The Future of Hemp: Medicinal, Recreational, Industrial, or All the Above?

Annual U.S. Hemp-derived CBD Spending to Reach $6.26 Billion by 2025

March 24, 2021

Cannabis Industry Big Data Pioneer New Frontier Data Accelerates International Growth, Expands Leadership Team

March 30, 2021By Trevor Yahn-Grode, Data Analyst, New Frontier Data

Converting the world’s economies and industries to achieve and maintain net-zero emissions represents the greatest, most comprehensive, and most consequential challenge that the modern world has yet faced.

Devoid of hyperbole, it is fair to say that achieving carbon-neutrality will impact every company in every industry which contributes in any way to the global economy. “Decarbonization”, as the quest for carbon-neutrality is sometimes described, is not only eminently desirable (being necessary to mitigate disruptions from runaway climate change), but an objective inevitability: So long as human activities add more carbon to the atmosphere than the latter can safely absorb, global warming will continue, and disruptions from climate change will become increasingly severe. Consequentially, questions about achieve carbon neutrality are not framed by “if”, but rather “how”.

Technologies like wind power, solar energy, electric vehicles, etc., to significantly reduce the need for fossil fuels, energy, and transportation, et al, account for roughly 43% of total emissions. Meanwhile, more than 30% of total emissions come from manufacturing physical products and materials like cement, steel, and plastic. Those collectively represent the long tail of carbon emissions: the many industrial ingredients considered fundamental to modern life. Such commodities must either find ways to eliminate or entirely offset their carbon footprints.

Bio-based materials – i.e., products made from plants – are becoming increasingly popular among industries as a means of reducing their carbon footprints. With government spending on climate set to increase dramatically, they may become even more popular.

Essentially, biomaterials take carbon out of the atmosphere via photosynthesis, and convert it into useful products. Hemp fiber – an unusually strong and versatile fiber – has significant potential to grow in this space, as its strength and versatility give it a wide range of applications, covering some of the most carbon-intensive industries there are.

Consider the construction industry, which produces more than 20 billion tons of CO2e emissions annually, generating approximately 15 million tons of drywall. Hemp-fiber construction products like Hempcrete and cellulose insulation can offer low-carbon alternatives to traditional construction materials. Also consider the growing bioplastics industry, growing at a compound annual growth rate (CAGR) of nearly 14%: Hemp fiber’s strength gives it unique applications within the polymers market, and it is approaching price parity with fossil-fuel-based alternatives.

Increasingly frequent and devastating wildfires are driving up lumber prices. Prices increased from 112% from February of 2020 to February of 2021, alone. If hemp does not find a market in construction materials, it may find one helping to replace trees as a source of paper and pulp products – an environmentally taxing industry valued at $6.2 billion USD. Overall, hemp fiber seems to be marching towards price parity with relative speed. Proposed carbon taxes could hasten this process.

