Which States Are Looking to Legalize Cannabis This Year?

Survey Says: Opposition Keeps Fading to Legalization’s Favor

March 1, 2022

Almost 1/5 of Americans Report Consuming Cannabis Each Year

March 15, 2022By J.J. McCoy, Senior Managing Editor, New Frontier Data

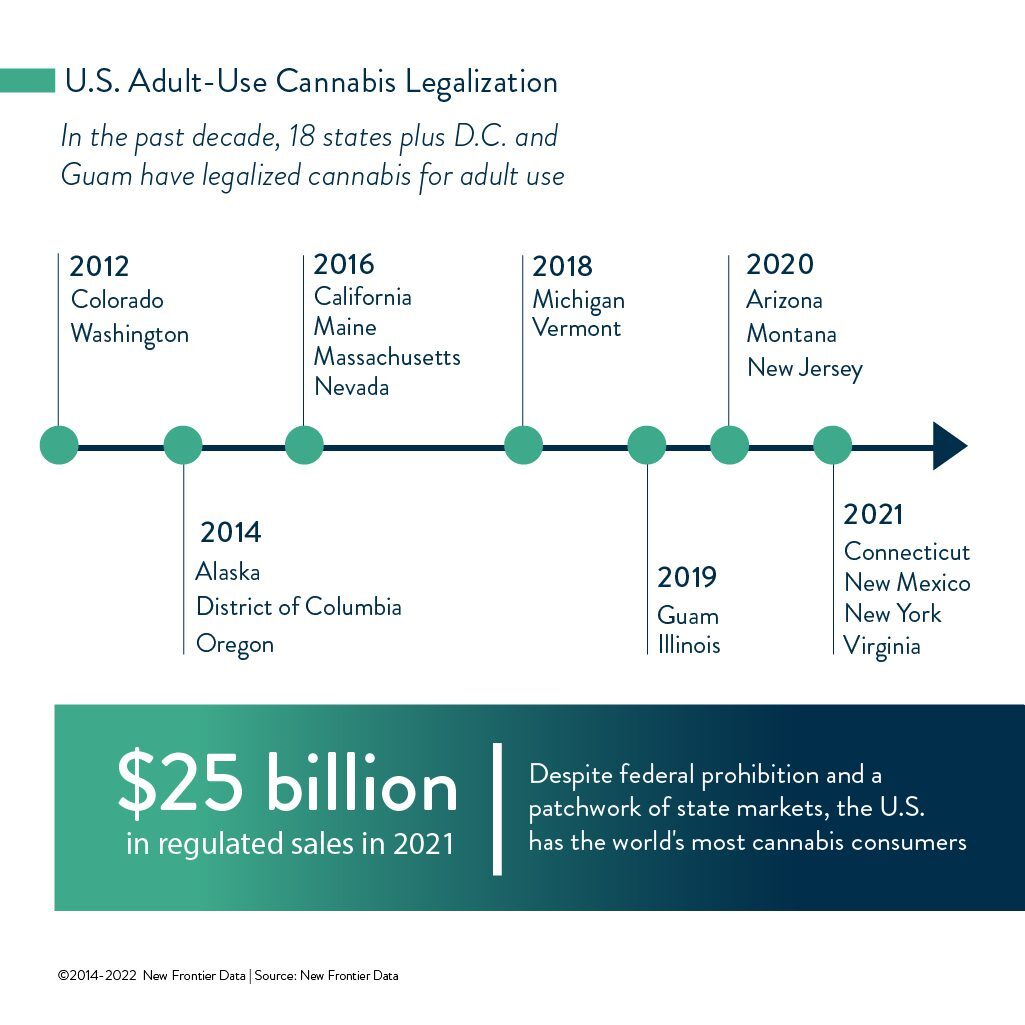

It was Election Day 2012 when Colorado voters approved a ballot initiative legalizing cannabis for sale, possession, and use by adults. In nearly a decade since the Centennial State became the first U.S. state to do so, 17 others (along with both the city of Washington, D.C., and the territory of Guam) have legalized cannabis even while the federal government maintains its longtime prohibition of marijuana. When Mississippi legalized medical marijuana last month, it marked more than twice as many (37) more states and territories (4) now permitting the use of cannabis to treat qualifying medical conditions. Worldwide, 33 countries have legalized its medical use since 2018.

Despite its prohibition, the U.S is home to the most cannabis consumers in the world, with 45 million people reportedly using cannabis annually. Nine of the 10 largest consumer markets are in North America or Europe, affirming strong market opportunities in both continents as lawmakers liberalize cannabis policies and transition to regulated markets.

U.S. Cannabis Sales Surpass $25 Billion

New Frontier Data notes that even while the U.S. lacks a federally regulated framework, the patchwork of state markets makes it the world’s largest legal cannabis market by a wide margin, generating over $25 billion in regulated sales in 2021. Even so, those U.S. legal sales captured slightly more than one-quarter of the country’s $90 billion in demand, underscoring the robust growth potential in the world’s largest consumer market, projected to surpass $40.5 billion in sales by 2025.

