Pennsylvania Growers Lack in Diversity

Diversity & Community Impact Fall Short in PA Grower’s Application

July 9, 2017

Cannabis Taxes Are A Boon for Colorado’s Government’s Coffers

July 16, 2017By J.J. McCoy, Senior Managing Editor for New Frontier Data

Last month, Pennsylvania officials made two much-awaited announcements toward the opening of the commonwealth’s medical cannabis market next year. In separate press conferences held a week apart, the Pennsylvania Department of Health in charge of administering the Keystone State’s medical cannabis program awarded 12 licenses for cultivation and distribution, and issued 27 permits to open dispensaries. Those companies now have six months to become operational prior to the program’s first sales of prescriptions and products.

Pennsylvania’s Medical Marijuana Act took effect on May 17, 2016, and is expected to see sales implementation in early 2018. All of the cannabis products sold must be produced in-state by the licensed growers who will be allowed to sell to any of the state-sanctioned dispensaries.

Among the 26 states where legal cannabis is grown, Pennsylvania joins Oregon not to have an in-state residency requirement. Indeed, among the first 12 permits issued, eight went to businesses with out-of-state headquarters.

As detailed in New Frontier Data’s “The Cannabis Industry Annual Report: 2017 Legal Marijuana Outlook”, now available, Pennsylvania is poised to become one of the nation’s largest medical cannabis markets: Through the compound annual rate (CAGR) described in the report, by 2025 Pennsylvania will account for 5% of all U.S. legal cannabis sales.

In August 2016, the state published an advisory “roadmap” with more than 90 pages of draft regulations defining how Pennsylvanian cannabis should be cultivated, protected, and tracked. The state’s review board was under mandate to give significant weight to minorities represented among each applicant’s company executives and managers. The regulations, which required that each business have a diversity plan, were widely considered to create one of the nation’s most diversity-friendly programs. The licenses remain contingent on as-yet to be completed criminal background checks on the companies’ principles and employees; any such red flag reported could jeopardize an awarded license.

“This has been a highly competitive process and the department received hundreds of quality applications,” said John Collins, director of the state’s Office of Medical Marijuana. “Once this program is fully operational, patients with serious medical conditions will have locations throughout the commonwealth where they can purchase medication to help in their treatment. We remain on track to provide medication to patients in 2018.”

Of course, applicants also needed to be well-funded. The cultivation licenses are estimated to be worth about $40 million apiece. The dozen cultivation licensees were chosen among 163 applicants identified by the state, each of which invested up to $750,000 for application fees, and to hire attorneys, consultants, lobbyists, and architects to help navigate the appropriate legal, operational and real estate requirements.

The Department of Health gathered an anonymous panel of state employees to grade the applications. While the state published the scores of each applicant to provide transparency to the process as the winners were announced, the officials also released heavily redacted copies of applications, some pages of which were completely blacked out. Other applications were stripped of even basic information, to the extent that company owners and backers could not be determined.

