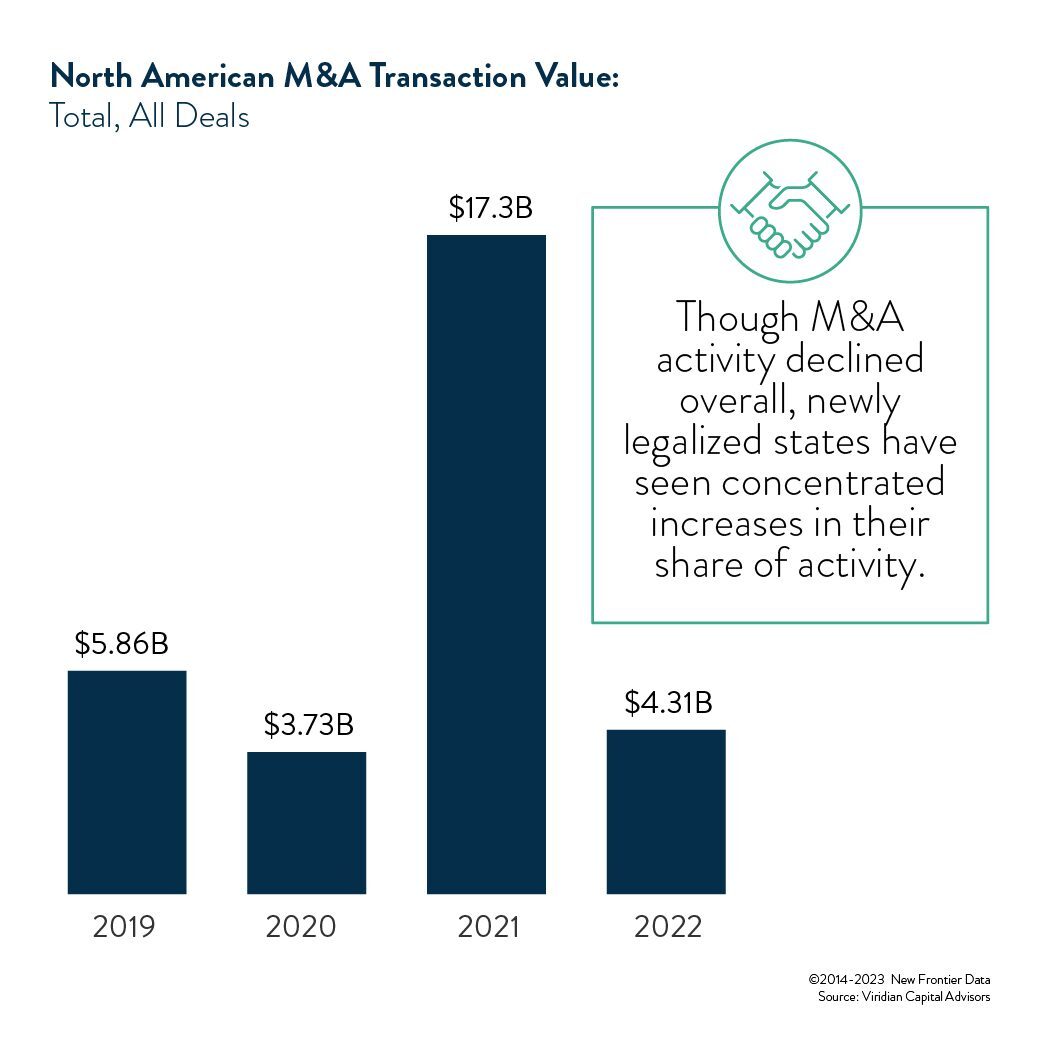

In 2021, following reports of record sales in legal state markets during the pandemic, virtually every sector of the industry saw blockbuster investments. Companies raced to enter new markets, expand operational capacities, and acquire novel intellectual property, leading to over $17 billion in M&A deal activity that year. However, enthusiasm has since waned amid a combination of economic headwinds and dampened expectations for federal action, and cannabis industry M&A transaction values in North America shrank to just $4 billion in 2022.

The U. S. drove the majority of M&A activity last year, accounting for 68% of global M&A transactions in 2022. While Canada did beat the U.S. in establishing a fully legal national market, the legalized U.S. states collectively represent a population 6x larger than Canada’s. Furthermore, the rapid pace of state-level legalization1 in the past few years suggest the legal market opportunity in the U.S. alone will account for the lion’s share of legal global demand for the foreseeable future.

The pace of U.S. state legalization and market regulatory expansion events have led to concentrated increases in the share of M&A activity in those states (e.g., New York went from 1% in 2021 to 11% in 2022, and Texas went from 0% in 2021 to 9% in 2022, whereas California shrunk from 35% of M&A activity in 2021, to just 7% in 2022.)