Today, eight months before the U.S. midterm elections, popular support for marijuana legalization has never been higher. Two years after legal cannabis was deemed by many jurisdictions as “essential business” during widespread shutdowns to mitigate the COVID-19 pandemic, mainstream acceptance has broadened Democratic and Republican political support for both state and federal reform measures.

Though there was initial enthusiasm for federal legalization after the election of President Biden in 2020, no action has been forthcoming from the administration. Instead, cannabis proponents and industry lobbyists expect to see a continuation of incremental measures come to pass, including several yet in 2022.

New Measures Taking Shape

Banking reform for cannabis businesses as detailed in the SAFE Banking Act would allow federally insured financial institutions to serve state-legal, plant-touching businesses without fear of legal jeopardy. The bipartisan Biological Medical Marijuana Research Act would expedite long-stifled research about cannabis, and the Veterans Equal Access Act of 2021 would allow Veterans Administration doctors to provide advice and treatment involving medical marijuana to former members of U.S. military services.

In a political era of fierce partisanship and sharp discord, the HOPE Act has the support of unlikely allies including Representative David Joyce (R-Ohio) and Representative Alexandria Ocasio-Cortez (D-NY) seeking to direct funding to states to expunge offenses for cannabis-related convictions.

Advocates also tout legal cannabis’ potential to create jobs and mitigate economic shortfalls from the pandemic. They welcome it as a moneymaker for states, and an overdue means for social justice for those demographic sectors most disproportionately affected by cannabis-related prosecutions and mass incarcerations.

Robust medical cannabis patient programs can help substantial portions of the populace, and help reduce stigma as positive precursors to adult-use regulations. The three leading U.S. medical markets by patient saturation (i.e., Oklahoma with 10% of its residents registered, New Mexico at 6%, and Pennsylvania at 4.5%) demonstrate successful levels of penetration where regulations and social acceptance have proved vital to the performance of those medical markets.

New Mexico has already moved into adult use, and Pennsylvania lawmakers have expressed intentions to do so. Oklahoma represents a real test of the medical-saturation effect, being a state that has fully embraced cannabis for medical use but stands down regarding progress towards full legalization.

Legalized Adult-Use States

Alaska (legalization passed in 2014), Arizona (2020), California (2016), Colorado (2012), Connecticut (2021), Illinois (2019), Maine (2016), Massachusetts (2016), Michigan (2018), Montana (2020), Nevada (2016), New Jersey (2020), New Mexico (2021), New York (2021), Oregon (2014), Vermont (2018), Virginia (2021), and Washington (2012), along with the District of Columbia (2014), and Guam (2019)

States on the Bubble for Legalization Measures in 2022

Delaware, Florida, Maryland, Minnesota, Missouri, New Hampshire, and Ohio for adult-use programs, and Texas for expanding its medical-use program

Delaware: Already having a well-established medical marijuana program, the House Health and Human Development committee in January approved HB 305, a bill awaiting consideration before a vote. Governor John Carney has been lukewarm to it, neither advocating legalization nor threatening a veto if the bill reaches his desk.

Florida: Though nothing will happen during this legislative session while the Sunshine State’s Republican majority and Governor Ron DeSantis oppose adult-use legalization, polled majorities favor it among both Democratic (76%) and Republican (64%) voters.

Maryland: With the Maryland General Assembly considering whether to debate adult-use cannabis legislation this year, support among polled residents decreased slightly (from 67% to 60%) between March and October 2021, according to Goucher College.

Minnesota: Though adult-use cannabis was technically legalized in May 2021, the measure stalled when the legislative session ended two days later. Lawmakers are now resuscitating it, and the governor has earmarked funding for legalization in his annual budget request.

Missouri: Multiple competing campaigns are afoot to present legalization bills; given that the Missouri General Assembly has not been as supportive as the overall electorate, pursuing the initiative petition process seems vital.

New Hampshire: Without including retail sales, state representatives voted in January to legalize possession and home cultivation. With another half-dozen cannabis proposals being considered, a more comprehensive program including commercial retail and cultivation looks due for passage this year.

Ohio: Featuring one of the nation’s top medical cannabis programs, Ohio has a measure headed for its November ballot amid strong voter support. Other reform measures are under consideration, including a Republican-backed adult-use bill.

Texas: The state’s Compassionate Use Program limits medical cannabis to low-dose THC containing no more than 1% THC by weight. Advocates like Americans for Safe Access want to expand the medical-use program, noting that the state’s registry of some 3,500 patients grew by 46% in 2021, even though only two Austin-area dispensaries exist throughout the nation’s second-largest state by area. Texas is notable as the largest state which has not yet approved a full medical market. Amid a population of nearly 30 million, the state’s prospective program could fast become the country’s largest medical market.

Local political dynamics — including specifics of the proposed language in each market — will influence the timing and likelihood of passage of each state’s reforms.

As seen in states including Mississippi and South Dakota, even broadly popular measures may face stiff opposition and legal intervention from conservative lawmakers who oppose expanding access to cannabis. However, with the tide of public opinion gathering strongly behind ending prohibition, the coming expansion of state markets in the U.S. is all but assured.