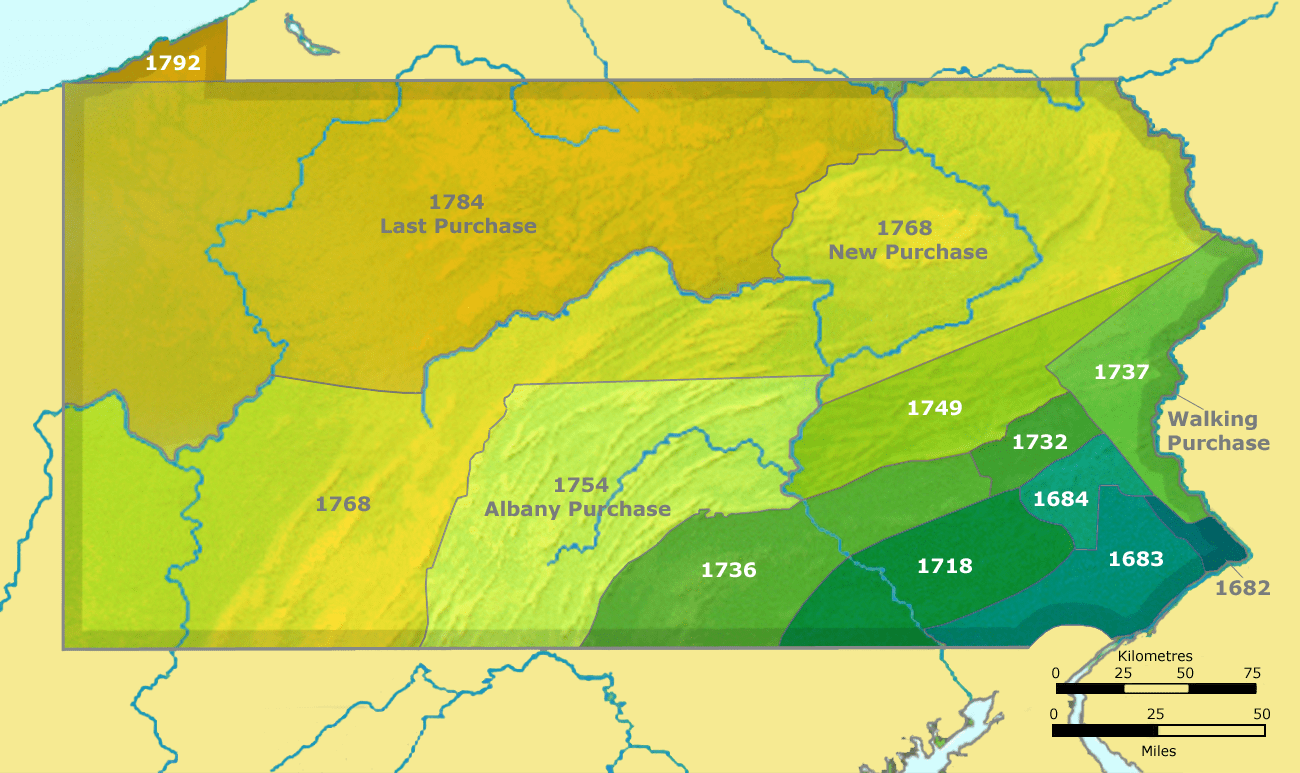

New Frontier Data research analyzed the state’s top four evaluation criteria, and determined that the average scores for each applicant on a 100-point scale:

- Diversity plan — 43%

- Community Impact Assessment — 46%

- Business History and Capacity to Operate — 70%

- Capital Requirements — 70%

Overall, the average score graded out at 63% of the potential maximum.

As attorney Steve Schain of the Hoban Law Group told the Philadelphia Inquirer, “many an influential applicant is volcanically angry in a particularly venomous, Philadelphia kind of way.” Having represented both successful and losing applicants during the process, Schain described it as “an equal-opportunity shellacking, that both the mighty and the not-so-mighty suffered. But the state had to make a decision. There was extraordinarily strong competition.”

Staffers from state senate offices have reported getting inundated with calls from angry applicants, although they had nothing to do with the Department of Health’s scoring process.

As detailed by the Philadelphia Inquirer, “the application process has already proved lucrative for the state… aspiring growers paid a nonrefundable $10,000 application fee — or a total of $1.7 million — to get their foot in the door. The aspirants also had to plunk down a $200,000 deposit — refundable only to the losers — and show they had access to at least $2 million in additional capital.”

Each cultivation applicant also had to pay for architectural plans, security studies, and zoning appeals. While a second round of permits is expected to increase the number of growing facilities to 25, the state reportedly anticipates lawsuits from the applicants not receiving licenses.

Each of the 27 dispensary permit holders chosen among 280 applicants is eligible to open a total of three locations, meaning that a total of 81 dispensaries could operate throughout the state, though some of the permit holders plan not to open all their eligible locations at this point. For now, 52 dispensaries will be expected.

A complete list of locations is available on the Department of Health website at www.health.pa.gov. Likewise, individual dispensary locations, scorecards for all dispensary applicants, and redacted applications for the new permit holders are available on the Medical Marijuana section on the Department of Health website. Redacted applications for all grower/processors are also available on the website.

J.J. McCoy

J.J. McCoy is Senior Managing Editor for New Frontier Data. A former staff writer for The Washington Post, he is a career journalist having covered emerging technologies among industries including aviation, satellites, transportation, law enforcement, the Smart Grid and professional sports. He has reported from the White House, the U.S. Senate, three continents and counting.