The Year in Review: Market Expansion & Pressure Points Against Progress

$10B+ in Cannabis Capital Raises to Exceed Pre-Pandemic Levels

December 15, 2021

Legal Cannabis Strongly Positioned for Another Milestone Year in 2022

January 10, 2022By New Frontier Data Research Team

Partisan Pushback against Public Acceptance

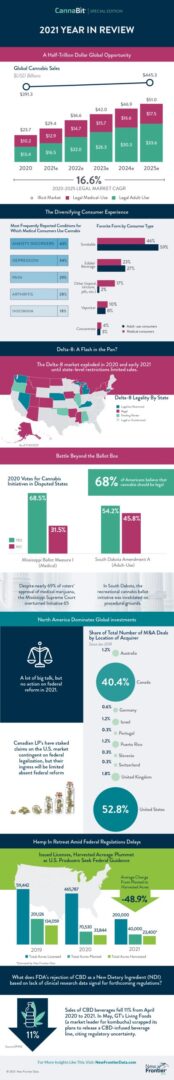

Government-led rollbacks of voter-approved initiatives in Mississippi and South Dakota illustrate growing political friction as legalization increasingly extends to conservative markets. More than two-thirds (68%) of Americans surveyed believe that cannabis should be legal. As each new year brings fresh developments in the forms of new markets, novel products, and increasingly diverse experiences, there remains some fundamental disconnects between the court of public opinion and the implementation of policy to align with sentiments for reforms.

The passage of six cannabis-related ballot measures in five states during the 2020 U.S. elections represented a milestone expansion for the sector. Arizona, Montana, and New Jersey each approved measures legalizing cannabis for personal use, while Mississippi approved a medical cannabis program. South Dakota, in a unique turn, approved separate ballot measures supporting each medical and adult use of cannabis – the first state to approve dual measures in a single election cycle.

However, in the year since the ballot mandates, procedural objections and technicalities have been raised to impede or overturn the voter-approved initiatives.

In South Dakota, the recreational cannabis ballot initiative — Amendment A — was invalidated on procedural grounds. A lawsuit funded by the administration of Gov. Kristi Noem (R) argued that the provisions of Amendment A violated the state’s single subject requirement for ballot initiatives. The South Dakota Supreme Court ultimately agreed, striking down the law and dealing a blow to advocates of the narrowly won measure.

Noem, who dismissed the voters’ “wrong choice” after the measure passed, hailed the court’s ruling. However, the victory on a technicality may be short-lived, as cannabis advocates have successfully demonstrated the majority support among the electorate, which trends indicate will only increase over time.

There have been other instances in 2021 of procedural objections utilized to undermine successful cannabis ballot initiatives. Despite nearly 69% of voters’ approval of medical marijuana, the Mississippi Supreme Court overturned Initiative 65 in response to a challenge of the initiative’s validity based on a failure to meet the required number of signatures required to qualify for the ballot. There too, conservative opponents used a technically to forestall the passage of a decidedly popular measure.

Bowing to public pressure, Mississippi lawmakers proposed legislation to create a medical marijuana program mirroring that approved by voters in November, though plans to convene a special session to vote on the measure have stalled.

The tension between rising public approval versus long-entrenched opposition among conservative lawmakers, looks to be a recurring theme in the coming years as public attitudes evolve more broadly than partisan opposition against the issue. South Dakota and Mississippi illustrate some legislative and legal maneuvers that can impede or overturn voter approved measures. However, as more adults embrace new levels of acceptance for cannabis in American society, opponents will conversely face challenges to maintain a prohibitionist status quo.

Political Posturing, But No Federal Progress

With the passage of several state-level ballot measures in 2020 and Democrats taking control of Congress and the White House, expectations were high that 2021 would be the year for historic federal reform. Both Joe Biden and Kamala Harris had expressed support, if mildly, for reforms around cannabis laws, social equity, and criminal justice. Senate Majority leader Chuck Schumer (D-NY) began the new year touting a historic piece of legislation to deschedule and regulate cannabis in the U.S., and in July released a discussion draft of the Cannabis Administration and Opportunity Act, a sweeping piece of legislation that would not only decriminalize cannabis, but establish a range of programs for cannabis research, social equity, expungement of cannabis convictions, and to delegate regulatory powers from the DEA. At year’s end, however, the CAOA has not been formally introduced in Congress, and there seems to be little consensus on the bill’s provisions.