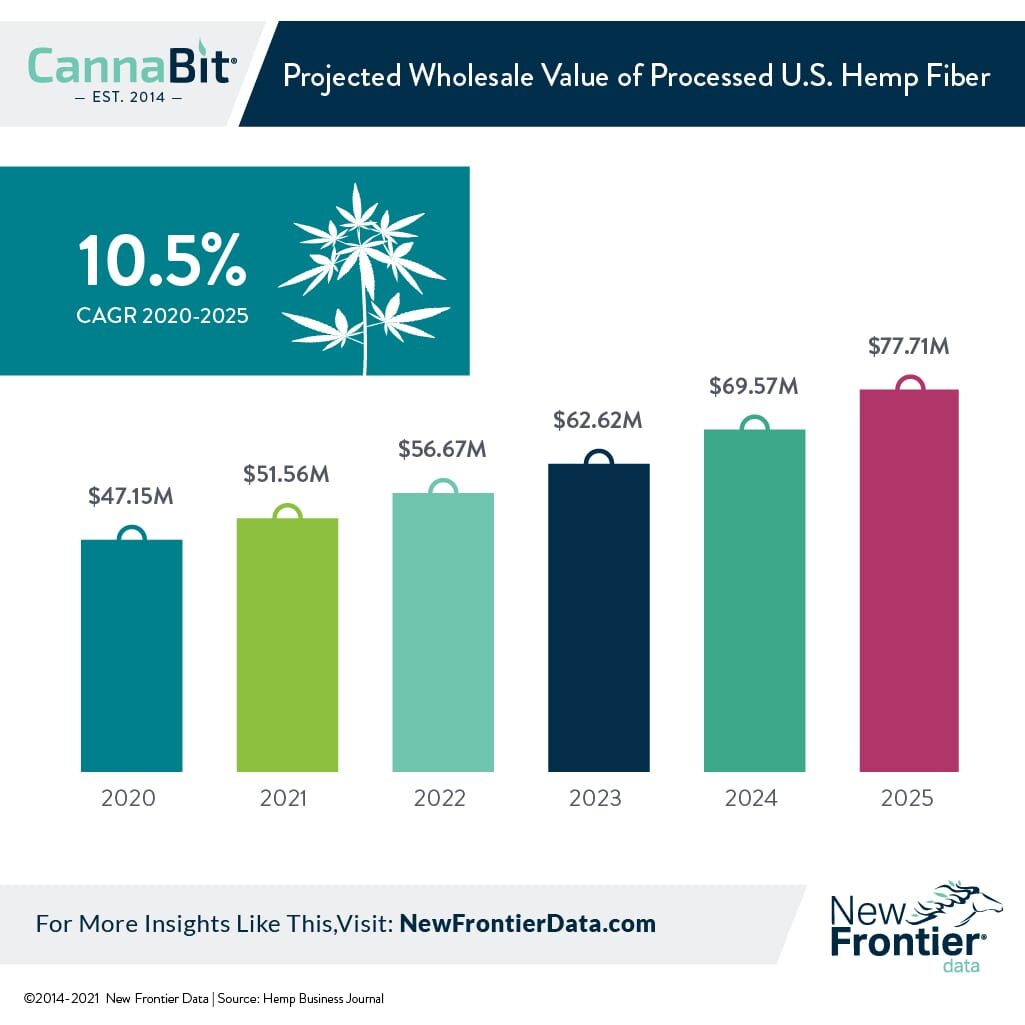

Despite the potential, the nascent North American hemp fiber industry is still struggling to find its footing. Less than 6,000 acres of fiber hemp was harvested in 2020, worth no more than $47 million USD (and possibly quite a bit less, as prices have been exceedingly volatile). Despite increasing interest from mainstream companies like Patagonia, 3M, and Georgia-Pacific, a lack of processing capacity and the outright absence of product standardization codes have slowed progress.

In the meantime, end markets for hemp fiber remain uncertain and volatile. While hemp advocates often point out that the plant can be used in making tens of thousands of products, very few of those markets exist right now, and those which do tend to be low-margin commodities like animal bedding, in which hemp trades at a high premium.

The industry is also facing a skeptical farming community. To increase its acreage, the hemp fiber industry must necessarily take market share from other crops. Getting farmers to switch from well-established markets like corn and soybeans to grow fiber hemp will demand that farmers’ confidence that they can sell their output at good prices. In 2020, one-third (33%) of hemp farmers were first-time growers, and – despite promises of large profits – most lost money on hemp when CBD prices crashed, and a glut of supply flooded the market. The experience damaged hemp’s reputation among farmers, and left many in the community understandingly skeptical of the crop. It remains a concern that must be allayed if the industry is to properly scale.

In the face of such challenges, 2021 represents a critical year for the hemp fiber industry, and its outcomes will have an immense impact on the future of the industry. New Frontier Data analyzes the segment’s vast potential and possible pitfalls in greater detail in the comprehensive new report, The U.S. Hemp Market Landscape: Cannabinoids, Grain & Fiber, now available for free download.