U.S. Consumers Acquiring a Taste for Cannabis-Infused Beverages

Cannabis Industry Stakeholders Urged to Address Social and Environmental Challenges

May 9, 2022

Momentum for Federal Legalization of Cannabis Shifts Toward Incrementalism

May 10, 2022By Noah Tomares, Research Analyst, New Frontier Data

Back in October 2018, respondents to a New Frontier Data consumer survey reported that nearly half (45%) of American cannabis consumers who also drank alcohol expected to eventually replace at last some of the latter with cannabis.

Unfortunately, people’s thirst proved to outpace products’ taste for some time, as cannabis can be notoriously difficult to effectively infuse into beverages. Cannabinoids — including both tetrahydrocannabinol (THC) and cannabidiol (CBD) — are fat-soluble, and do not easily mix with water (though THC is soluble in alcohol, it is illegal anywhere in the United States to combine alcohol and cannabis). So even if it was not the taste or a chunky consistency that lacked appeal for a consumer, it was the delayed onset of effects, or a stubbornly inconsistent dose of THC (since cannabis oil and water separate) from bottle to bottle or even sip to sip.

Since Canada federally legalized cannabis for adult use in 2018, major beverage manufacturers have sought to make inroads in the market, with brewing giants like Molson Coors, Anheuser-Busch InBev, and Constellation Brands each investing millions of dollars in Canadian cannabis producers. But there, too, progress has been slower than anticipated, due largely to limitations like Canada’s tight marketing and advertising restrictions on cannabis, inconsistent dosing equivalencies between dry cannabis and beverages, and social distancing and shutdowns during the COVID-19 pandemic. The country’s restrictive regulations prevented manufacturers from selling their beverages in a familiar way (e.g., six-packs were prohibited), which also made it difficult to appeal to would-be consumers. New Canadian rules have been adopted to allow for more purchasing of cannabis per sale, though industry experts say they still do not change the maximum limit of 10 milligrams (mg) of THC per container.

Emulsification Is the Key for Beverages

Happily for tipplers in the short years since, novel nano-emulsification technology has been developed for beverage startups to create much more palatable and enjoyable cannabis beers, cocktails, seltzers, teas, and tonics for casual consumers seeking sociable alternatives to alcohol. For any who enjoy the taste and traditions of alcohol if fretting about its health effects, an expanding array of non-alcoholic, low-calorie, cannabis-infused beer and wines offer some intriguing potential replacements (where legally available).

