Senate Action on SAFE Looms as Distant Refuge in Post-Pandemic Reality

The InterCannAlliance Welcomes Royalty and Ministers from African Nations to its Regional Hemp and Cannabis Symposium

March 20, 2020

California Cannabis Sales Gather Momentum

March 22, 2020By Josh Adams, Senior Industry Analyst, New Frontier Data

Though recent developments about the COVID-19 pandemic have overshadowed them in the current zeitgeist, 2019 was a year for some positive and historic developments in the legal cannabis industry.

Congressional legislation was specifically designed to improve cannabis businesses’ access to financial services and provide a safe alternative to a cash-intensive, severely underbanked cannabis business ecosystem. Presently, the cannabis industry is served largely by state banks and credit unions, in part because of hesitance by large national and international financial services institutions to get involved in the industry without clear guidance and assurances from the federal government. New Frontier Data’s recent report, U.S. Cannabis Accounting & Financial Management: 2019-2020 Best Practices, explores related developments as they may affect the financial health and growth of the regulated cannabis industry.

The Secure and Fair Enforcement (SAFE) Banking Act is designed to bring some relief and regulatory clarity to cannabis banking while fostering an environment where banks are comfortable providing a range of financial services to cannabis businesses. Specifically, the SAFE Banking Act would shield banks and credit unions which work with cannabis companies from legal penalties. It would bar federal regulators from terminating a bank’s FDIC deposit insurance, a risk that has thus far prevented most banks from accepting cannabis business.

In September 2019, the House of Representatives passed the SAFE Banking Act with relatively strong bipartisan support. Nevertheless, its future in the Senate is uncertain. Given the emergence of new macroeconomic concerns, a downturn in the domestic economy, and continuing fallout from the COVID-19 pandemic, any movement regarding cannabis banking issues seem relegated to a long legislative queue. Thus, pending some progress at the federal level to establish protections for financial institutions, any establishment of consistent and accessible banking services for cannabis businesses likely remains theoretical.

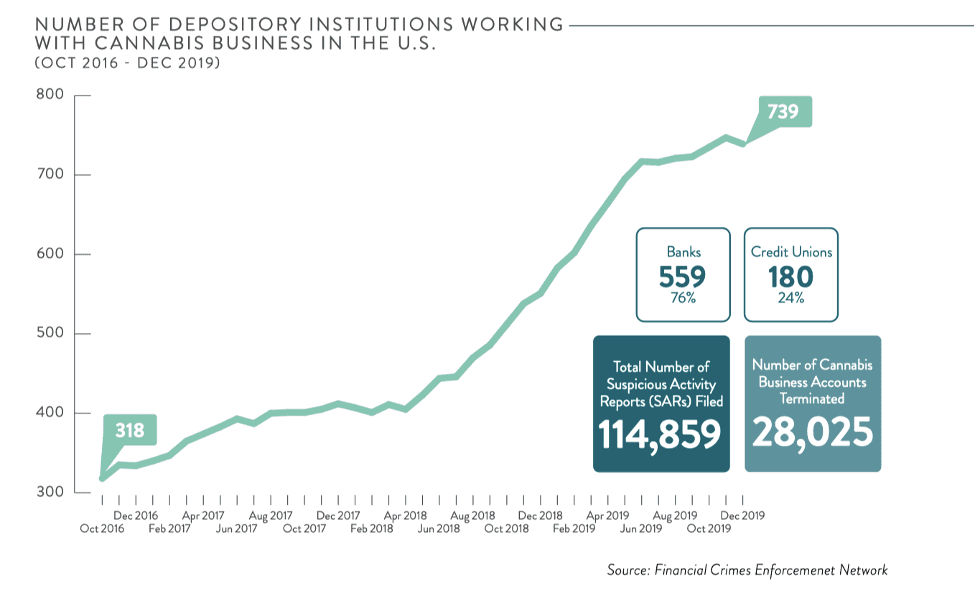

Still, there have been positive developments for the cannabis industry and financial institutions willing to provide services. As of Q4 2019, there were 180 credit unions and 559 banks serving the cannabis industry. Those represented a 132% increase in the number of financial institutions serving cannabis businesses since October 2016. Despite such improvements, cannabis businesses are continually in jeopardy of losing access to banking services, often without warning.

Additionally, many of the financial institutions serving the cannabis industry offer more limited services than those provided to other types of businesses. Access to loans, revolving credit facilities, and direct-account, credit-card payment processing remain elusive, resulting in less operational efficiency. Furthermore, such limitations force cannabis businesses to remain cash-intensive, creating security risks for stores and employees, generating high security costs, and needlessly complicating and constraining the ability of cannabis businesses to engage in routine financial transactions.

New Frontier Data explores the broad financial landscape for cannabis businesses in U.S. Cannabis Accounting & Financial Management: 2019-2020 Best Practices. The report details shifts in the financial environment facing cannabis businesses, including investment and company valuations, the emerging role of technology for cannabis companies, mergers and acquisitions activity, and the continued tax implications of 280E.