November Elections May Add to Increasing U.S. Medical Cannabis Programs

U.S. Medical Cannabis Program Growth

October 18, 2020

U.S. Legal Cannabis Market to Reach $35 Billion by 2025

October 23, 2020By Kacey Morrissey, Senior Director of Industry Analytics, New Frontier Data

This past weekend, Virginia opened its first licensed medical cannabis dispensary when Dharma Pharmaceuticals made its original sale in Bristol, located in the southwestern edge of the state. It marks the Old Dominion State as the 34th (plus the District of Columbia) in the U.S. to operate an effective medical marijuana system.

Later this month in Richmond, the state capital will open its first licensed medical cannabis production facility, an 82,000-square-foot operation expected to produce about 2,000 pounds of dry weight cannabis monthly.

States often establish legal medical cannabis programs before adopting adult-use measures, though South Dakota next month may elect on the same day to enact both a medical and a recreational program. Voters there will decide whether to adopt Measure 26 to establish a medical cannabis program and registration network for patients with qualifying conditions. Its Amendment A measure would legalize adult-use cannabis and require state legislators to adopt medical cannabis and hemp laws.

Meanwhile, Mississippi voters on November 3 will consider competing measures to legalize cannabis for medical purposes. Initiative 65 (added to the ballot via a public petition) would enable physicians to recommend medical cannabis for patients with any of 22 qualifying conditions (e.g., cancer, multiple sclerosis, or post-traumatic stress disorder). Under Mississippi law, its legislature may amend or draft an alternative resolution; its competing measure requires medical products to be of pharmaceutical quality, limits smoking of medical cannabis to terminally ill patients, and leaves creation of the state’s regulatory framework up to the legislature.

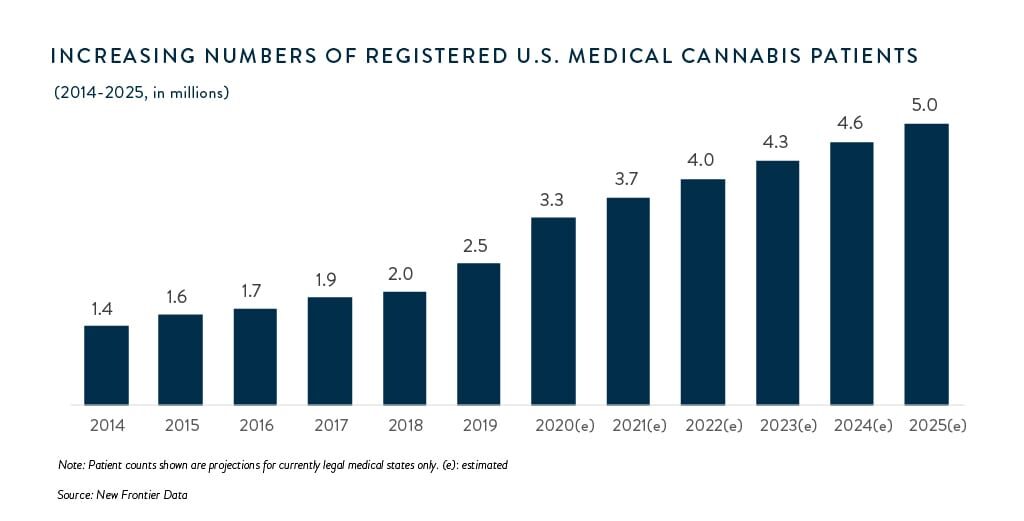

Nationally, the total number of patients treating ailments with legal medical cannabis has surpassed 3 million, a number projected to increase as newly legal medical markets become operational. An estimated 44.5 million American adults will consume cannabis at least once in 2020 across both legal and unregulated markets. That total is projected to grow by roughly 4% per year over the next six years, reaching an estimated 52.3 million consumers by 2025.

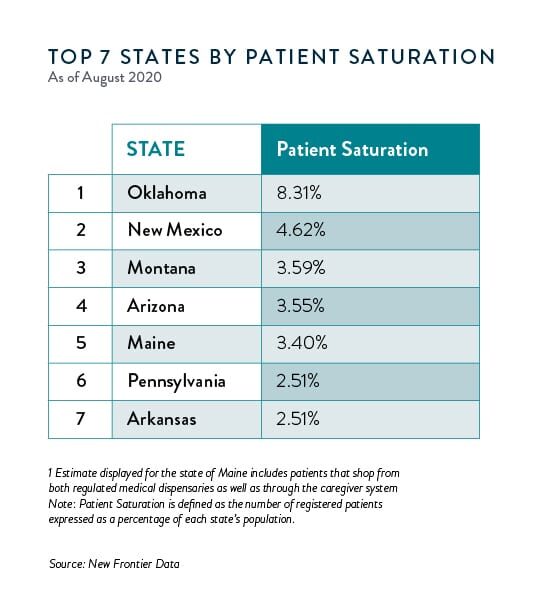

Across the 34 states (plus D.C.) with legal medical cannabis, those with the highest patient saturation rates (i.e., number of registered patients among the total state population) are Oklahoma, New Mexico, Montana, and Arizona, respectively.

Industry expansion is fueled by convergent forces, including:

- The addition of new legal markets as more states reform their cannabis laws;

- Sustained growth in demand in legal states as consumers make the transition from the unregulated market to the legal one; and

- Increased cannabis consumption as the public recognition of cannabis’ expansive therapeutic value grows, and cannabis is diversified for varying medical and wellness uses.

While legal state medical cannabis programs are providing medical cannabis access to a combined 3.1 million patients nationwide, strictly defined qualifying condition lists can greatly limit potential participation to a small pool of residents in some medical markets. And with just 28% of the U.S. population residing in a state that has legalized adult-use, most Americans still lack access to legal cannabis.

However, newly legal states are generally trending toward more expansive medical programs, permitting a broad array of health care practitioners to recommend medical cannabis for diverse lists of qualifying conditions.