In November, Rep. Nancy Mace (R-S.C.) introduced an alternative piece of cannabis legislation, the States Reform Act, to similarly decriminalize cannabis and establish a framework for regulating and taxing the industry while providing for the expungement of records for nonviolent cannabis offenders. However, her bill too ended the year without movement. Unsurprisingly, given the inaction on Capitol Hill, there was likewise little progress made on efforts to reform cannabis banking, as an attempt to wrap the SAFE Banking Act into an essential defense spending bill also failed.

Given the evanescent enthusiasm for federal action in 2021 which failed to see results, the outlook for progress on federal reform has dimmed. However, with pressure mounting from the growing number of states where cannabis is now legal, congressional lawmakers increasingly recognize that they cannot indefinitely ignore the issue.

Gaining a Sporting Chance

U.S. sprinter Sha’Carri Richardson’s high-profile cannabis-related disqualification after the U.S. Olympic trials demonstrated that Americans have become significantly more tolerant of cannabis use, even if some dramatically inaccurate stereotypes persist.

Richardson, a favorite for world gold in the 100-meter sprint, had her qualifying run invalidated, and she was subjected to a one-month suspension after testing positive for THC metabolites —the suspension being just long enough to prevent her from running in the Olympic 100-meter event 29 days later.

Many Americans expressed frustration at the outcome, noting that her consumption occurred in an adult-use state, and thus was wholly legal. Many also expressed compassion and understanding for her using it under the stress of her mother’s death.

Despite overwhelmingly supportive sentiments being expressed, the story also revealed some pervasive, broadly inaccurate stereotypes about cannabis users. While speaking/tweeting/posting in support of Sha’Carri Richardson, many commented about her achievement being even more impressive within the context that she was a cannabis consumer, a notion playing on the stereotype of a lazy, slow, apathetically unproductive stoner.

Regardless, Richardson represented the latest world-class athlete to acknowledge personal cannabis use; with wider social acceptance, most professional leagues ending their testing for cannabis, and more professional endorsements being made by retired sports figures, many more athletes are expected to follow her lead in the year ahead.

Furthermore, new literature like Runner’s High: How a Movement of Cannabis-Fueled Athletes is Changing the Science of Sports, is further challenging stereotypes of lazy, inactive cannabis consumers while introducing many long-time consumers to instead try exercise and fitness use cases which they may not have previously considered.

How Will the Hemp Harvest Grow?

While the decline of U.S. hemp production acreage in 2021 may be construed to mean that hopes for a domestic hemp industry has fizzled, looking only at overall acreage does not capture the fluctuations in different production and market categories. In the past three years, it has been estimated that 80%-90% of acreage planted in the U.S. had been singularly dedicated to CBD production. New Frontier Data estimates that in 2021, there were 40,000 acres planted, though only 23,000 acres (58%) harvested, due to losses through drought and crop failure.

The 2021 decline of hemp acreage was indicative of the industry’s effort to balance supply with still nascent market demand. The hemp sector continues to struggle to find equilibrium between supply and demand due to the opacity of the industry and a lack of centralized data to inform production and pricing decisions.

Nevertheless, while CBD acreage has diminished year-over-year, grain and fiber acreage has steadily increased. The past summer served as a pilot year for producers to dial in the agronomics of successfully growing a hemp crop for grain and/or fiber. New Frontier Data estimates that in 2022 and beyond, acreage will increase as large-scale, contract production will be necessary to feed the processing capacity of grain and fiber processors that have come online around the U.S. in the past 12 months.

The shift from production for CBD to producing grain and fiber with be further accelerated by innovations in processing, which will enable faster, more cost-effective decortication of hemp – heretofore a key and chronic barrier to commercializing hemp’s fiber applications.

Regulatory Loopholes Create Opportunities in Challenging, Opaque Markets

Delta-8 THC represented an outcome from years of CBD overproduction mixed with lack of a regulatory framework for the U.S. CBD/hemp-derived cannabinoid industry. It showcased how operators are inclined and enabled to exploit opportunities in the legal gray area lacking specific clarity from regulators. The delta-8 market exploded during 2020, and early 2021 before state-level bans began to restrict and prohibit sales.

The degree of the disconnect was illustrated in September by a public safety warning issued by the FDA.

In 2018 and 2019, farmers across North America, eager to capitalize on the CBD wave, jumped into speculative hemp production without contracts. That proved to be a leading factor behind the current oversupply of CBD hemp biomass.

Furthermore, lack of federal regulatory clarity from the FDA about products containing hemp-derived CBD limited access to mainstream retail distribution channels for brands and manufacturers. In turn, the market for CBD products has not realized the CAGR growth that some had anticipated.