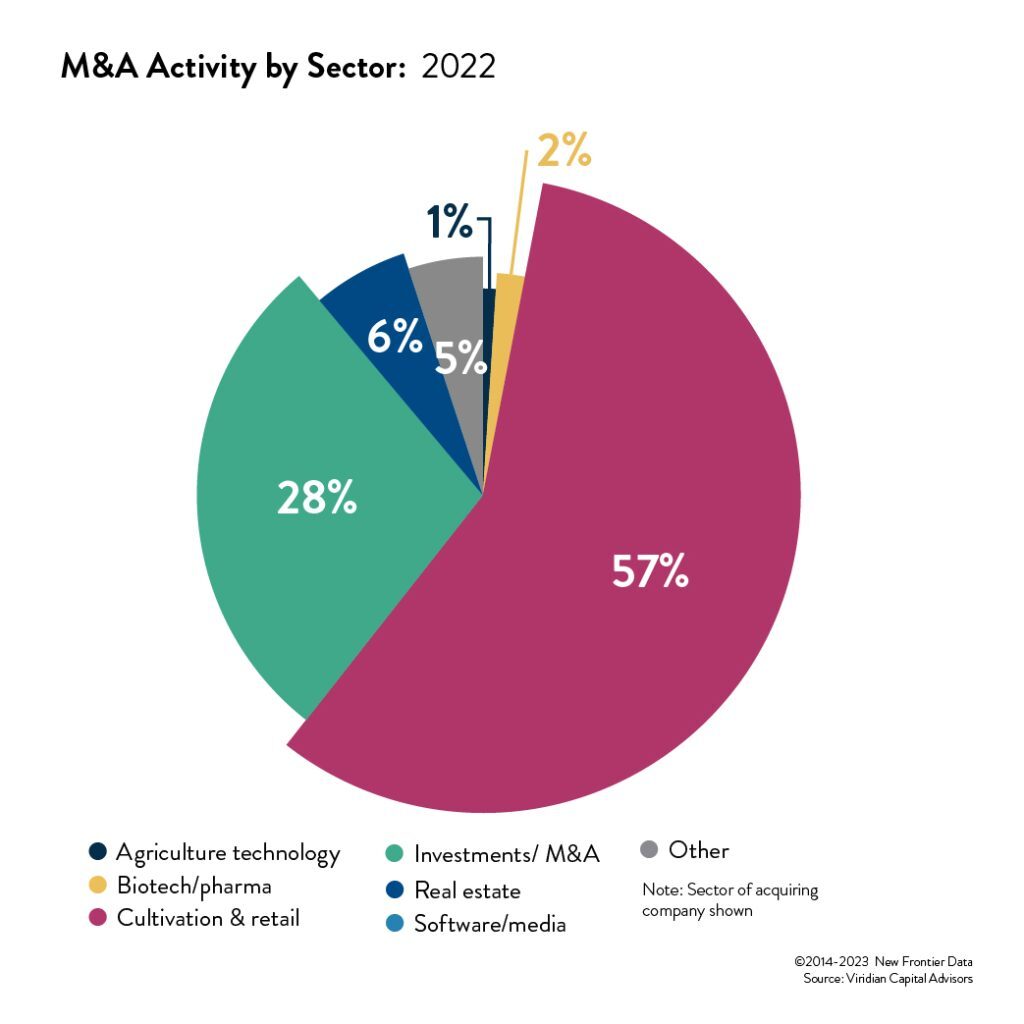

Cultivation and retail remain the leading sectors for M&A activity in 2022

The quantity and size of M&A deals have decreased across the entire industry since 2021, however, the fall in the value of public and private companies is still attracting strategic buyers from within the cannabis sector and potential buyers from adjacent sectors. Cultivation and retail remain asthe leading cannabis industry sub-segment for M&A activity in 2022. Despite the decrease in overall cannabis industry M&A activity in the last year (70% of activity in 2021 to 57% in 2022), the cultivation and retail segments are still the most desirable areas for investment and lending. This will continue to drive the majority of deal activity due to the recent pace of state-level legalization, and the subsequent expansion of cultivation and retail access that is necessary to support the operationalization of cannabis sales in newly legal state markets.

For more analysis on recent capital activity in the cannabis industry, download the Cannabis Capital: 2023 Industry Market Report with Viridian Capital Advisors and join us for a live webinar on April 19th at 12pm PT where we will be joined by Scott Grapier, the Founder and CEO of Viridian Capital Advisors.

1 Following on the footsteps of CT, NM, NY, and VA last year, three additional states – MD, MO, and RI, passed measures to legalize adult-use cannabis sales in 2022, bringing to total to 22 U.S. states (including D.C.) where high-THC cannabis is legal for adult use, and 39 (including D.C.) where high-THC cannabis is legal for medical use