Proposed Federal Excise Tax Could Squeeze Legal Cannabis Sales

Vermont on the Verge: Governor’s Veto of Adult Use Bill Leaves Variety of Options

May 26, 2017

Cannabis Stocks Grow 236.1% in 2016

May 31, 2017Proposed Federal Excise Tax Could Squeeze Legal Cannabis Sales

- In March, H.R.1823 – Marijuana Revenue and Regulation Act was introduced in the House of Representatives by Rep. Carlos Curbelo (R-FL) and Rep. Earl Blumenauer (D-OR) and in the Senate by Sen. Ron Wyden (D-OR), Sen. Rand Paul (R-KY), and Sen. Michael Bennet (D-CO).

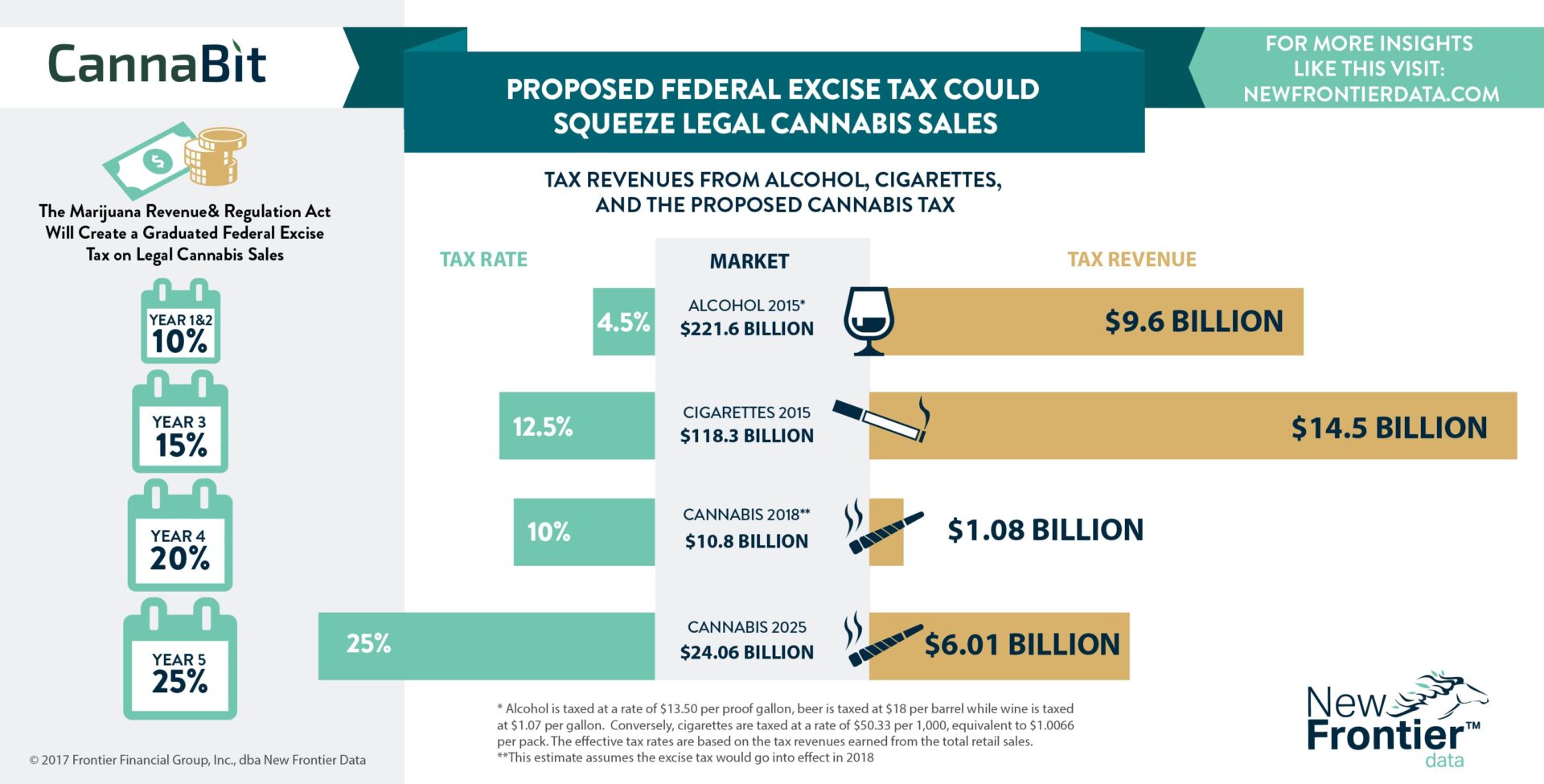

- The bill, as proposed, would establish a federal tax on all legal sales of cannabis in the United States. The tax rate would begin at 10% on retail sales of cannabis in 2018 and increase to a maximum of 25% five years after implementation.

- These tax rates on cannabis are much higher than existing effective federal excise taxes on alcohol, which has a rate of 4.5% and cigarettes, which has a rate of 12.5%

- Growth potential for the cannabis industry may be severely limited by these tax rates as it could increase the retail price of cannabis significantly.

- States like Washington, which already imposes a 37% state excise tax on cannabis on top of state sales tax and local taxes, would see the total tax rate on cannabis exceeding 60% under the proposed bill.

- The proposal of a federal tax on cannabis is a positive development for the industry in the push for national legalization. However, a new tax not harmonized with existing state-level taxes might lead to a resurgence of the illicit market as consumers seek cheaper alternatives.