The Economic Impact of Medical Cannabis Consumers

U.S. Medical Cannabis Market Projected to Almost Double to Over $16 Billion by 2025

May 11, 2021

Letting Voters Decide Is Not a Last Word for Prohibition Causes

May 24, 2021By Josh Adams, Ph.D., Senior Industry Analyst, New Frontier Data

While much attention paid to the cannabis industry focuses on the expansion of adult-use markets, medical cannabis markets continue to grow across the United States. New Frontier Data’s latest report, Medical Cannabis & Pharmaceuticals: Growth & Disruption in U.S. Healthcare, explores how medical consumers are integrating cannabis into their health and wellness practices, and sometimes using it as an alternative to traditional pharmaceuticals.

Medical cannabis consumers are highly engaged in the regulated marketplace. Medical consumers on average spend more per month on cannabis than do adult-use consumers ($298 per medical consumer, versus $278 per adult-use consumer). Additionally, more medical consumers (59%) report spending over $100 per month on cannabis products. Those trends in spending are also driving the overall growth of the medical cannabis space.

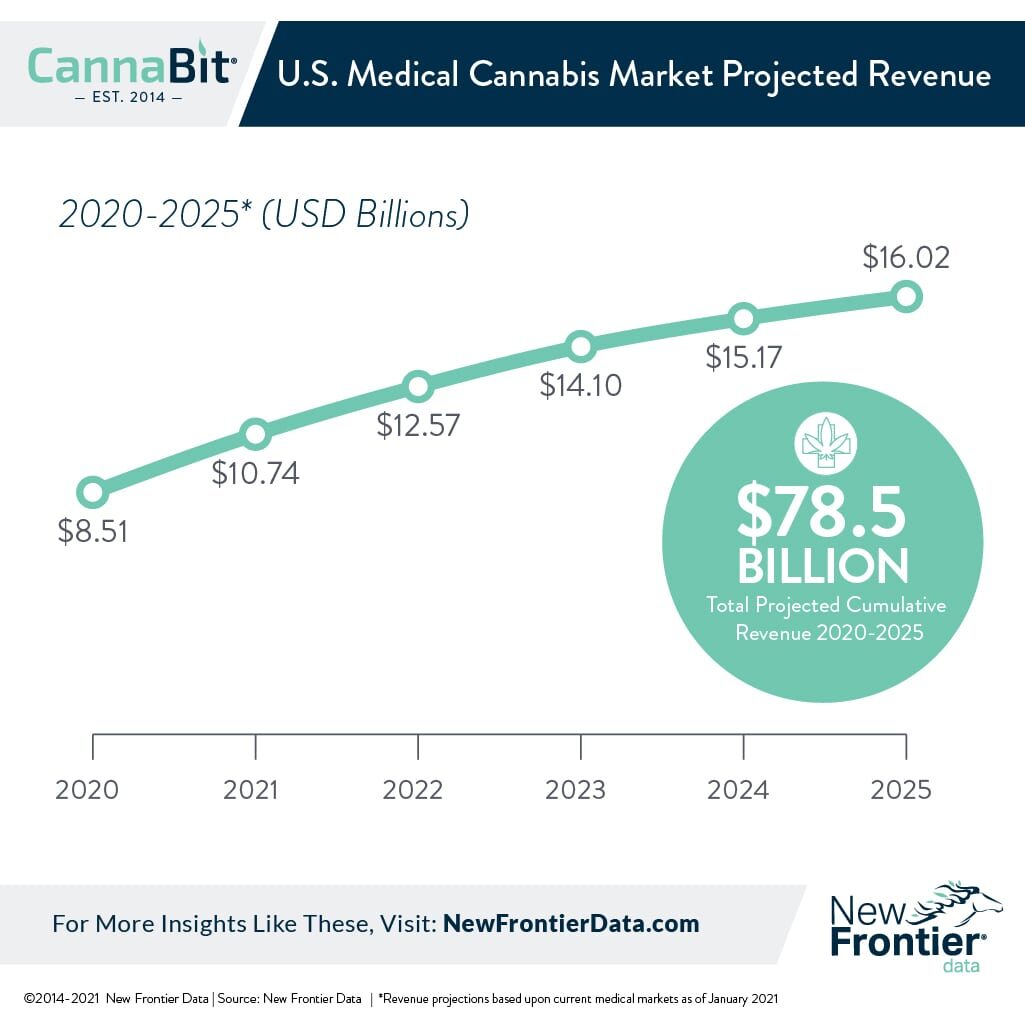

Overall U.S. spending on medical cannabis is expected to grow from $8.5 billion in 2020 to $16 billion in 2025, for a cumulative $78.5 billion in revenue across the next five years for medical cannabis alone.

States with established medical cannabis programs can expect to benefit from the growth over the same period: Between 2020-2025, Florida (among the largest state medical cannabis markets) is expected to generate a cumulative $14.5 billion in revenue. Similarly, states with smaller but still substantial markets — such as Oklahoma ($8.7 billion) and Pennsylvania ($7.8 billion) — can expect to see significant revenue from their medical cannabis segments.

Building on the organic growth of the medical cannabis industry, it is likely that the industry will see increased interest from established actors in the pharmaceutical space. As pharmaceutical companies develop cannabis-derived medications, participate in the FDA development-and-approval process, and acquire FDA-approved indications for their drugs, their products will be situated firmly as medical interventions. The entrance of those companies should also bring increased levels of institutional investment for the development and marketing of cannabis-derived pharmaceuticals.

The research draws extensively from New Frontier Data’s 2021 U.S. cannabis consumer survey, in continuation of its series of ongoing consumer research examining legal cannabis markets in the United States and globally.