States Scramble to Increase Tax Revenue as Cannabis Prices Fall

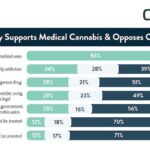

Strong Majority Supports Medical Use and Opposes Criminalization of Cannabis Users

January 27, 2017

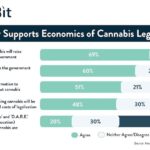

Majority Supports Economics of Cannabis Legalization

February 3, 2017By New Frontier Analysts

As more states legalize cannabis and the supply of legal cannabis for sale increases, prices have fallen across the board. As a result, many states have seen the pools of cannabis tax revenues dry up. This creates issues funding programs in states that rely on these relatively new revenue streams. These states will need to work quickly to find ways to supplement this money, or adjust the manner in which cannabis sales taxes are applied. Since cannabis is easier to acquire than ever before, customers are no longer willing to pay a premium as they did when the black market was the only option. As more cultivators and dispensaries enter the market place, price competition is the main way to gain an advantage. Product differentiation is difficult to establish, as many growers have no branding beyond a strain name. Market factors have coalesced to create a price war and a supply glut, pushing cannabis prices steadily lower.

The falling prices and subsequent decrease in tax revenues have created budgetary issues that will likely be addressed in the coming months across the states that have legal cannabis markets. Colorado has seen the impact of this price drop on tax revenue quite drastically, with whole sale prices falling by roughly 25% in the past year. To make up for the price drop, Colorado is actively considering a new cannabis tax structure, or an increase in the current rates. Meanwhile, states with different policies are being seen as the new models moving forward. Two primary examples are Alaska and California. Alaska charges a flat tax, $50 per ounce of cannabis purchased, regardless of price. California charges growers a tax per ounce, and then applies a second tax as a portion of the sale price when the transaction takes place. These two tax structures allow for the cannabis tax revenues to be more independent of the market price for cannabis.

New cannabis tax policies could have very real impacts on the market not long after they are adopted. Taxing growers will cause the prices consumers see to rise, as the cost created by the tax will be transferred from growers to dispensaries and on to customers. This could discourage legal purchasing, and drive some consumers back towards the black market. Such a tax could also create an incentive to grow more expensive or higher quality strains, as the flat tax per ounce would be a smaller proportion of the total revenue per ounce. This would also probably lead to higher prices for consumers, but the increase in quality may justify the price hike for some. A flat tax per ounce at the point of sale, rather than taxing cultivators, could incentivize consumers to buy more expensive strains, where the tax would be a smaller proportion of the total expenditure. While these different tax policies may theoretically increase the revenue streams, they will also drive some customers back to the black market, or cause them to illegally travel across state lines when possible to take advantage of lower tax rates. As with all taxes, a balance will need to be struck between increasing revenue and limiting the burden on the consumer.

New Frontier Analysts

Our data scientists drill deep with rigorous analytics to provide insight into key trends and market opportunities. We track the state of cannabis and its regulation in all major legal markets.