The Medical Cannabis Consumer in 2021

Generational Differences Among Cannabis Consumers

April 26, 2021

Medical Cannabis Consumers and Pain Management

May 10, 2021By Josh Adams, Ph.D., Senior Industry Analyst, New Frontier Data

As the landscape of the United States’ legal cannabis industry continues to evolve, the reasons why consumers seek out cannabis are themselves in flux. While much attention is paid to the legalization of adult-use cannabis and the rollout of those respective markets, medical markets also are experiencing growth as more consumers turn to cannabis for its therapeutic applications.

New Frontier Data’s newest report, 2021 U.S. Cannabis Consumer Evolution: Archetypes, Preferences, and Behaviors, closely monitors recent shifts in the cannabis industry, and continues the latest, cutting-edge research into cannabis consumers’ preferences and behaviors. To gain a deeper understanding of the diversity of cannabis consumers, the authors examined how certain consumer segments use cannabis for medical purposes, and how those consumers understand cannabis as part of their overall wellness regimens.

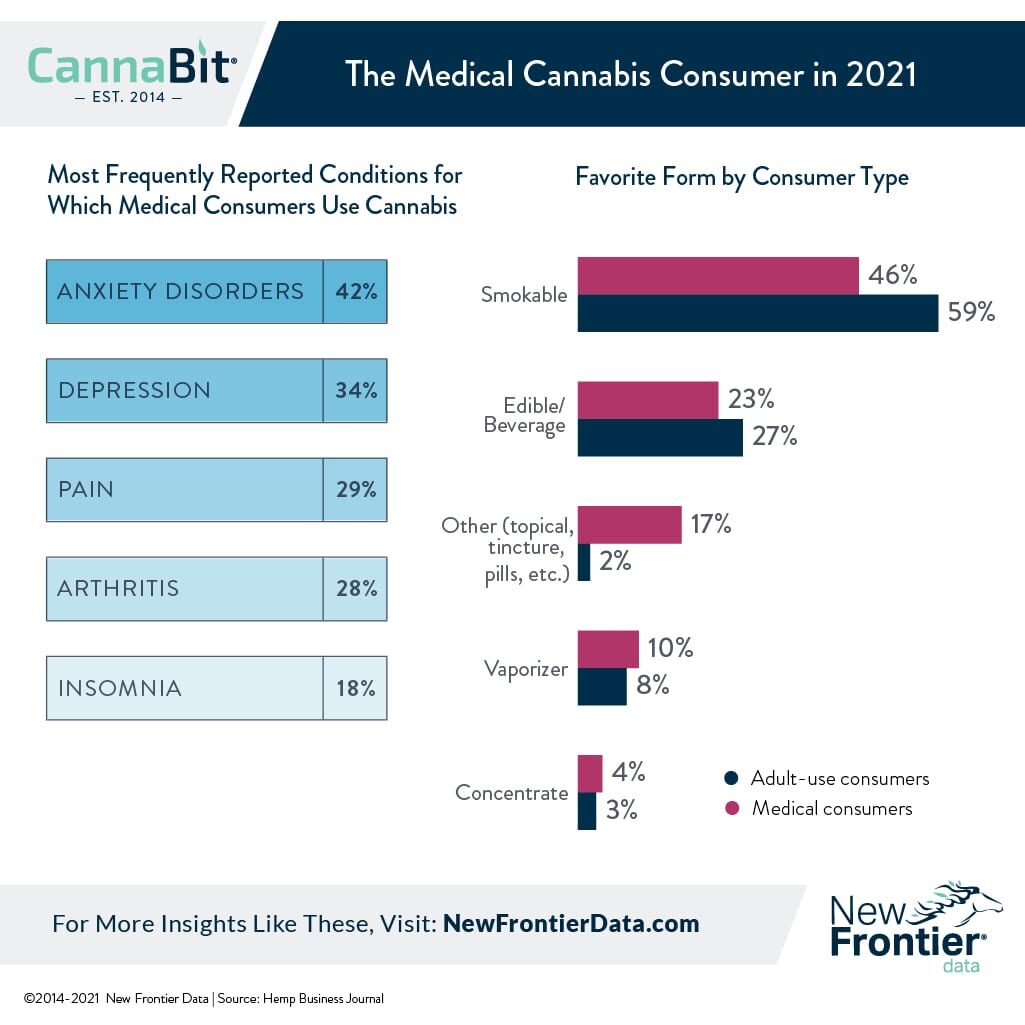

Medical consumers are those who characterize their cannabis use as either “only” or “primarily” medical. That identification is unrelated to the overarching state market in which the consumer resides, and self-identified medical consumers are distributed across regulated medical and adult-use markets (as well as illicit markets). Based on New Frontier Data’s nationally representative survey of cannabis consumers from across the U.S., as of this year 42% of respondents identify as medical cannabis consumers — an increase of 7% since 2018.

As availability of cannabis products increases, and consumers settle into consistent modes of use, there is an increasing divergence between patterns seen among medical consumers and adult-use consumers. Medical consumers report using cannabis at higher rates than do adult consumers: Two-fifths (41%) of medical consumers are daily consumers (a rate 11% higher than for adult-use consumers), while another 26% are weekly consumers. Given those higher use rates, medical consumers also tend to spend at higher rates than do adult-use consumers, with 30% of the former (vs. 22% of the latter) spending an average above $100+ per purchase.

There are also differences in product preferences between medical and adult-use consumers. While smokable cannabis is the leading product among both consumer groups (46% for medical consumers vs. 59% for adult-use consumers), medical consumers are more like to use alternative product forms. Specifically, medical consumers use tinctures, topicals, or pills (17%) and vaporizers (10%) at higher rates than do adult-use consumers (2%/8%). Similarly, medical consumers are likelier (63%) than adult-use consumers (47%) to have used a CBD-only product.

With the expansion of both adult-use and medical markets across the U.S., as well as increased levels of product differentiation, it is reasonable to expect consumers to further refine their preferences both for desired effects as well as modes of delivery. Additionally, as cannabis is used for health-oriented purposes which fall outside of traditional understandings of medical applications, an increase may be anticipated among wellness cannabis consumers who represent a merging of both adult-use and medical practices.

New Frontier Data’s U.S. cannabis consumer survey is a continuation of its series of ongoing consumer research examining legal cannabis markets in the United States and globally, to provide in-depth insights into the many growing segments of the industry and its spaces.