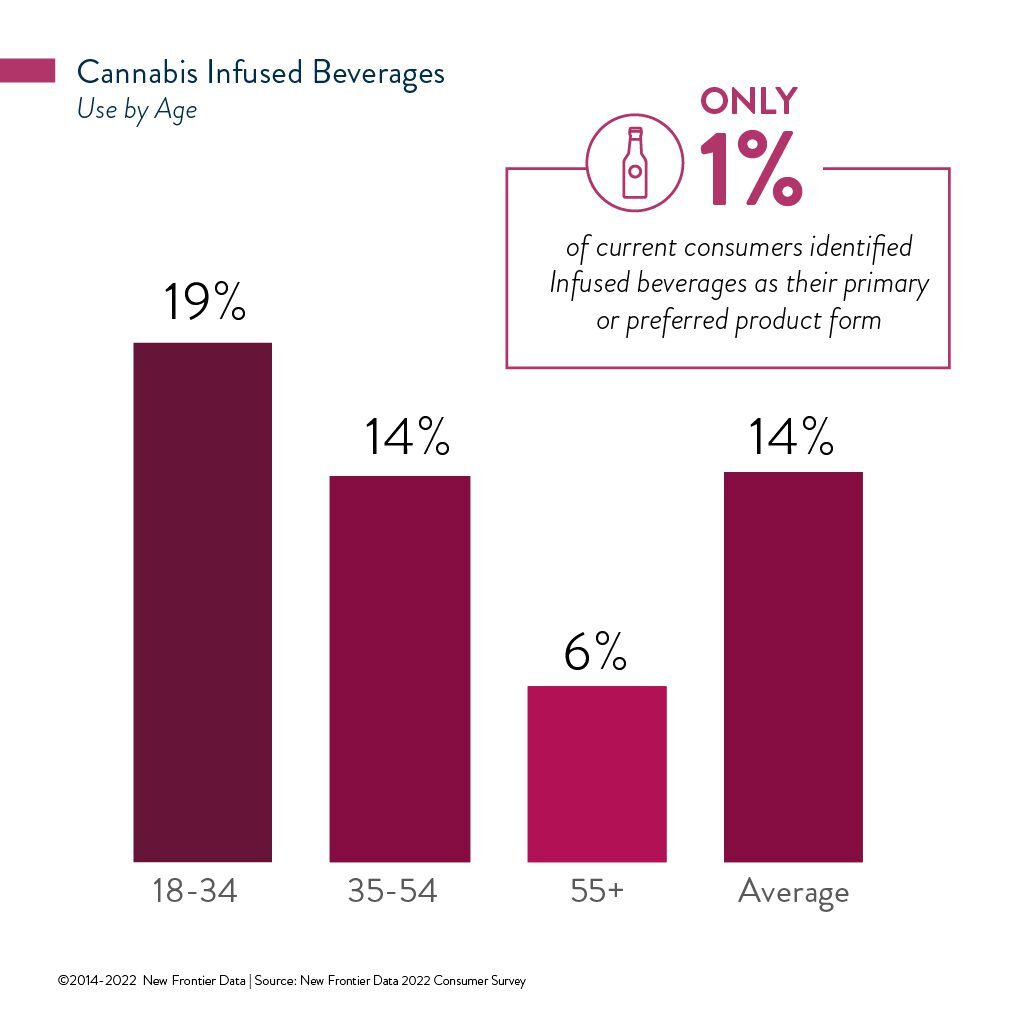

Still, in our latest consumer survey, however, only 14% of current American cannabis consumers reported having yet tried an infused beverage. Despite how conveniently beverages can be consumed in social environments (essentially mirroring alcohol), just 1% of current consumers identified them as their primary or preferred product form. Understanding how and why (or not) that individuals have chosen to engage with the niche product can fuel further insight into the market’s trajectory.

More than half (57%) of current U.S. cannabis consumers now enjoy both flower and non-flower products. While flower continues to dominate legal sales nationwide, non-combustible products can represent an innovative, potentially more socially acceptable way for consumers to enjoy one of their favorite plants. For potential consumers considering trying cannabis, non-combustible products represent a lower barrier to entry. The products are more closely related to products which individuals often already enjoy.

Those residing in adult-use markets (15%) are only slightly more likely to have tried an infused beverage than are consumers in either medical (13%) or illicit (13%) markets. Beverage consumers were also more likely to report primarily sourcing their cannabis from a brick-and-mortar retailer than was an average consumer (41% vs. 34%). Men are slightly more likely (16%) than are women (12%) to have tried an infused beverage. Younger consumers (ages 18-34) are more than 3x likelier to have tried an infused beverage than those over the age of 55 (by a 19% to 6% margin, respectively).

Consumers Share Reasons for Consumption

On average, cannabis consumers having tried an infused beverage cited more reasons for consuming cannabis overall than did those who had not. They are also more likely to consume cannabis daily (by 58% to 45%, respectively).

Nevertheless, when asked to identify their primary reasons for consuming cannabis, both cohorts shared their top three reasons: relaxation (17%), reducing anxiety (16%), and pain management (14%). Infused beverage consumers were substantially more likely to say that they use cannabis to enhance enjoyment of social situations (42% vs. 29%).

When asked about their favorite product form, the average consumer reported most enjoying joints, solid edibles, and blunts, respectively. Among all current consumers, smoking joints remains the most popular way to consume cannabis. Individuals who have tried infused beverages selected the same three products, but ranked solid edibles above the other combustibles.

While non-combustible products are often viewed as a more viable entry point for potential consumers, current infused-beverage consumers are equally likely to partake in combustible products as those who have not tried infused-beverages.

When it comes to alcohol, infused beverage consumers were more likely to say that they consume alcohol at least weekly, compared to the average cannabis consumer (56% vs. 45%). There is also potential overlap where product presentation is closely aligned. Cannabis consumers who enjoy alcoholic hard seltzers are 1.9x more likely to have tried a cannabis-infused beverage over the average cannabis consumer.

Potency of Potables

One reason why infused beverages in the U.S. have not yet competed with the success of solid edibles may be the cost-per-dose relative to other forms. An individual infused beverage might contain 2.5 mg, 5 mg, or even 10 mg of THC, comparable to a single edible. Cannabis beverages, however, are most often marketed like alcoholic beverages: individually or as part of a four-pack or six-pack, — making them more expensive per milligram than per most packages of solid edibles.

Higher potencies exist among infused beverages, whether designed for individual consumption or to be dosed out for mixing with other beverages. However, those products run their own risk of alienating users, by shifting the onus of titration onto the consumer, lest they overestimate their tolerance.

The growth of non-smokable products will continue, as half of all consumers (and 61% of those under age 35) say they would be interested in trying new products as they learn about them. Due in no small part to the similarities these products have with alcohol, infused beverages have generated a fair bit of speculation about how large the category could grow.

Still, while the share of preference for infused beverages will likely increase significantly over time, retailers in the near term should expect beverages to remain a small if fast-growing category.

For more comprehensive information on cannabis consumers and the products they enjoy, refer to New Frontier Data’s Cannabis Consumers in America; Dynamics Shaping Normalization in 2022.