Why Trudeau’s Per-Gram Tax Would Make Less Sense Than Legitimate Sales

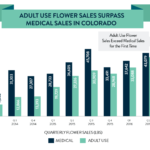

Adult Use Flower Sales Surpass Medical Sales in Colorado

October 8, 2017

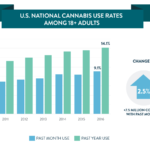

U.S. National Cannabis Use Rates Among 18+ Adults

October 15, 2017By Beau Whitney, Senior Economist of New Frontier Data

Among lawmakers and economists, devising tax policy is a fundamental topic and a relatively simple task. Yet given the nascent markets and unsettled unknowns throughout the cannabis industry, tax policy turns out to be a more dynamic, complex issue as soon as it involves cannabis. Perhaps no truer is that being demonstrated right now than with the proposed $1-per-gram cannabis tax recently proposed by Canadian Prime Minister Justin Trudeau.

In economics, taxes are generally used for two purposes: 1) to dissuade a person from doing something, thereby changing behavior (such as a higher cigarette tax imposed to reduce smoking); or 2) to raise revenue for the government. Typically, governments impose revenue-generating taxes to help support the public good, such as by providing health services, policing, or basic infrastructure. Given that premise, what is the intended outcome for Trudeau’s proposed tax?

How effective a tax may prove to be either in changing behavior or generating revenues depends on consumers’ sensitivity to price changes. If a consumer has very few options or substitutes, then demand is called inelastic, and consumer demand will change very little despite a price increase. Conversely, if consumers can choose among various options, then demand is elastic, and will change significantly in response to higher prices.

A tax policy to generate revenue is most effective when demand is inelastic – when the consumer is forced to pay higher prices because there is no practical alternative. A tax policy with the intent to change consumer behavior is most effective when demand is elastic: The government will impose a high tax to drive up prices, to result in consumers’ reducing their demand.

Currently, cannabis consumers in North America tend to be very price-sensitive, implying that demand is very elastic and that revenue-generating policies will have limited efficacy if the tax is too high. Virtually every state and province has is a viable illicit market acting as a substitute source of supply relative to any legal, regulated market. By having options, consumers will tend to seek the lowest price, regardless of sourcing from an illicit market.

Ergo, if a government’s objective is to create a new stream of revenue, policymakers must be keenly cognizant of the illicit market. If policies create disincentives to participate in the legal market, the revenue objectives of the will fall short, prolonging the impact of the illicit market. In Canada’s case, Prime Minister Trudeau has explicitly stated that his policy is not about revenue. Given the proposal, that is a good thing: “Nobody’s mindset on this approach is about bringing in tax revenue,” Trudeau said, insisting that the primary goal is to eliminate the illicit market, and keep the public safe from bad actors.

If Trudeau’s intent instead is to change behavior, then a tax increase (and higher prices) should reduce the elastic demand overall. Canada’s cannabis market offers multiple choices for supply: Through its regulated market (currently medical LP, but opening for adult use in 2018/2019), but also an illicit market. With such availability and substitution, consumers feeling that a tax is too high to pay will simply buy from the illicit market. British Columbia consumers, for example, can easily visit one among many (federally illegal) retail outlets operating in their province.

So, what is the solution for Canada to run a popular and self-sustaining regulated market? Two prospective strategies have been implemented in other jurisdictions: The first is to tax based on weight (the approach touted by Trudeau); the second is a tax based on sales (while hybrid models exist, we will limit this analysis to a straight comparison).

The proposed weight-based, $1(Canadian) per gram tax for purchases under $10 in price is effective, straightforward to implement, and easy to regulate. For every gram sold, the government gets $1. The rub is that a weight-based tax creates a permanent barrier between regulated prices versus those charged in the illicit market, and that the price difference only grows over time. While participation can be expected early on, as prices commoditize there will be less incentive to participate in the legal market: Experience shows that the price consumers will be forced to pay will exceed the premium consumers are willing to pay simply for legitimacy.

Typically, static taxes tend to create a product’s price floor: In this case, no matter how low prices may fall on the open market, there will always be a $1 (per gram, at that) difference between the regulated price and the rate charged on the illicit market. On a percentage basis, the chart below outlines the differences between the regulated and illicit pricing as commoditization occurs. Currently, some U.S. outdoor producers are already selling at $1 wholesale/$4 to $6 retail, so as the Canadian market normalizes, its weight-based tax will represent a significant premium beyond the illicit market’s pricing.

In terms of pricing, a price floor generally hurts the consumer; in this case it hurts producers, too, since their legal products will be less competitive against the illicit suppliers’. As commoditization occurs, the net result of a weight-based tax is that producers will see less of an incentive to produce, and consumers will have less incentive to buy from them. Thus, the predictable result will be to delay the conversion of producers and consumers from the illicit market to the legal, regulated market.

In comparison, while a tax based on sales also creates a barrier between regulated and illicit market prices (and potential disincentive to legal participation), the difference is that as prices commoditize the separation between legal and illicit prices remain the same on a percentage basis. Consumers have demonstrated their willingness to pay a premium to participate in the legal system so long as that premium (tax) is not too high. Policymakers then just need to determine precisely which taxing levels will invite participation without discouraging customers’ conversion from the illicit market (happily, New Frontier Data can provide such analysis).

Given how price-conscious cannabis consumers tend to be, a sales-based tax would support more public policy objectives than would a weight based tax; as it would help drive greater participation in the legal market. As prices commoditize, it would not get in the way of legitimate producers’ efforts for price competition against the illicit market. In fact, throughout the commoditization process, the tax would support Trudeau’s goal of reducing illicit activities as at some point, margins get too low even for the illicit actors to stay in business, and this will drive participation in the legal market.

The bottom line? Given Trudeau’s priorities to promote public safety and participation in the regulated market over the government’s collected revenues per se, then a sales-based tax is preferable to a weight-based one. He would do better to forego taxing the grams, and focus on taxing retail receipts.

Beau Whitney, Senior Economist of New Frontier Data

Beau Whitney is the Senior Economist for New Frontier Data. Whitney has a unique blend of high tech business operations skills, economics and pollical analysis, as well as cannabis industry experiences.

While at Intel and TriQuint Semiconductor, Whitney honed his business operations skills associated with quickly ramping products from low volume to high volume. This is a skill he has since transferred to the cannabis industry. He is the former chief operations officer and compliance officer of one of the largest vertically integrated, publicly traded cannabis company in North America. His experiences incorporated growing, extraction, edible manufacturing and wholesale and retail distribution operations.

As an economic and policy analyst, his Whitney Economics white papers analyzing the cannabis market have been referenced in Forbes Magazine, USA Today, as well as in cannabis industry publications and across the Associated Press wire. Whitney has provided policy recommendations at the state and national levels and is considered an authority on cannabis economics.