Reefer Routine

A Family Affair: Social consumption and cannabis

November 26, 2024

A Message from Gary Allen – Charting the Next Chapter: Equio.ai

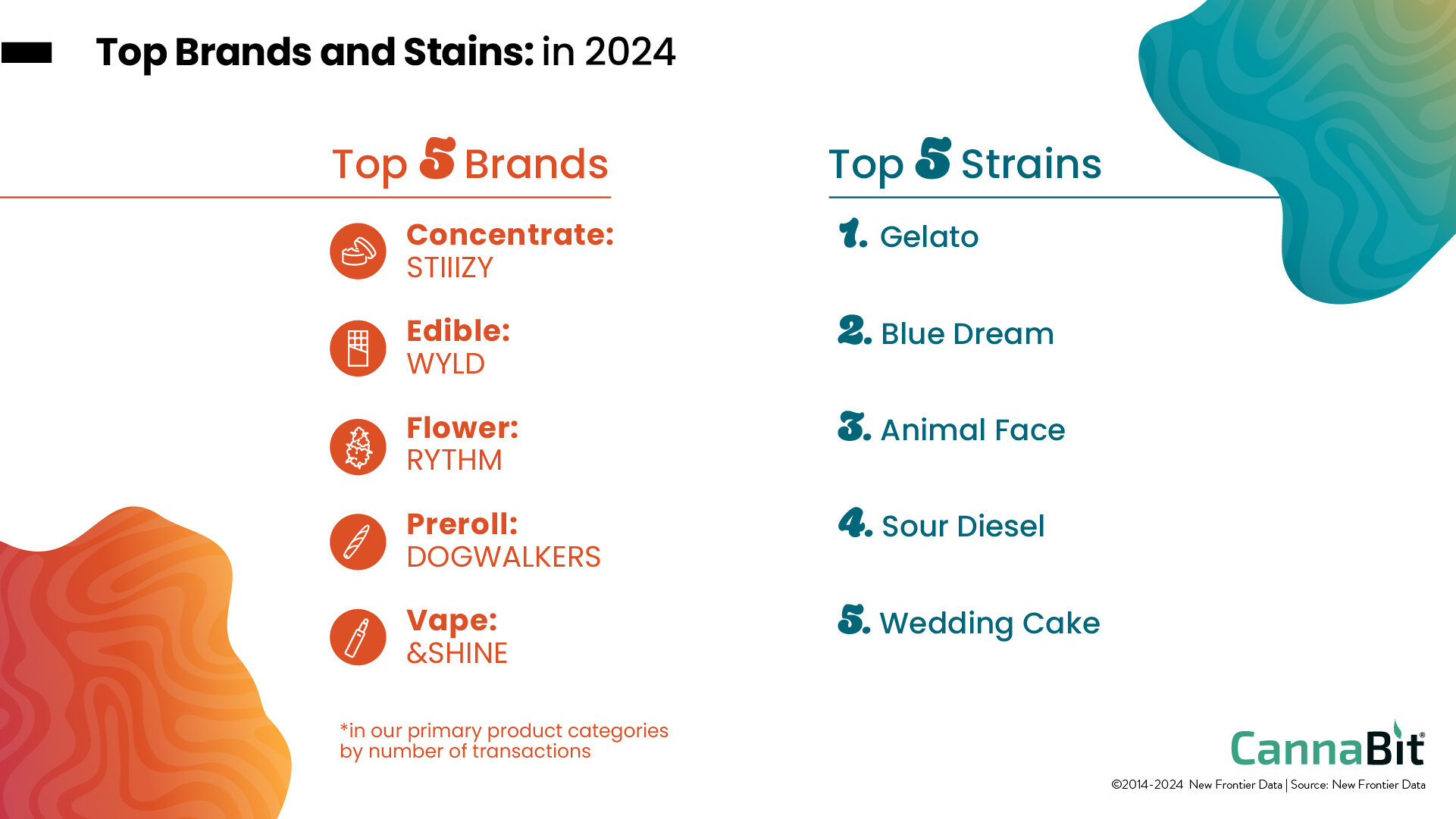

December 17, 2024Has the cannabis shopping experience become “stopping at the grocery on the way home from work”? When cannabis markets were shiny and new, the dispensary visit experience was giving candy store scene in Willy Wonka. Now that some programs are over a decade old, consumers are falling into patterns, developing loyalty to tried-and-true brands, and seeking to re-hash previous cannabis experiences rather than take chances on something new. This is to be expected. When I think back on the variety of alcohol that I consumed in my early 20’s vs. now, I see Long Island Ice Teas and Jaeger bombs transitioning into my favorite red blend (Fry, in case you were wondering). What are some of the indicators of market stabilization and what does this shift mean for brands and retailers?

In our brand-new end-of-year report, available for FREE download, we examine the normalization and stabilization of the cannabis retail space by analyzing sales trends in 2024. Looking at sales over time by product type, average spend, brand loyalty and differences between mature and immature markets, a story emerges. Once regular access to cannabis is secured, consumers relax into patterns of behavior with the goals of replication and consistency rather than novelty and unknown outcomes. Find a gummy that helps with sleep? You are likely to seek out that same gummy at regular intervals. Discover your go-to strain for a hike in the hills? You are likely to buy it every time you hike, lest take a chance on something with unknown effects.

Just because a brand or strain is on top today, doesn’t mean they will always occupy the top spot (remember Tab?). The evolution of cannabinoid technology and future policy shifts like interstate commerce may open the field and invite competition. However, consumers will still be looking for consistency and familiarity, similar to shopping for other wellness products. When you go to the store, do you buy a different kind of multi-vitamin every time? Likely not. You grab your favorite so that you can get the task done and be on your way. Or maybe you set up a recurring shipment on Amazon and stop thinking about buying vitamins all together. And while cannabis will continue to be more exciting than a multi-vitamin, we can expect that, as markets continue to mature, consumers will become more habitual and less adventurous when it comes to cannabis shopping. And, once cannabis can be shipped direct around the country, you may just subscribe to a monthly club (like I do with Fry wine) and call it a day. Download the new report here!

You’ve got questions? We’ll help you get the answers.

Whether you’re launching a new brand, expanding into stores, or opening a retail location, understanding your customers is key. At New Frontier Data, our custom research and surveys provide actionable insights tailored to your needs. From market trends to consumer behavior, we deliver the answers you need to make informed decisions and grow your business.

Let us help you unlock the potential of your market with data-driven strategies.

Get Started