STUDY: Cannabis Consumers Are Focused on Intentional Goals

Women Report Less Success Reaching Their Goals with Cannabis Products

September 20, 2022

Back to Nature: Cannabis Consumers Gain Satisfaction in Outdoor Settings

October 4, 2022By Amanda Reiman, Chief Knowledge Officer, and J.J. McCoy, Senior Managing Editor, New Frontier Data

Far beyond the tired old stereotypes about cannabis habits, today’s cannabis consumers are quite focused about their goals, practices, and experiences. While factors including age, gender, and desired outcomes all play their roles in determining preferences among cannabis products, today’s cannabis consumer seeks very specific effects.

Whether those intentions be relaxation, pain management, or enhancing a social experience, it’s vitally important for anyone competing in the market to focus on providing them the products that meet their needs. For producers and marketers, tailoring their brands to those specifically sought effects and experiences is fundamental in creating and maintaining meaningful connections to their customers.

To help, New Frontier Data — in partnership with cannabis discovery company Jointly — has released Cannabis Consumers in America: (Part II) The Purposeful Consumer, the second report in a three-part series about U.S. consumers and their intentions, preferences and behaviors.

Since Jointly launched its consumer data platform in 2020, some 80,000 cannabis consumers have rated and recorded their individual experiences. To date, more than 206,000 of them have documented experiences detailing goals, products, doses, product effectiveness, and flavor/aroma ratings. They include 140,000 experiences noting the time of day, duration since a previous session, the presence or absence of exercise, hours of sleep, hydration, fullness of stomach, and side effects.

Trends Play Out Among Age Groups

Flower remains the most commonly used (but not the highest-rated) form of cannabis in terms of meeting people’s consumption goals. It is possible that while flower is more popular overall, those seeking specific outcomes prefer the standardization and sophistication of manufactured products. Beverages, in particular, were rated very highly for helping consumers achieve their goals. That may be related to easy dosing (e.g., most beverages contain one serving), their ready substitution for alcohol, or technologies (like nanoemulsion) which shorten time of onset.

Flower is also consistently the most frequently used product type across all categories for purposeful consumption, followed by a vape. Consumers choose edibles or drinks more frequently to replace other substances than for other goals. Topicals, while uncommon, see higher frequencies of use for recovering from exercise, easing everyday pain, or enhancing intimacy.

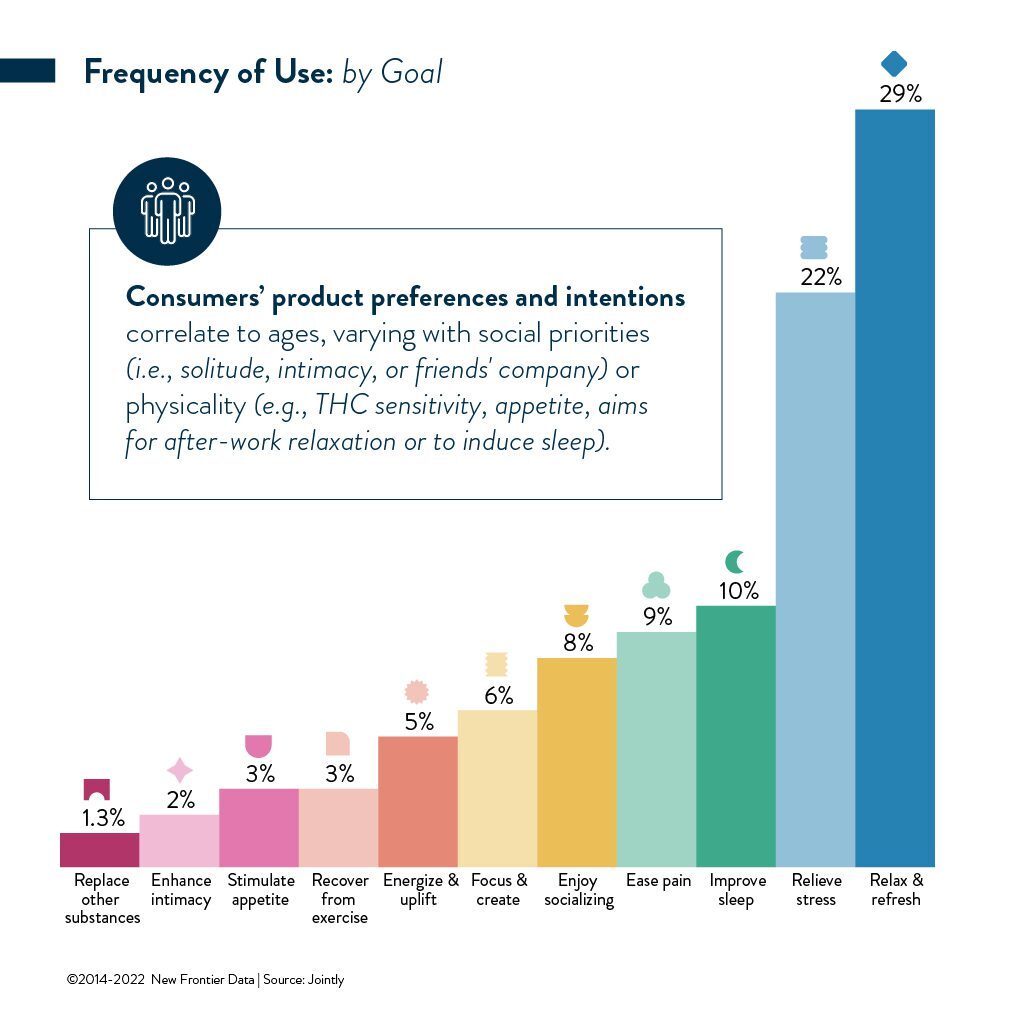

Relaxing/refreshing and relief of everyday stress were the most popular goals reported. “Recover from exercise”, “stimulate your appetite”, “enhance intimacy” and “replace other substances” were the least common aims chosen.

Consumers’ product preferences and intentions correlate with their ages: Choices can vary widely depending on social priorities (e.g., discretion, solitude, or shared company of friends) or physicality (i.e., THC sensitivity, aims for after-work relaxation or to induce sleep). Older consumers are more likely to be using cannabis for sleep, versus younger folks’ being more likely to do so for relaxation. While all age groups predominantly use flower, concentrates and dabbing are more common among younger consumers, with tinctures and edibles preferred among older people. Preferences may be related to users’ relative metabolism.

Webinar on September 29

It’s crucial for any cannabis business to understand consumers’ purchasing behaviors, particularly by identifying product and experience preferences. During a Sept. 29 webinar, “Intentional Cannabis Consumption”, New Frontier Data’s Chief Knowledge Officer Amanda Reiman will join Jointly’s CEO and Co-Founder David Kooi, and Sara Payan, Public Education Officer at The Apothecarium in San Francisco, for some engaged discussions.

At 3 p.m. EDT, the industry experts will discuss how cannabis producers are targeting consumers looking for specific outcomes: Intentional consumption is the process of selecting cannabis products based on specific goals. What are the most common goals for cannabis consumers and which products are most effective at meeting these goals? As the cannabis industry evolves, emerging products are targeting consumers looking for specific outcomes.

Anyone registering here who is unable to attend the webinar will be notified afterward about when a recording is made available on Equio®, our cannabis business intelligence platform. Meanwhile, click here to download a complimentary copy of the report. Interested in accessing Part I of our Cannabis Consumers in America report series? Purchase an Equio® subscription to gain access to New Frontier Data’s entire library of Analyst Reports, and our five dashboards of interactive data widgets connecting you to the best-in-class retail, consumer, and market intelligence.