The meteoric rise of delta-8 THC (delta-8) was borne from myriad factors highlighting larger trends across the U.S. cannabis landscape. Delta-8’s molecular similarity to delta-9 THC and the psychoactive compound that legally distinguishes industrial hemp from marijuana under U.S. law made it easy for manufacturers to market the compound as “weed light” to a widening consumer market.

Consumer interest in delta-8 was particularly high in jurisdictions which prohibit access to medical or recreational consumer marijuana. Delta-8 effectively existed in such gray areas due to the regulations of the 2018 Farm Bill, ultimately if incidentally allowing it to be sold through distribution channels as disparate as gas stations and convenience stores.

In March, New Frontier Data reported that the average price of delta-8 THC biomass had fallen 45% since August 2020, with full-year projections for U.S. sales of delta-8 THC exceeding $10 million.

Come 2021, the average per-kilogram price of delta-8 rose 4% in May, to a high of $1,227.15. However, prices subsequently have fallen sharply: In June prices were down 1% to $1,215; by July prices fell by a whopping 12%, to $1,069.20; and by November they dropped to $1,015.74. With a spate of bans enacted during the year, and the FDA’s stern public health warning, the commercial optimism about delta-8 has seemingly fizzled.

Cultivators also lack confidence in the government after the FDA’s rejection of CBD as a New Dietary Ingredient (NDI).

Despite three years having passed since passage of the 2018 Farm Bill, the FDA remains yet to produce a definitive regulatory framework for products containing hemp-derived CBD. Now, it seems regulations are even further out of reach, as the agency has reconfirmed its position that CBD is subject to the drug preclusion language in the federal Food, Drug, and Cosmetic Act, per objection letters posted regarding New Dietary Ingredient Notifications (NDIN) filed by Charlotte’s Web and Irwin Naturals citing a lack of clinical research.

While the FDA did release a Data Acceleration Plan (DAP) in the fall to accumulate data on products containing hemp-derived CBD from “novel” sources like social media, industry stakeholders are growing ever more disillusioned. Overall, signals from the FDA suggest that the industry remains years away from seeing a regulatory framework for the manufacturing and sale of products containing hemp-derived cannabinoids.

The open-ended inaction has a negative impact on continued capital investment and access to mainstream retail distribution channels for manufacturers of hemp-derived CBD products. Facing such, many stakeholders are turning their sights to Congress to pass legislation which would force the FDA to regulate the products. Two bills (one in the House, one in the Senate) seek to federally regulate products containing hemp-derived CBD, H.R. 841 and S. 1698.

The expectation that the industry will regulate itself or provide the funds for clinical research is unrealistic. Given that retail sales of CBD-infused foods, beverages, and supplements saw sharp declines from June 2020 to June 2021, brands will likely prioritize survival, even if that means operating in regulatory gray areas.

According to the wellness-focused data technology firm SPINS, sales of CBD supplements fell 6% in 2020, and sales of CBD beverages fell 11% year over year from April 2020 to April 2021. In May, GT’s Living Foods (a market leader for kombucha) scrapped its plans to release a CBD-infused beverage line, citing regulatory uncertainty.

A Year-End Flurry Opens New Opportunities for 2022 and Beyond.

In quick succession at year’s end, Luxembourg, Germany, and Malta respectively announced that they would advance measures that would legalize production and personal use of cannabis. While Luxembourg and Malta have long represented progressive markets on cannabis policy, December’s announcement by Germany’s new coalition government came as a surprise to many who had not expected drug policy reform to be a leading priority given the economic, health-care, social, and environmental challenges facing the EU’s largest country.

The developments in Germany will stir several effects going into 2022, including dramatically expanding the addressable market within Germany from a few hundred thousand medical patients, to the 7.4 million Germans who consume cannabis annually, and increasing pressure on other Western European capitals (especially France, Italy, and Spain) to consider similar measures. The developments in Europe are also important affirmative signals of the rapidly shifting global conversation, and offer quickly expanding opportunities for early entrants into the market.

While it may take several years for these proposals to translate into fully operational markets, those three countries have set a milestone precedent in the reform and liberalization of European cannabis policies.

For those disappointed by the lack of progress on U.S. federal reform, 2021 may be remembered as a year of unrealized promise. However, with legal markets logging record-shattering sales, public acceptance of cannabis reaching unprecedented levels, a spectrum of new opportunities borne of innovations from cultivation to consumer products, and milestone opportunities created by emerging markets in both the U.S. and Europe, 2021 should be viewed as a foundational year in the expansion, normalization, industrialization, and commercialization of legal cannabis, setting the stage for new stages of growth in 2022 and beyond.